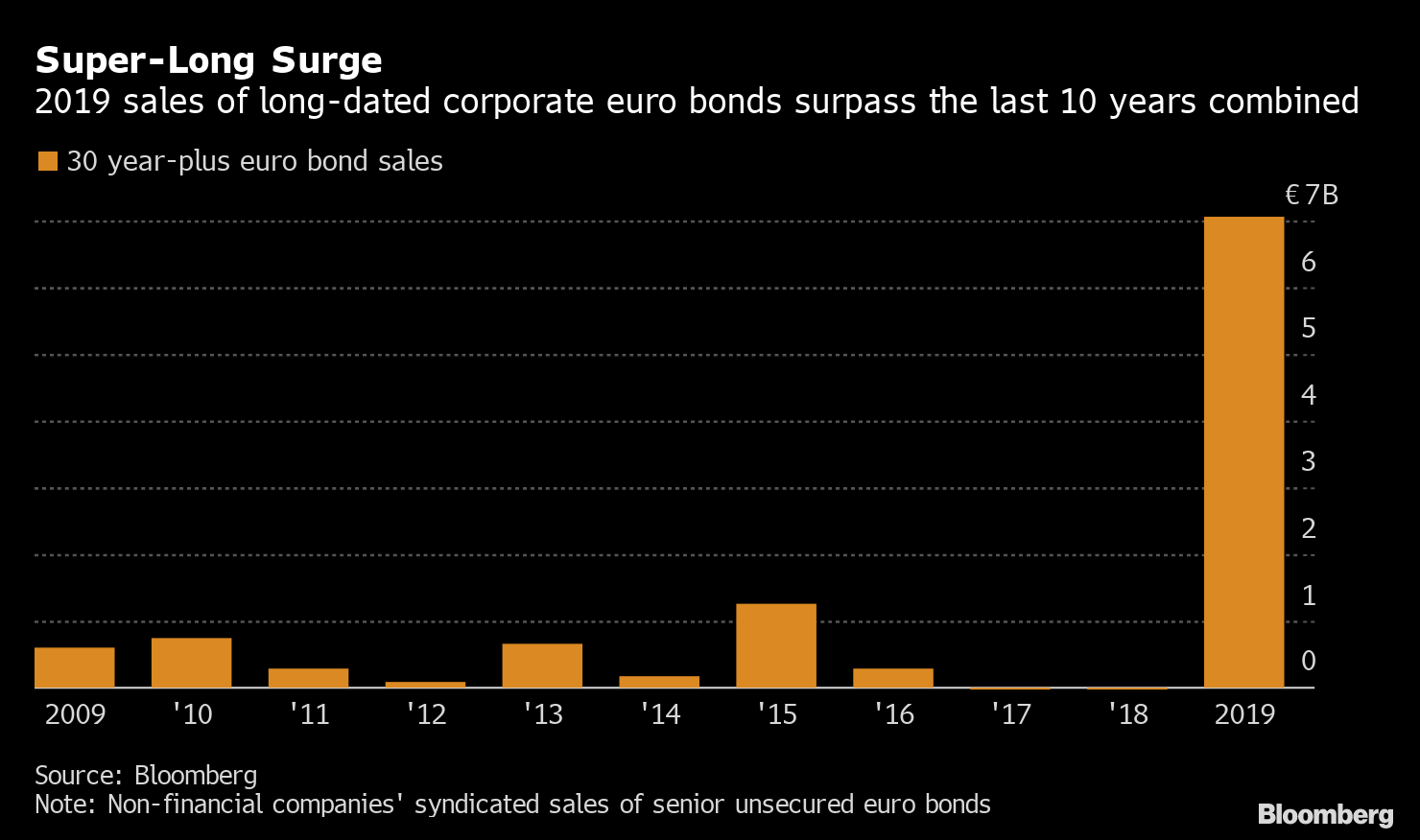

| Welcome to your morning markets update, delivered every weekday before the European open. Good morning. There's a change in leadership at one of the world's most important technology firms, sentiment in equities is being hurt by a lack of clarity on international trade and the pound is holding gains before next week's election. Here's what's moving markets. New Page It's the end of an era at Google, where founders Larry Page and Sergey Brin are stepping down as leaders of parent group Alphabet Inc., ending day-to-day involvement just as regulators intensify scrutiny of an internet industry the two men helped form. Sundar Pichai, currently CEO of Google, will also now run Alphabet, giving him the reins at projects like autonomous cars and health-care technology. While Page and Brin will still be controlling shareholders and stay on the board, here's why the changes mark an end to their efforts to become the Warren Buffett of tech. Trade Uncertainty Asian stocks followed U.S. peers lower for a second day after U.S. President Donald Trump told reporters in London Tuesday that he has no deadline for a partial trade deal with China, and as the passing of a U.S. bill that could see new sanctions imposed on Chinese officials over human rights abuses against Muslim minorities threatened to further slow up proceedings. Shares in Paris took much of the trade war impact in Europe amid a risk of fresh U.S. tariffs on goods ranging from wine and cheese to handbags. Pound Weighs France's CAC 40 wasn't Europe's worst-performing blue chip index yesterday: the U.K. FTSE 100 sank 1.8%, the most in two months, as polls showing a firm lead for the Conservative party ahead of next week's election lifted the pound and hurt exporters' shares. In latest campaigning, Jeremy Corbyn continues to tout protection of Britain's treasured National Health Service from a U.S. trading pact as a reason to vote for his Labour party. At least Bank of America is ready for Brexit. The pound edged lower this morning, up about 0.5% against the dollar this week. 75,000 The global banking sector has now cut more than 75,000 jobs this year, with the vast majority of them in Europe, as negative interest rates and a slowing economy force lenders to slash costs. The latest to swing the axe was Italy's largest bank, UniCredit SpA. The full-year results