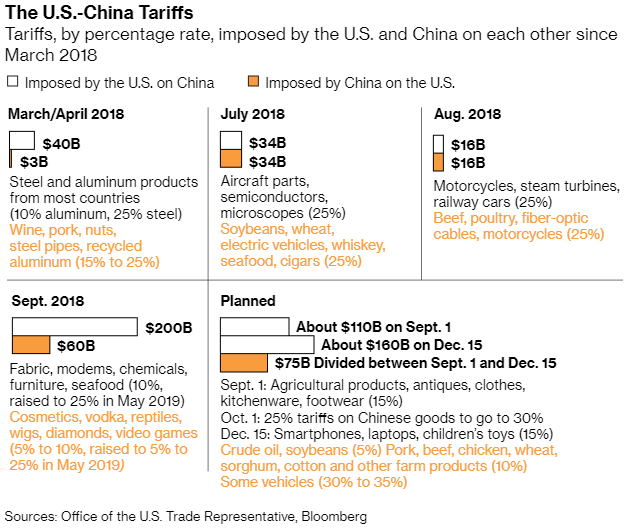

| Tariffs are hiked again, Hong Kong protests flare up and Argentina introduces capital controls. Here's what's moving markets. More Tariffs, No Deal The Trump administration slapped tariffs on roughly $110 billion in Chinese imports on Sunday, marking the latest escalation in a trade war that's inflicting damage across the world economy. The 15% U.S. duty hit consumer goods ranging from footwear and apparel to home textiles and certain technology products like the Apple Watch. A separate batch of about $160 billion in Chinese goods -- including laptops and cellphones -- will be hit with 15% tariffs on Dec. 15. China retaliated as of 12:01 p.m. Sunday in Beijing, with higher tariffs being rolled out in stages on a total of about $75 billion of U.S. goods. Face-to-face talks between Chinese and American trade negotiators scheduled for Washington in September are still on, Trump told reporters Sunday after returning from Camp David. Hong Kong Protests Flare Up Again Hong Kong protesters caused major disruptions to the city's international airport Sunday, massing outside the building in an attempt to paralyze transport to and from the facility, with the rail operator shutting some subway stations Monday after they were damaged. Protesters vandalized turnstiles at some of stations and sprayed graffiti on them. Sunday's civil action – the 13th straight weekend of political unrest – followed a night of some of the worst violence in the city since the anti-China demonstrations began almost three months ago, and came despite the Airport Authority Hong Kong obtaining an injunction last month against people holding demonstrations there and a later one preventing them from blocking roads. Market Open U.S. stock futures slumped when trading began Sunday evening. The yen climbed and the yuan edged lower after the new U.S. tariffs kicked in on Chinese goods and data showed further deterioration in China's manufacturing sector. U.S. equities saw their first monthly decline since May despite finishing mostly higher on Friday. American markets are closed for the Labor Day holiday. Key events this week include Australia setting monetary policy on Tuesday. Federal Reserve speakers include New York Fed's John Williams on Wednesday and Fed Chairman Jerome Powell on Friday. The U.S. jobs report on Friday is projected to show nonfarm payrolls rose by 165,000 in August, slightly above the month prior, and for the unemployment rate to be steady at 3.7%. Argentina's Capital Controls Argentina's government imposed capital controls to halt a slump in foreign-currency reserves and the peso that has pushed the country to the brink of default. The central bank set a limit of five days for exporters to repatriate foreign currency, while institutions will need authorization of the bank to buy dollars in the foreign-exchange market, except in the case of foreign trade, according to a statement from the bank. The announcement comes as Argentina's currency crisis spirals out of control. About $3 billion drained out of foreign currency reserves on Thursday and Friday alone as the government struggled to repay short-term debt and slow the drop in the peso. The country risks exhausting its net reserves, which stand at under $15 billion, within weeks if it keeps losing money at this pace. Eye of the Storm Dorian came ashore on tiny Elbow Cay in the Bahamas Sunday as the strongest hurricane ever recorded there, bringing 185 mile-per-hour winds, 10 to 15 inches of rain, and a storm surge that could top 23 feet that could leave the islands devastated for years. The fate of Florida remains uncertain. The eye of Category 5 Dorian struck about 12:40 p.m. with wind gusts of more than 220 mph (354 kilometers per hour) in addition to its sustained winds, the U.S. National Hurricane Center reported. What We've Been Reading This is what's caught our eye over the weekend. And finally, here's what Tracy's interested in this morning The U.S. administration's latest round of tariffs on an additional $110 billion of Chinese goods came into effect over the weekend. Trump of course reportedly wanted to go further – by blocking U.S. companies from doing business with China at all. With ongoing trade tensions as the background, it's worth taking a moment to read the latest member survey of the U.S. China Business Council.  While the full 20 pages is difficult to summarize, there are some surprising tidbits for anyone thinking about American companies operating in China. For instance, 97% of those surveyed reported that their China operations remained profitable in the face of a number of challenges. Meanwhile, some 11% of respondents said that China's "Made in 2025" survey – its project to encourage domestic tech industry – had created positive opportunities for their business. As the survey notes: "This shift may indicate that some of China's efforts to offer foreign companies increased access to industrial policies are beginning to take root." Anyway, the whole thing is worth reading for a more nuanced take on the prospect of U.S. companies doing business with China. One other thing of note this week when it comes to relations between the world's two biggest economies: The U.S.-China Economic and Security Review Commission will hold its annual review, with a public hearing on Wednesday, Sept. 4. You can follow Bloomberg's Tracy Alloway at @tracyalloway. The best in-depth reporting from Asia Pacific and beyond, delivered to your inbox every Friday. Sign up here for The Reading List, a new weekly email coming soon. Before it's here, it's on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can't find anywhere else. Learn more. |

Post a Comment