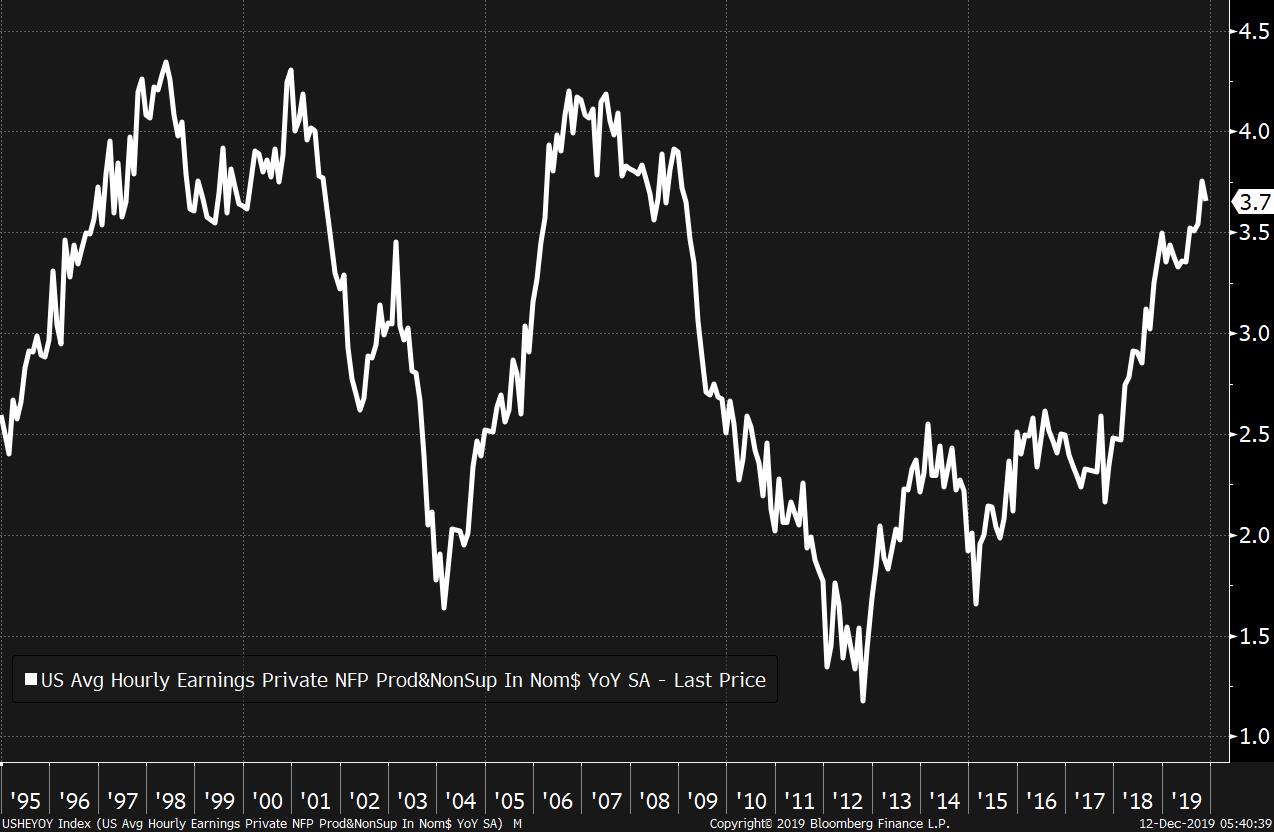

Tariff deadline nears, ECB decision day, and voting underway in U.K. election. CloseA Chinese Ministry of Commerce spokesman said that trade teams from his country and the U.S. remain in close contact as Sunday's deadline for higher tariffs approaches. Officials from China are expecting a delay to the measure to give more time to reach an interim deal, according to people familiar with the discussions. There may be some news on that later today as President Donald Trump is expected to meet his trade team. First meeting There is no change in policy expected at today's European Central Bank decision, announced at 7:45 a.m. Eastern Time. At 8:30 a.m., Christine Lagarde will host her first press conference as president with investors likely to watch closely for hints as to how she will address policy issues differently from her predecessor. Today's meeting will also see an update to the bank's economic forecasts, which will stretch into 2022 for the first time. Speaking of forecasts, yesterday Fed Chairman Jerome Powell signaled a long pause in rates, saying the U.S. can sustain much lower unemployment than previously thought. ElectionVoting has started in the U.K. election, with the final polls suggesting that the Conservative lead over the Labour Party may have narrowed in the closing days of the campaign. FX traders seem to be confident of a Boris Johnson victory, with the pound holding close to $1.32 this morning, the highest level since March. Voting ends at 5:00 p.m. Eastern Time, with broadcasters releasing their exit polls at the time and counting getting underway almost immediately. The result should be clear around midnight. Markets riseYesterday's Fed decision has been viewed as slightly bullish by markets, and equity investors are acting accordingly. Overnight, the MSCI Asia Pacific Index climbed 0.6% while Japan's Topix index closed 0.1% lower. In Europe the Stoxx 600 Index was broadly unchanged at 5:50 a.m. as investors in the region awaited the ECB decision. S&P 500 futures pointed to a small gain at the open, the 10-year Treasury yield was at 1.802% and gold was flat. Coming up…November U.S. PPI and weekly jobless claims data land at 8:30 a.m., with the latter expected to show an increase from last week's seven-month low of 203,000. As well as the ECB, there are rate decisions in Turkey, Switzerland and Peru today. Companies reporting earnings include Oracle Corp., Broadcom Inc. and Adobe Inc. What we've been readingThis is what's caught our eye over the last 24 hours. And finally, here's what Joe's interested in this morningThe most interesting thing that Fed Chairman Jay Powell said at his press conference yesterday came in response to the final question of the day when he was asked by Brian Cheung of Yahoo Finance what it would take for Powell to characterize the labor market as "hot." Powell replied that it all came down to wages, and that while he was comfortable saying the labor market was strong, he wasn't comfortable calling it either tight or hot because wage growth still isn't that fast. What struck me about this answer is that for years now, people have been using words like "hot" or "tight" to describe the labor market and virtually nobody bats an eye. It's just taken as accepted that with the unemployment rate down at 3.5%, and employers complaining about the difficulty of finding workers, that it might be tight. And yet here's the Fed chair refusing to either one of these terms. And for good reason: a truly hot labor market would see faster pay. Powell's answer made me think of a conversation we had earlier this week on TV with former Minneapolis Fed President Narayana Kocherlakota, who is now at the University of Rochester. He argued that one reason the Fed tightened excessively in 2018 (and was forced to wind back in 2019) has been the obsession with "normalizing" policy. In other words, there's this momentum to hike rates because rates just seemed low and abnormal, not because the data really demanded it. Again, this term 'normalization' seems pretty insignificant and people throw it around all the time, but it's basically nonsense and for most people it effectively means: "what rates used to be when I was young and in my prime." This is all a good thing. If people stop blithely using words like "hot" and "normal" to describe the economy or interest rates, and actually look at what the data is saying, it may filter into better policy decisions.  Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. Before it's here, it's on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can't find anywhere else. Learn more. |

Post a Comment