season starting in January will be eyed for more bank cost-cutting, according to Bloomberg Intelligence analyst Jonathan Tyce, with HSBC Holdings Plc and Societe Generale SA among those that need to cut back, he wrote in a note. Coming Up… Euro-area finance ministers meet in in Brussels and the Polish central bank is expected to leave its interest rates as they are. Elsewhere, this afternoon's U.S. ADP employment report sets us up for nonfarm payrolls on Friday, while China Caixin services purchasing managers index numbers topped expectations overnight. What We've Been Reading This is what's caught our eye over the past 24 hours. And finally, here's what Cormac Mullen is interested in this morning Corporate credit is often pointed to as a canary in the coal mine for timing financial market peaks as yield spikes and funding freezes often precede stock-market sell-offs. While there are small signs of recent investor selling in pockets of the high yield credit world, there is little, just yet, in the secondary market that is causing any serious alarm bells to ring. On the issuance side, however, there are definitely signs that 2019 has been truly exceptional. As my colleague Neil Denslow points out, sales of super-long euro corporate notes have surged this year, particularly since the summer, as firms grab the chance to lock-in rock-bottom borrowing costs. Electricite de France's pricing of a 1.25 billion-euro 2049 note on Monday was the eighth 30-year senior euro bond issued by a non-financial borrower this year. That lifted the sales tally to a smidgin over 7 billion euros, or more than the last 10 years combined. While there is likely a myriad of firm- and sector-specific reasons for the rush to take advantage of cheap long-term financing, one way of looking at the spike in demand is simply that corporate treasurers think it won't be available next year. This could be a seen as a reasonable concern that corporate borrowing costs may rise as the global economy reflates. It could also be seen as a way of getting ahead of a potential liquidity crunch from a financial market dislocation.  Cormac Mullen is a Cross-Asset reporter and editor for Bloomberg News in Tokyo. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. Before it's here, it's on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can't find anywhere else. Learn more. |

Post a Comment