Good afternoon from Los Angeles, wherever you may be. AT&T invited investors, analysts and reporters to Stage 21 on the Warner Bros. lot Tuesday for a showcase of its upcoming streaming service HBO Max, and the phone company wanted guests to leave with one message: "we're all-in."

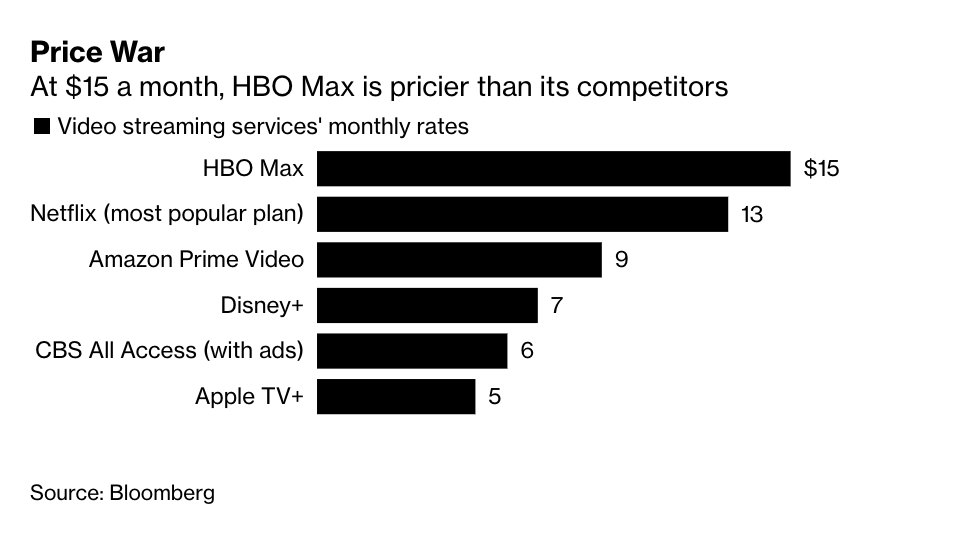

Not kinda in, like Comcast's Peacock. Not tangentially in, like Apple TV+. All-in, like Netflix and Disney. The programming lineup for HBO Max will include all of HBO's TV shows and movies, a deep catalog of old movies and TV shows, as well as loads of originals—all for the same price as HBO, $14.99. That is expensive relative to the competition (see the below chart), but cheaper than the company had been signaling.

AT&T will spend up to $2 billion on HBO Max next year, and expects the service will lose money for a couple years before turning profitable in 2025.

While AT&T didn't say the word Netflix very often, its top executives took several shots at the streaming service that shall not be named. Bob Greenblatt said HBO would use humans to help guide viewers to new shows (not that stupid algorithm!), while his deputies stressed the superiority of releasing new episodes of a show gradually instead of all at once (screw you binge viewing!).

The presentation left me with a few immediate thoughts:

That's a lot of stuff. HBO Max has the most robust programming of any streaming service. It has the best dramas and comedies of HBO ("Game of Thrones," "Sex and the City," "The Wire") and animation from Adult Swim ("Rick and Morty"), Studio Ghibli ("Spirited Away") and the whole "South Park" catalog. It has TV classics like "Friends" and "The West Wing," as well as an excellent catalog of movies ("The Matrix," "Wonder Woman" and "Bridesmaids").

Finally, it has a bunch of originals we know little about (including a drama series directed by Ridley Scott and a new series from Issa Rae). Between HBO and HBO Max, the service will have more than 80 original series in 2021, a pace of more than one a week. There will be little reason for viewers to cancel, if they sign up in the first place. Speaking of signing up..

Marketing the service will be a challenge. It should be easy for AT&T to convert existing HBO customers to buy the same product with even more stuff. But is that the pitch for the people who don't pay for HBO?

A lot of people are already exhausted by the volume of new TV shows, and the dizzying array of places to watch them. The TV industry released more than 500 scripted series last year, a number that will pass 600 in short order. Netflix and Hulu had the benefit of being first. Disney+ has all the Disney brands. Apple TV+ is basically free. What helps HBO Max stand out?

The international rollout suggests AT&T is not exactly all-in. HBO Max will roll out in Spanish-speaking Latin America, Central Europe and the Nordics in the next couple of years. What's missing? Brazil. The United Kingdom. Canada. Australia. Those are four of Netflix's 10 biggest markets.

AT&T doesn't want to forego the very healthy money it gets licensing all of HBO's programs to local TV networks. Economically, it makes sense. Strategically, it means HBO Max is not a global product.

The pay-TV business is only getting worse

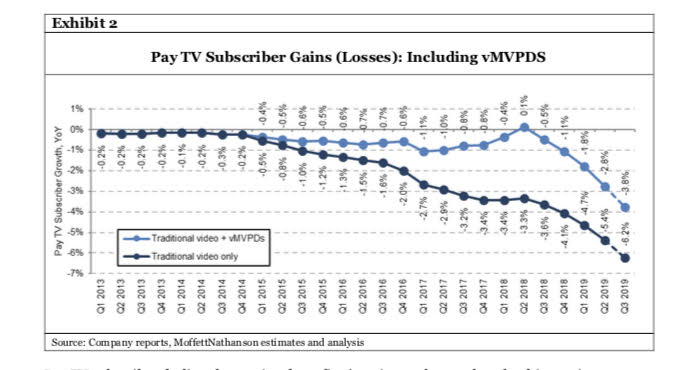

In case you need a reminder of why AT&T is bothering with HBO Max, take a look at this note from analyst Michael Nathanson. The headline:

What's even worse than "Freaking Ugly"?

Cord-cutting is accelerating at rates that exceed analysts' predictions. AT&T, Verizon, Comcast and Charter lost a combined 1.7 million pay-TV customers in the quarter, most of them from AT&T/DirecTV. Digital TV packages, once thought to be the future, are not. Sony shut down PlayStation Vue, its "skinny bundle," while AT&T Now lost thousands of customers.

Just look at this chart:

That decline in subscribers for pay-TV packages affects TV networks that collect money for each subscriber, known as affiliate fees. Affiliate fee growth is slowing from high single digits in recent years to low single digits now.

TV ad sales aren't growing at all. National TV ad sales declined almost 3 percent through the first 8 months of the year, and are down about 1.5 percent so far this TV season, according to Standard Media Index.

Post a Comment