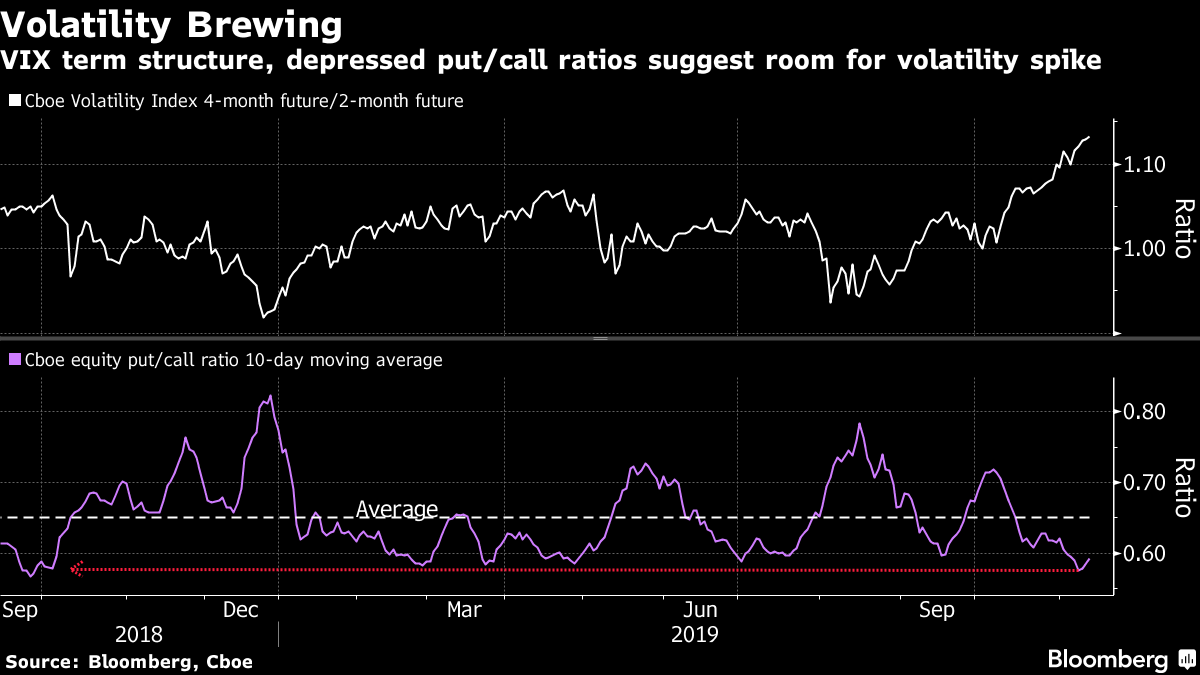

| Welcome to your morning markets update, delivered every weekday before the European open. Good morning. Donald Trump made threats on tariffs and criticized the Fed, Spanish politicians still have work to do and the violence in Hong Kong is showing few signs of abating. Here's what's moving markets. Tariffs and Rates The highly-anticipated speech from U.S. President Donald Trump at the Economic Club of New York didn't include too much that was new but reiterated some favored topics with verve. Trump said the U.S. will substantially raise tariffs on Chinese goods if no deal is struck between the two countries and he repeated the same threat for any other countries that don't play ball. The president also went after the Federal Reserve again, slamming the central bank's shunning of negative rates as bad for the U.S. He also warned that should he lose the 2020 election, that could put market gains in danger. Spain's Government Spanish Acting Prime Minister Pedro Sanchez's Socialists cut a deal on Tuesday to work with the anti-establishment Podemos party to work together in a coalition to govern the country, an attempt to bring at least some degree of certainty to the country's political situation. It's a significant move but there are still some big hurdles to get over yet, not least the fact that the two parties don't have enough votes to form a majority and so some wooing of the smaller parties will be required to get a government fully formed. All eyes on Madrid after Spanish stocks and bonds underperformed following Tuesday's news. 'Unthinkable' Stocks in Hong Kong took a plunge again and the swings are getting wilder as the tensions between pro-democracy protesters and the local government show few signs of abating, with the security chief warning of "unthinkable consequences" if the violence continues. There is growing debate among the protest leaders about the tactics being used amid fears they could embolden China to exert its authority further. Early data indicate the economy is still suffering the effects of the unrest and local banks are telling staff to cancel meetings and be safe. Borrowing Funding costs are low and companies are getting in while the getting is good. U.S. drugmaker AbbVie Inc. has sold the largest block of bonds of the year to fund its purchase of Allergan Plc, encouraged by narrowing credit risk premiums as investors pile money into corporate credit funds. These cheaper costs and the outlook for these to rise in coming months may also help explain the bold pushes in recent weeks from private equity, another example of which can be seen in reports that 3G Capital, known normally for investing in consumer businesses, is eyeing the elevator business of German conglomerate ThyssenKrupp AG. Coming Up… Asian stocks retreated, led lower by Hong Kong's Hang Seng, and futures in the U.S. and Europe aren't painting a prettier picture of the open. U.K. and U.S. inflation data will land, as will the latest World Energy Outlook report from the International Energy Agency. On the earnings front, the U.K. has flurry of midcap names reporting including housebuilder Taylor Wimpey Plc, property firm British Land Co. Plc and pub chain JD Wetherspoon Plc, where the man in charge is a notable Brexit supporter. Also, the impeachment hearings will start and be televised, plus President Trump is meeting with Turkey's Recep Tayyip Erdogan. What We've Been Reading This is what's caught our eye over the past 24 hours. And finally, here's what Cormac Mullen is interested in this morning Signals of complacency in U.S. options markets are multiplying and that suggests we could be in for a spike in equity volatility ahead. The renewed positive sentiment toward a trade deal has reduced demand for protection from a U.S. stocks sell-off. That has pushed down the premium investors pay for bearish put options over bullish calls -- as measured by options skew -- to not far off its low for the year. Meanwhile, a CBOE gauge measuring the volume of bearish options bets relative to bullish ones for U.S. stocks is also highlighting investor complacency. The indicator's 10-day moving average hit the lowest in more than a year last week. The gauge can often be a contrarian signal for equity markets. And finally, the term structure -- in this case the difference in pricing of medium-term volatility futures relative to their short-term equivalents -- suggests the market is expecting more price swings ahead. Monday's musings showed hedge funds at least are still betting on volatility declining -- today's examples show they may be soon scrambling to adjust to a surge instead.  Cormac Mullen is a cross-asset reporter and editor for Bloomberg News in Tokyo. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. Before it's here, it's on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can't find anywhere else. Learn more. |

Post a Comment