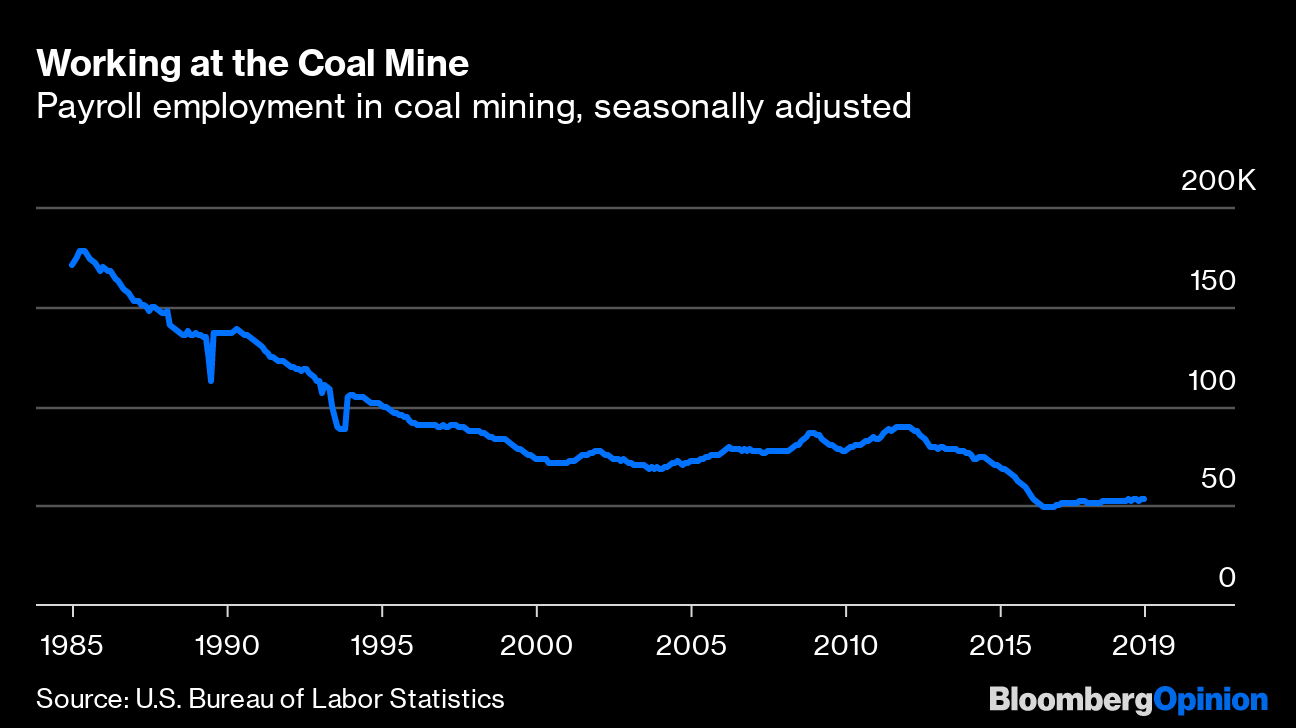

| This is Bloomberg Opinion Today, a mashup of Bloomberg Opinion's opinions. Sign up here. We're looking for your feedback to help improve this newsletter. Please follow this link to our survey, which will take only a few minutes. Today's Agenda  The Tragedy of the Commons, Global Edition The world's biggest problem is that the world's biggest problem will always be somebody else's problem until it isn't. A far less Yogi Berra-ish way of putting this is that human civilization's biggest threat, the despoilment of our environment, is the ultimate example of a tragedy of the commons. That's when a thing is freely available to all the people, so all the people use it up as quickly and irresponsibly as possible, until that thing is gone and all the people suddenly feel all the regret. You can see this most immediately in the oceans, writes Noah Smith: Nobody really owns them, and through overfishing, pollution and climate change we are destroying them. Noah admits we could always grow fish on farms, but is that the world we want? Not to mention the very real risk that making life's cradle inhospitable to life will likely bring many other nasty repercussions. Thomas Edison recognized this problem 100 years ago, in relation to energy production, writes Liam Denning. He wondered why we burn every resource we can find instead of relying on renewable stuff. This has lately dawned on much of the rest of humanity, but not quickly enough. Liam suggests assigning hard prices to the environment as if it were a scarce commodity as oil once was, because that's what it is. Meanwhile, even in relatively green Germany, one of the world's biggest users of wind energy, there is a Nimby-driven backlash against wind turbines, notes Leonid Bershidsky. Even some environmentalists oppose them, claiming they hurt birds, forests and such. The wind industry must address this — with better energy storage, say — or Germany will go back to burning stuff again. In the U.S., the best hope at the moment may be an unsavory but time-honored one: lawsuits, namely against Big Oil. As Noah Feldman writes, this isn't a particularly efficient way to solve social problems, but it has at least assigned hard costs to tobacco's dangers and the opioid crisis. This could be a start to gauging the true value of the commons. Smartphone Land in Bad Decline Apple Inc. last night reported a grim quarter to end a grim fiscal year of falling iPhone sales, so the stock naturally … rose today. Because Apple is a software company now, not an iPhone company, according to the market. But Shira Ovide writes investors have gotten a bit ahead of themselves in pricing Apple like some kind of reborn growth phoenix. Not only is the smartphone market that is still Apple's lifeblood in secular decline, the global economic backdrop is no great shakes, either. Both hammered