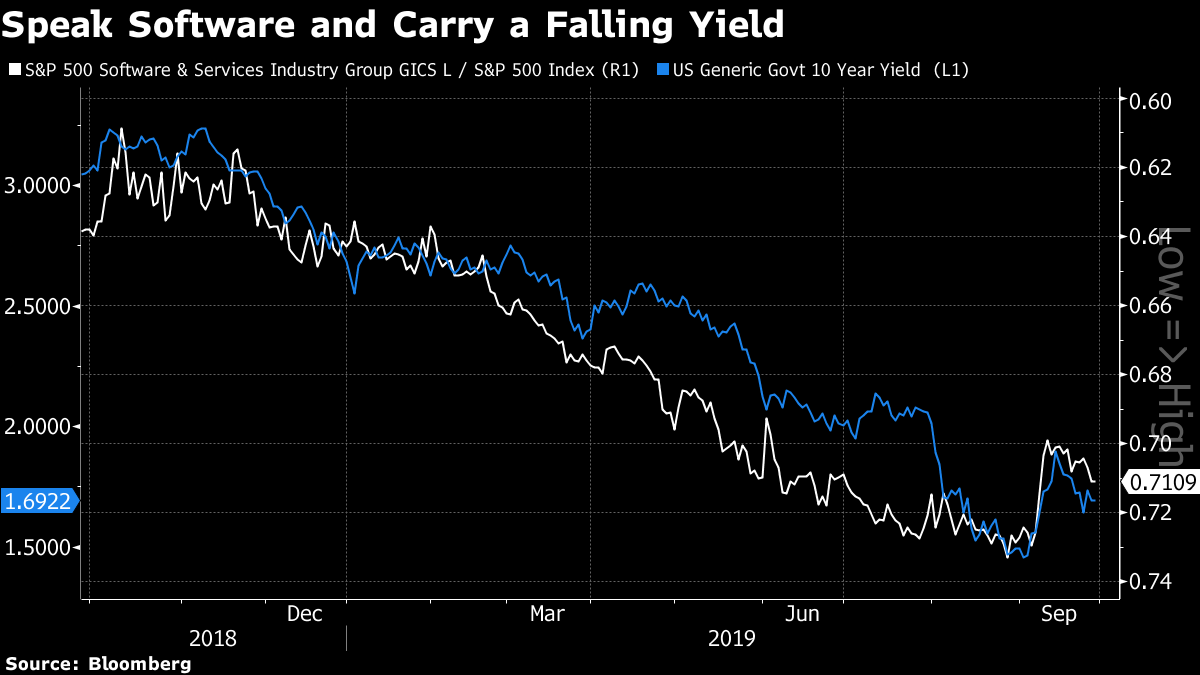

Trump's comments fuel impeachment probe, more warning signs for Europe's economy, and little hope for a Brexit breakthrough. Close to a spyPresident Donald Trump's recorded comments at a closed-door gathering with U.S. diplomats seem set to add fuel to Democrats' impeachment drive. Trump is seen describing the whistle-blower as "close to a spy" and demanded to know who the person is, in a video of the event obtained by Bloomberg News. The release of the complaint and testimony by acting intelligence chief Joseph Maguire yesterday raised the specter of a White House "cover up" according to House Speaker Nancy Pelosi. House Intelligence Chairman Adam Schiff said it gave "a pretty good road map of allegations we need to investigate." The S&P 500 Index closed lower for the fourth time in five days as the political turmoil damped demand for risk assets. Four-year lowThe European Commission's monthly economic sentiment indicator dropped to the lowest level since 2015, with the industrial confidence sub-index plumbing a six-year trough. A slowdown in Germany continues to be one of the biggest drivers of the worsening performance, with the DIW Institute forecasting the region's largest economy is already in a recession. European Central Bank Chief Economist Philip Lane said policy makers still have room to cut rates further if needed. Little hopeEven by the standards of recent EU-U.K. meetings, expectations for a breakthrough at today's meeting between the two sides are very low. European officials have all but given up hope of finding a way forward in the coming weeks as Prime Minister Boris Johnson's inflammatory rhetoric against his domestic opponents is seen as a hindrance. There was some good news for the embattled prime minister as he won a High Court case in Northern Ireland which had sought to have a no-deal Brexit declared a violation of the Good Friday peace accord. The pound weakened after Bank of England policy maker Michael Saunders said a rate cut may be needed even if a no-deal Brexit is avoided. Markets mixedOvernight, the MSCI Asia Pacific Index slipped 0.6% while Japan's Topix index closed 1.2% lower after inflation data came in below expectations. In Europe, the Stoxx 600 Index was 0.5% higher by 5:45 a.m. Eastern Time with miners leading the gains, while London's FTSE 100 Index was the region's best performer due to the falling pound. S&P 500 futures pointed to a gain at the open, the 10-year Treasury yield was at 1.71% and gold dropped. Coming up…The August PCE report, published at 8:30 a.m., is expected to show a jump in income growth to 0.4% from a month earlier, with spending growth softening to 0.3% and the PCE inflation gauge increasing to 1.8%. Durable goods orders, published at the same time, are forecast to drop 1.0%. Consumer sentiment figures for September are released at 10:00 a.m. with the latest Baker Hughes rig count at 1:00 p.m. What we've been readingThis is what's caught our eye over the last 24 hours. And finally, here's what Luke's interested in this morningThe U.S. stock market has a dependency issue: it can't go up unless Treasury yields do too. That's only a mild exaggeration. For the past two months, over 75% of days in which the S&P 500 has gained coincided with a rising 10-year Treasury yield. Prior to that, the year-to-date share of "stocks gain, yields rise too" was 55%. Why August as a demarcation line? Well, it's when the 10-year yield cracked below 2% on the heels of the Federal Reserve's commencement of an easing cycle. It's also when investors began to really throw in the towel on the prospect for reflation over the next year, judging by the slimming spread between 10-year yields and the 10-year, one-year forward rate. For software stocks – the most important contributors to the bull run – it's striking how much relative performance over the past year has been linked to bond-market dynamics. The thinking here is that falling yields reflect concern about future global activity, so stocks that have shown a structurally superior earnings profile (growth stocks, like software) are prized. If the equity market were to become a little more yield-agnostic, this would likely be a positive for risk bulls. Relying on rising yields to power the market higher amid a backdrop of deflating domestic confidence, an ongoing Fed easing cycle, an endless barrage of conflicting trade headlines, lackluster activity abroad, and now a potential impeachment of U.S. President Donald Trump would seem akin to swimming against the tide. The story of 2019 for the 10-year yield has been a tendency to trade in 20-basis point ranges then knife downwards. Perhaps a period of Treasury yields consolidating as earnings season approaches will give stocks a chance to craft their own narratives.  Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. Before it's here, it's on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can't find anywhere else. Learn more. |

Post a Comment