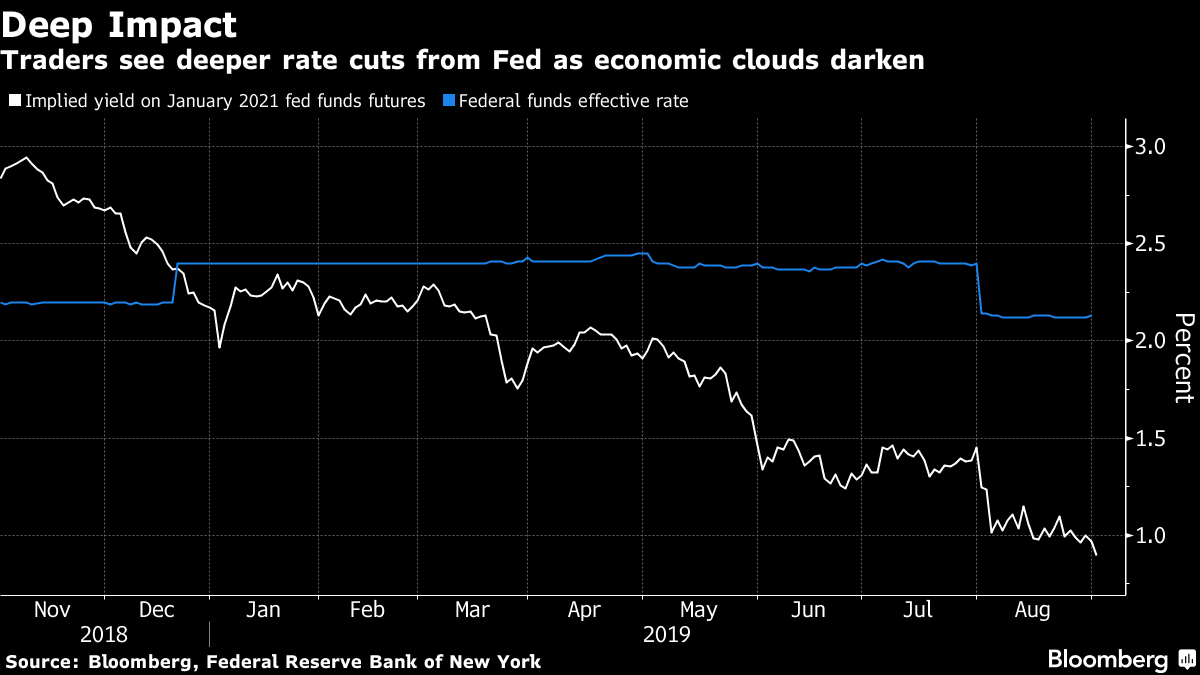

| Welcome to your morning markets update, delivered every weekday before the European open. Good morning. Boris Johnson lost his first key vote as U.K. prime minister, a crucial U.S. data point missed expectations, the trade scenario is still not much clearer and another European rate setter is sounding a little hawkish. Here's what's moving markets. Losing Control Six weeks into the top job and U.K. Prime Minister Boris Johnson is staring into the abyss. Members of the House of Commons voted 328 to 301 Tuesday to take control of the parliamentary agenda, and now plan to put forward a draft law that would force Johnson to delay Brexit until Jan. 31. If that vote passes, the PM says he'll call a general election. Here's a roundup of the equity sectors and stocks to watch if he follows through on his pledge. ISM Shocker If you were glued to events in Westminster yesterday, you might have missed it. But from a global markets perspective, something possibly even bigger was happening, as a key U.S. factory gauge unexpectedly contracted for the first time since 2016. The Institute for Supply Management's purchasing managers index was weaker than all forecasts in a Bloomberg survey of economists, falling below 50 to indicate the manufacturing economy is shrinking. The dollar tumbled, and it failed to recover overnight. Lacking Answers Investors aren't yet getting the trade clarity they seek. U.S. President Donald Trump warned China on Tuesday that any trade deal will be much tougher on the Asian nation if it happens after he wins the 2020 U.S. presidential election. Meanwhile, China's largest technology company, Huawei Technologies Co., was in focus again, accusing Washington of orchestrating a campaign to intimidate its employees and launching cyber-attacks to infiltrate its internal network. The recent tariff fallout has led some economists to cut their forecasts for Chinese economic growth in 2020 to below 6%. Asia Mixed Asian stocks were mixed Wednesday on low volumes amid focus on the ISM number. The euro was steady as European Central Bank policy maker Francois Villeroy de Galhau added to skepticism over the need for renewed asset purchases and in Italy, Prime Minister-designate Giuseppe Conte is set to form the next government after getting the backing of supporters of the Five Star Movement. Oil futures in New York edged higher after closing 2.1% lower on Tuesday. Coming Up... Bank of England Governor Mark Carney's appearance before the Treasury Committee today could be one of his last chances to publicly address lawmakers before the Halloween Brexit deadline. On the data front, we await the services purchasing managers' index from the euro area and the U.K. French aerospace and defense firm Dassault Aviation SA and U.K. home-builder Barratt Developments Plc are among companies scheduled to report earnings. What We've Been Reading This is what's caught our eye over the past 24 hours. And finally, here's what Cormac Mullen is interested in this morning An unexpected contraction in U.S. factory activity in August has provided traders with the latest ammunition to heap more pressure on the Federal Reserve. Interestingly, there was limited direct evidence of tariff increases creating price pressures or materials shortages in the report -- it seems the hit to confidence from the U.S.-China trade war is having the greater impact. After the data, the implied yield on Fed funds futures for January 2021 hit a new low, suggesting investors see deeper cuts ahead from the U.S. central bank in its bid to stave off a recession. The probability of a 50-basis-point cut at this month's meeting rose toward 30% -- up from about 10% a week ago. Traders are worried, and rightly so -- the figures put a dent in the theory that the U.S. economy can remain immune from global weakness. More than ever, they will look to the Fed to keep the risk asset party rolling.  Cormac Mullen is a Cross-Asset reporter and editor for Bloomberg News in Tokyo. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. Before it's here, it's on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can't find anywhere else. Learn more. |

Post a Comment