Samsung's sales and profits in the latest quarter, notes Tim Culpan. And there's not much Samsung can do but hunker down, folding phones or no. The same goes for Sony, which also reported last night. The Fed's Work Is Far From Done The Federal Reserve may be done cutting interest rates for now, but nobody should mistake this pause for a sign all is well with Fed policy, Bloomberg's editorial board warns. The central bank is still far too captive to markets, its communication is still too muddled, and its effectiveness is iffy. Any down time it has now should be devoted to solving these problems and getting ready for the next recession. Further Central Bank Reading: Twitter Signals Some Virtue In the Social Media Brady Bunch, Twitter Inc. is the Jan to Facebook Inc.'s Marcia. But the overlooked middle child won a round last night by declaring a ban on political advertising, just as Facebook — which has apparently chosen political advertising as the hill on which it plans to die — was reporting its earnings. This was a savvy, cost-free way of shaming a rival, writes Shira Ovide, though Twitter still has its own problems with deeply toxic non-ad content. Much of that content comes from the Twitter account of one President Donald Trump, notes Leonid Bershidsky, from which Twitter has derived much free advertising and social capital. Telltale Charts After a tiny bump, America's coal jobs are about to fall again, Justin Fox writes, as the coal industry stubbornly refuses to return to greatness.  Further Reading Boris Johnson seems to have better odds in this election than Theresa May did in her 2017 disaster, but success depends on whether voters make this a Brexit referendum or not. — Matt Singh Dems shouldn't fear a Tulsi Gabbard independent run. — Jonathan Bernstein Drug companies claim lower drug prices will squash innovation, but new studies, and simple history, say otherwise. — Peter Bach The food-delivery industry has a distinctly WeWork-y vibe these days. — Conor Sen Germany reminds us Bashar al-Assad is responsible for the bulk of the horrors in Syria. — Bobby Ghosh China has cleaned up its piracy-ridden music industry. Don't blame artists like Taylor Swift for playing catch-up. — Adam Minter The World Series was exciting, but baseball still has an aging, white fan base. — Stephen Carter ICYMI House Dems made impeachment formal. China threw cold water on trade hopes. There's a global fertility crisis. Kickers The map of America's food-supply chain is mind-boggling. Fundamental symmetries in the universe may hint at time's origin. There's a fine line between extreme haunted house and torture chamber. (h/t Scott Kominers) The World Series made an historical joke of home-field advantage. Note: Please send food supplies and complaints to Mark Gongloff at mgongloff1@bloomberg.net. Sign up here and follow us on Twitter and Facebook. |

Post a Comment