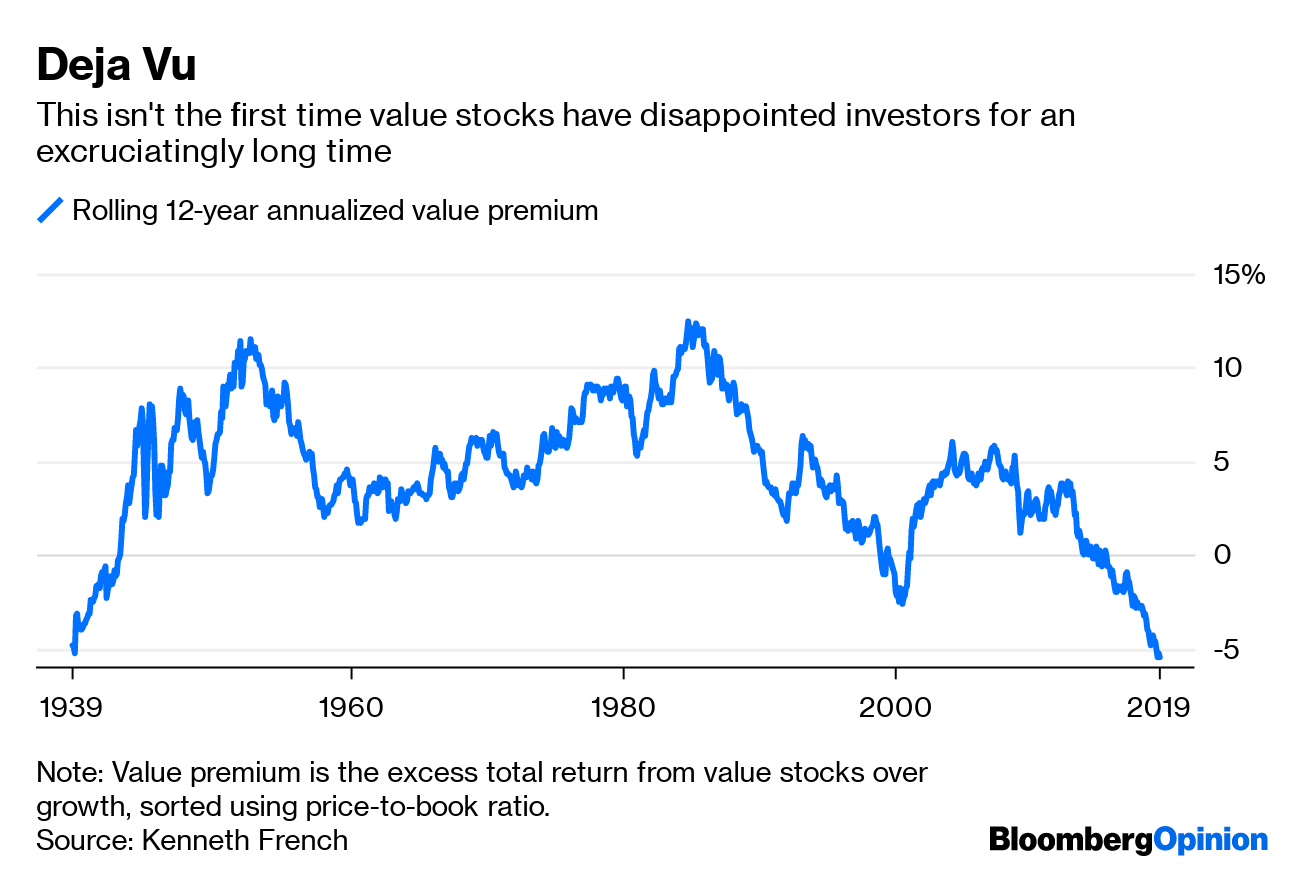

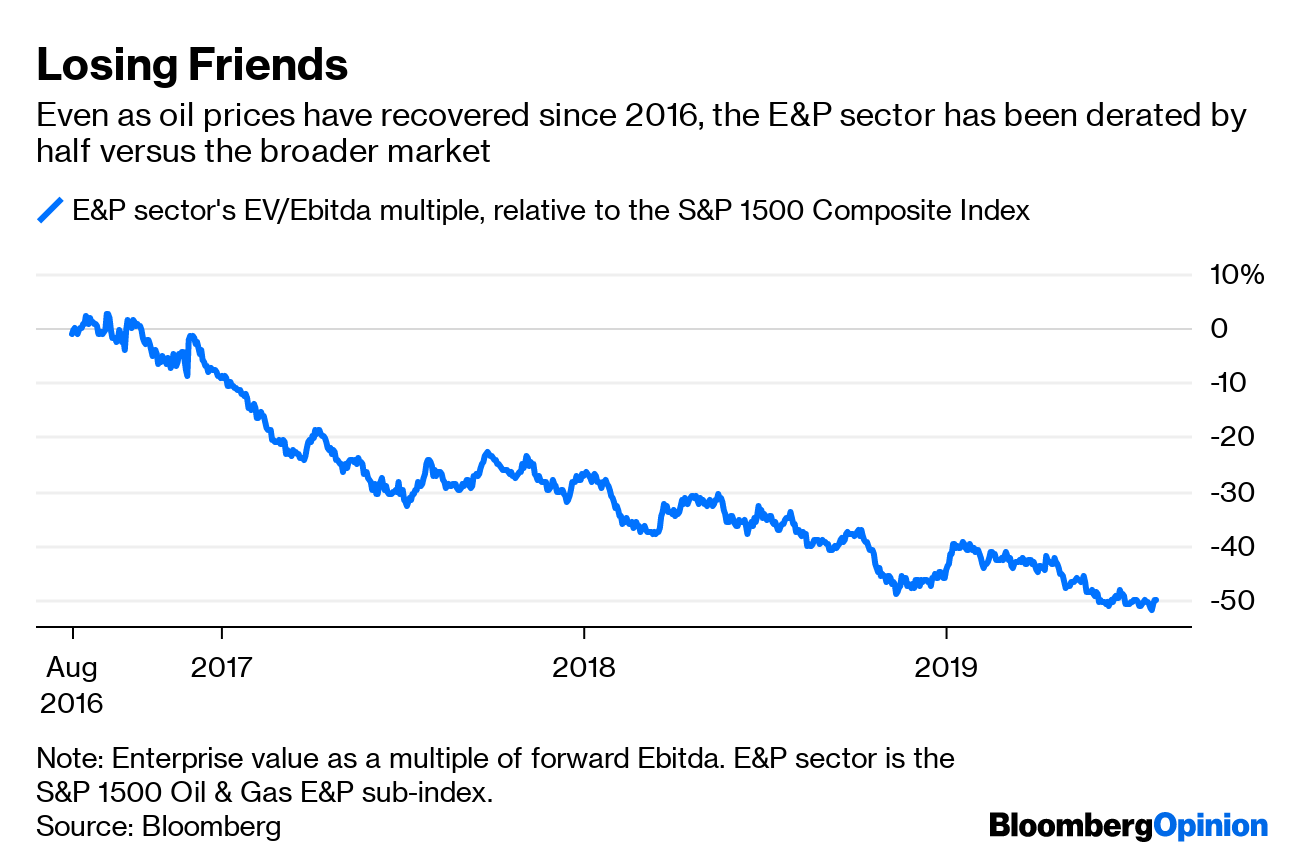

Today's Agenda  The Sum of All Market Fears For a long time, markets have been at the Fed's mercy: Hopes for low rates make stocks rise, fears of not-so-low rates make them fall. But a bigger monster is threatening them now, and it lives in the White House. As we wrote yesterday, the stock market cratered after President Donald Trump ratcheted up the trade war with China for no apparent reason but maybe to convince the Fed to cut rates more. And here's the thing: The bond market priced in more rate cuts, sure enough, but the stock market fell anyway and kept on falling today. This relative indifference to rates is kind of a new look for Wall Street, notes John Authers. It suggests traders fear trade hostility more than they fear not-quite-rock-bottom borrowing costs. Low rates make stocks a better bargain, notes Robert Burgess, but a trade war may offset any upside of a looser Fed. Trump's new round of tariffs would affect American consumers directly, notes David Fickling. Trump's advisers have wisely shielded consumers from the trade war so far, and it's probably no coincidence they've held strong even as manufacturing has fallen into recession. Soon that resilience will be tested. Meanwhile, as the Fed and other central bankers around the world scramble to cut rates, sometimes just to avoid annoying markets and tweet-happy presidents, China's central bank is able to stand pat and keep its powder dry, writes Shuli Ren. That may help it survive the trade war in the long run. Further Trade-War Reading: How are manufacturers handling this flare-up? Subscribers to Brooke Sutherland's weekly industrials newsletter already know. Maybe you should be one of them! Jobs Reports Are So 2009 Oh, by the way, there was a jobs report today. It was fine, mostly. Nobody cared. See the preceding section for why. When jobs have