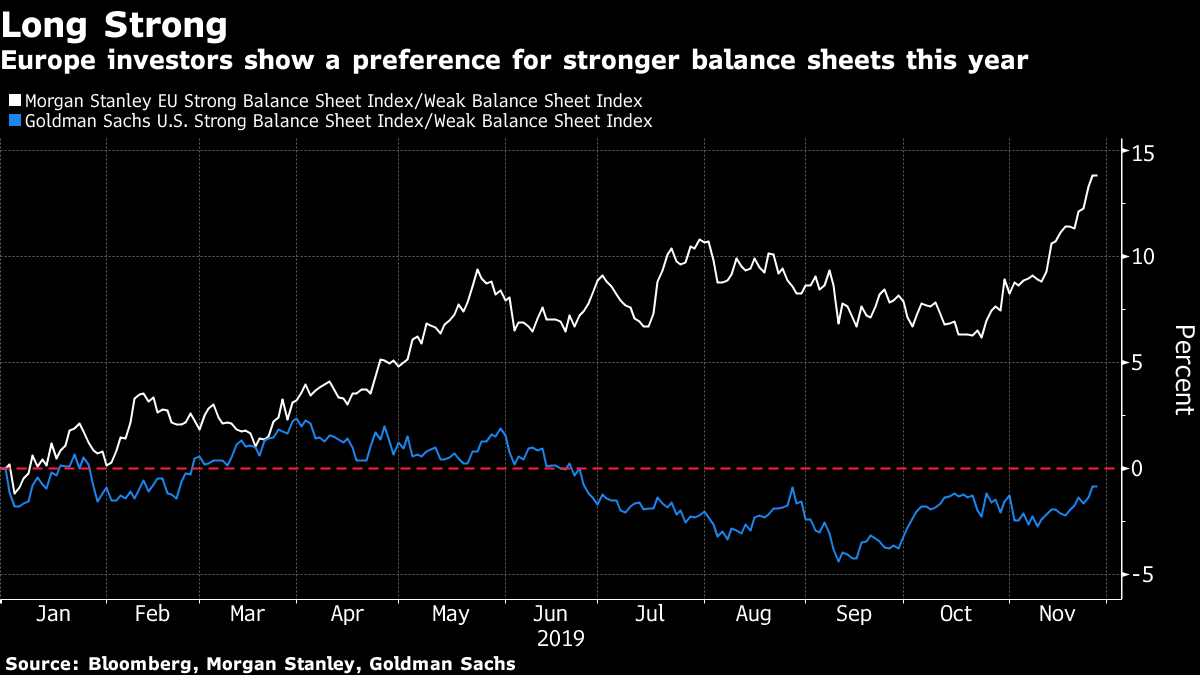

| Welcome to your morning markets update, delivered every weekday before the European open. Good morning. Trade talks inch forward, China is slowing down and the U.K.'s Labour Party continues to contend with anti-Semitism accusations. Here's what's moving markets. 'Final Throes' Progress on the first phase of a U.S.-China trade deal has been inching forward via phone calls and meetings, now President Donald Trump says the two are in the "final throes of a very important deal" and that the talks are going "very well." Time will tell if that's the case but the extra optimism is certainly buoying the mood so far this week, though the U.S. trade deficit demonstrates pretty clearly the impact tariffs are having. At least ties between China and the U.S. are as strong as ever in the bond market. Slowdown Early indicators are pointing to a slowdown in the Chinese economy for the seventh consecutive month. Combined with industrial profits from Chinese companies dropping by the most on record in October, that could take some of the sheen off any trade optimism for cyclical stocks and risk assets. The country is also facing more pressure on climate change, with top environmental officials having reiterated its commitments but provided little on questions around the deeper carbon emissions cuts being called for by the United Nations. 'Poison' Labour Party leader Jeremy Corbyn spent another day attempting to defend his party against accusations of institutional anti-Semitism and continues to face consistent claims that he is not fit for office, with the flames fanned by a television interview on Tuesday evening in which he again failed to convince on the subject. On Wednesday night, a poll will be released that last time managed to predict the surprising loss of the Conservative Party majority, so election watchers will be glued to that. Perhaps no one more so than Tory leader Boris Johnson who knows that should he win, that's only the start of the battle. Crypto Downtrend Bitcoin is on track for its worst month of the year. It's joining other cryptocurrencies in a persistent downtrend since China took steps to crack down on virtual-currency trading — more than 170 crypto platforms have since shut down. Bitcoin has now fallen for ten consecutive sessions but for those watching the market, this may hold some solace for those eyeing the technical signals of the market and may mean it will find a floor relatively soon. Coming Up… Asian stocks were mixed as traders continue to watch for any new signs on the U.S.-China trade talks, though the optimism has fed into a higher oil price which has held onto the gains made on Tuesday ahead of U.S. crude inventories later in the day. Company news will be topped by British American Tobacco Plc's trading update, coming as it does amid a rapidly deteriorating view of vaping in the U.S. What We've Been Reading This is what's caught our eye over the past 24 hours. And finally, here's what Cormac Mullen is interested in this morning On the face of it, the performance of European and U.S. stocks this year doesn't look all that different. The Stoxx 600 is up about 21% through Tuesday, not too far behind the 25% rise in the S&P 500. But underneath the surface, Europe investors have shown a clear preference for safety. As my colleague Ksenia Galouchko pointed out yesterday, they have been avoiding companies with shaky balance sheets and favoring firms that are better capitalized. A gauge of stronger balance sheet European companies from Morgan Stanley - those with low debt ratios and high interest coverage - has outperformed its weaker counterpart by close to 15% this year. An equivalent index from Goldman Sachs for the U.S. shows better capitalized firms have actually underperformed weaker ones by about 1%. Of course the two regions have shown completely different economic narratives this year -- the U.S. one of resilience and Europe one of faltering growth. So it makes sense to see U.S. investors more "carefree" in chasing stock gains across the board while their European peers have remained cautious and concentrated in safer names. It also suggests the potential for "lower quality" European stocks to catch up, should further signs of economic stabilization appear.  Cormac Mullen is a cross-asset reporter and editor for Bloomberg News in Tokyo. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. Before it's here, it's on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can't find anywhere else. Learn more. |

Post a Comment