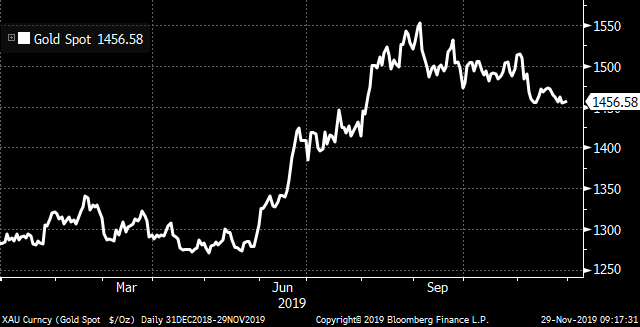

| Warning signs for China's economy, better news for the euro area, and Morgan Stanley ousts FX traders. Warning Signs are mounting that China's financial stress could soon test policy makers in the world's second largest economy. With early indicators showing growth slowing for a seventh month in a row, increasing risks in the banking system may only add to the dilemma. This week's unprecedented debt restructuring at a state-owned company points to authorities being wary of moral hazard from bailouts. All of which is probably adding to the country's apparent unwillingness to react with more than vague threats to President Donald Trump signing the Hong Kong bill. Better While China's economy seems to be at risk, there are signs that the worst may be over for the euro area. German unemployment unexpectedly dropped in November as a slump in manufacturing started to show signs of stabilizing. This morning's flash inflation estimate showed a pick-up to 1%, ahead of expectations, but still far below the ECB's target. Investors are taking notice of the less-than-awful outlook with U.S. purchases of ETFs focused on European assets hitting the highest level in almost two years in November. Mismarking Morgan Stanley fired or placed on leave at least four currency traders in New York and London over an alleged mismarking of securities that concealed losses of between $100 million and $140 million, according to people with knowledge of the matter. The bank's probe includes an investigation into currency options. Morgan Stanley's FX desk has struggled this year, with the lender's third quarter results showing that a strong performance in fixed income was "partially offset by a decline in foreign exchange." Markets slip With no developments in trade talks and a quiet session expected when U.S. markets reopen after the Thanksgiving break, stocks are drifting lower. Overnight, the MSCI Asia Pacific Index dropped 0.9%, while Hong Kong's Hang Seng Index had a surprise 2% tumble. In Europe, the Stoxx 600 Index was 0.1% lower at 5:50 a.m. Eastern Time, well off early session lows. S&P 500 futures pointed to a small drop at the open, the 10-year Treasury yield was at 1.759% and gold was flat. Enough is enough Prince Abdulaziz bin Salman will likely use his first OPEC meeting as Saudi energy minister next week to signal the kingdom will no longer compensate for other members' non-compliance with the OPEC+ production agreement. Russia, Iraq, Kazakhstan and Nigeria have all exceeded their agreed limits this year. There was some good news for Saudi Arabia on the Aramco IPO front, with the retail tranche more than fully covered ahead of the deadline. A barrel of West Texas Intermediate for January delivery was trading at $58.08, keeping the commodity headed for a fourth week of gains. What we've been reading This is what's caught our eye over the last 24 hours. And finally, here's what Lorcan's interested in this morning One of the main arguments used by fans of gold as a store of value and as an investment is that it is actually a physical thing. If you buy an ounce of gold you can hold it in your hand, you can put in in your safe, and you can rest assured that you have an asset that is valuable for what it is. That's in contrast to a dollar or a euro which are only valuable for what they represent. Fans of the shiny metal often cite John Pierpont Morgan saying more than a century ago that "money is gold, and nothing else." Over the years the idea of what money actually is and how it's created -- spurred by the financial crisis, Bitcoin and QE -- has changed significantly, but gold's inherent value remains unchanged. However, there is something afoot which may be changing that. A trend has emerged among nationalist leaders in eastern Europe for either repatriating gold reserves, or increasing purchases of the commodity. While this may seem like great news for gold bugs, it may not be a good thing at all. As Vuk Vukovic, a political economist in Zagreb, put it: "Gold is a symbol. When states purchase it, people everywhere see it as a sign of economic sovereignty." Gold's value is not just intrinsic. It is fiat nationalism.  Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. Before it's here, it's on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can't find anywhere else. Learn more. |

Post a Comment