been growing every month since President Barack Obama's first term, it eventually gets a little dull. It's certainly not going to compete with the existential threat of the Godzilla/Mothra/Ghidora-like battle of Trump against China and the Fed, notes Robert Burgess. But when jobs start falling again, look out. We may still be far from that moment, but there will come a transition period, when the job market goes from "fine" to "uh-oh." Could we be there now? The Bureau of Labor Statistics' "birth/death adjustment," which tries to account for the opening and closing of businesses, may not fully catch the beginnings of downturns, writes Justin Fox. But, believe it or not, it's usually not that wrong. Trump's Biggest 2020 Liability Is Trump Trump last night held the 925th political rally in the 924 days he has been president. He reached across the aisle to try to expand his base of support, and – oh, who are we kidding? You know the drill. He lavished praise on die-hard supporters and aired endless grievances against his many enemies, as he did at the other 924 rallies. "Oh, and he promised to cure cancer," Tim O'Brien notes. In short, Trump made it all about Trump. You might excuse this at a political rally, but Trump also makes it all about Trump at 9/11 first-responder ceremonies, his own father's funeral and other completely inappropriate venues, Tim notes. As this self-worship act wears thin, it will hurt him in 2020, but he's incapable of changing. Further 2020 Reading: Health care is the biggest issue for Democrats, but the debates so far have handled it badly. Here are some better questions we should be asking. – Max Nisen Boris Johnson's Brexit Plan B Across the Pond, Boris "Britain Trump" Johnson seems to have a political mess on his hands. He's got a wafer-thin parliamentary majority and an EU apparently disinterested in helping him avoid pulling the trigger on the no-deal Brexit gun he's