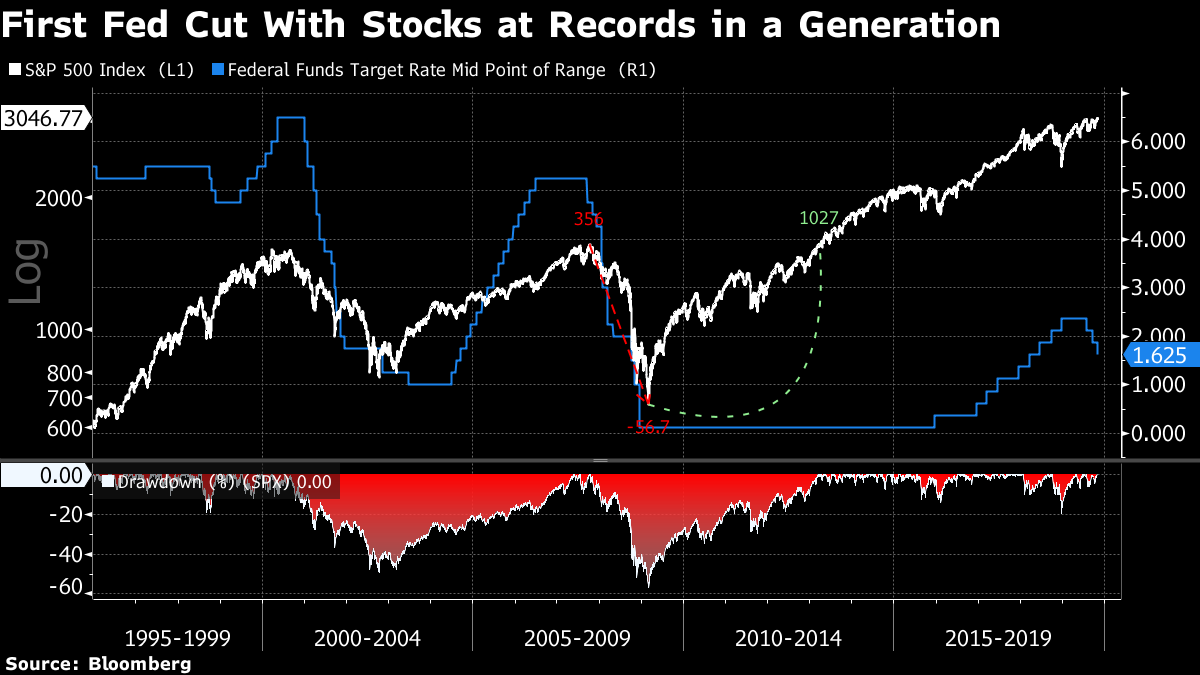

It's jobs day, China manufacturing data, and big oil reports. PayrollsToday's jobs number is expected to come in at 85,000, the lowest level in five months, as temporary factors are likely to weigh on the total. Some 46,000 workers at General Motors Co. were on strike during the mid-month reference period used by the Labor Department for the data published at 8:30 a.m. Eastern Time. This will make it harder than usual for economists to sort out the underlying labor trend at a time when other parts of the U.S. economy are showing weakness. Unemployment is forecast to tick higher to 3.6% and wage growth to post a small rise to 3%. China numberThere were some signs of resilience in Chinese manufacturing in the latest Caixin index reading which unexpectedly rose to 51.7. However, an official gauge dropped to the lowest level since February as factories throughout the region remain stuck in the doldrums. The main driver of that continues to be trade uncertainty, with hopes of a lift from a "phase one" deal between the U.S. and China tempered by comments from officials in Beijing casting doubt over the prospects for a long-term agreement. Big oilIt's another big day for earnings with Exxon Mobil Corp and Chevron Corp reporting before the bell after a quarter expected to be dominated by low commodity prices and weak refining margins. Alibaba Group Holding Inc. earnings will help give an idea of how the Chinese consumer is holding up. Berkshire Hathaway Inc.'s report tomorrow will give Warren Buffett a chance to explain what the company is doing with its cash pile in a period without any major acquisitions. Markets riseOvernight the MSCI Asia Pacific Index rose 0.3% while Japan's Topix index closed broadly unchanged, remaining close to its highest level of the year. In Europe the Stoxx 600 Index was 0.3% higher at 5:50 a.m. with basic resources among the best performers on the first trading day of the month, while banks were weaker. S&P 500 futures pointed to a gain at the open ahead of jobs data, the 10-year Treasury yield was at 1.695% and gold was flat. Coming up…Markit U.S. manufacturing PMI is at 9:45 a.m., with ISM manufacturing at 10:00 a.m. September construction spending is also at 10:00 a.m. Auto sales data for the October is due today. Fed speakers today are Dallas Fed President Robert Kaplan, Fed Vice Chairman Richard Clarida, Fed Vice Chair for Supervision Randal Quarles, San Francisco Fed President Mary Daly and New York Fed President John Williams. What we've been readingThis is what's caught our eye over the last 24 hours. And finally, here's what Luke's interested in this morningThe equity market's resilience this week amid the twists and turns of the Treasury market was a sight to behold. The idea that the Fed was done on delivering easing didn't really rattle stocks much. Think back to the start of the year, when the risk rally hadn't been so reliant on lower real rates since 2012. We're clearly in a new market regime. Such an outcome might have been expected, based on how the market's been operating in a "good news is good news" paradigm during at least the second half of this year, but it was nonetheless impressive. For most of the first half of 2019 – and even after the first rate cut, when the notion of a mid-cycle adjustment roiled stocks – the equity market was signaling that it needed the Fed's help. Now, traders are suggesting they only need the Fed to do no harm. The S&P 500 Index closed at an all-time high on a day when the Fed cut rates for the first time since January 31, 1996. Ultimately, when central bankers say they'll only hike on a material pick-up in inflation and such an increase is not on the horizon, that's a pretty big endorsement of risk-parity oriented portfolios. The equity market's newfound relative ambivalence to the Treasury market continued on Thursday. Ten-year Treasury yields tumbled about 8 basis points amid a rash of underwhelming data and reports that a comprehensive U.S.-China trade deal wasn't nearly as likely as the barebones so-called phase one deal. The benchmark borrowing cost dipped below 1.68% – nearly 20 basis points off its highs of the week. And yet, the S&P 500 Index only fell 0.3% on the day. That's tied for the smallest loss of the year for a session in which the 10-year yield posted a decline of that magnitude. U.S. stocks have dropped 1.4%, on average, during such a furious rally in rates in 2019.  Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. Before it's here, it's on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can't find anywhere else. Learn more. |

Post a Comment