holding on his own country. It would seem Johnson must back down soon, but Lionel Laurent suggests he may be gambling that France and other close trading partners will offer a way out. They'd be most exposed in a no-deal Brexit, which could inspire panicky side deals that help ease Britain's way out. Further Brexit Reading: Royal Bank of Scotland is a canary in the Brexit coal mine. It's not doing well. – Elisa Martinuzzi Telltale Charts Value investing is in the middle of an epic bad time, but it's not dead yet, writes Nir Kaissar.  Trump's trade hostilities pummeled energy stocks this week, and that's just a taste of what's to come, warns Liam Denning.  Further Reading The Trump administration's plan to move some federal agencies out of Washington will be a huge waste of money and a talent drain. – Bloomberg's editorial board European regulators ordered Google to feature other search engines on Android. Its response is self-serving. – Alex Webb Tunisia was the only country to leave the Arab Spring with a functioning democracy. An upcoming election will test it. – Bobby Ghosh Yes, GDP is flawed, but we'll never come up with a perfect measure of economic well-being. – Noah Smith Why are people are buying cassette tapes again? Certainly not for sound quality. – Leonid Bershidsky ICYMI Germany's entire yield curve fell below zero. Algae has closed New Jersey's biggest lake to swimming. We already have wildly efficient carbon-capture technology. Kickers Canadian paleontologists find a freaky new Cambrian sea creature. (h/t Ellen Kominers) Robots are better than humans at writing ad copy. Monkeys use logic to put lists in order. (h/t Scott Kominers for the previous two kickers) Living near trees improves well-being. Note: Please send trees and complaints to Mark Gongloff at mgongloff1@bloomberg.net. New to Bloomberg Opinion Today? Sign up here and follow us on Twitter and Facebook. |

Post a Comment