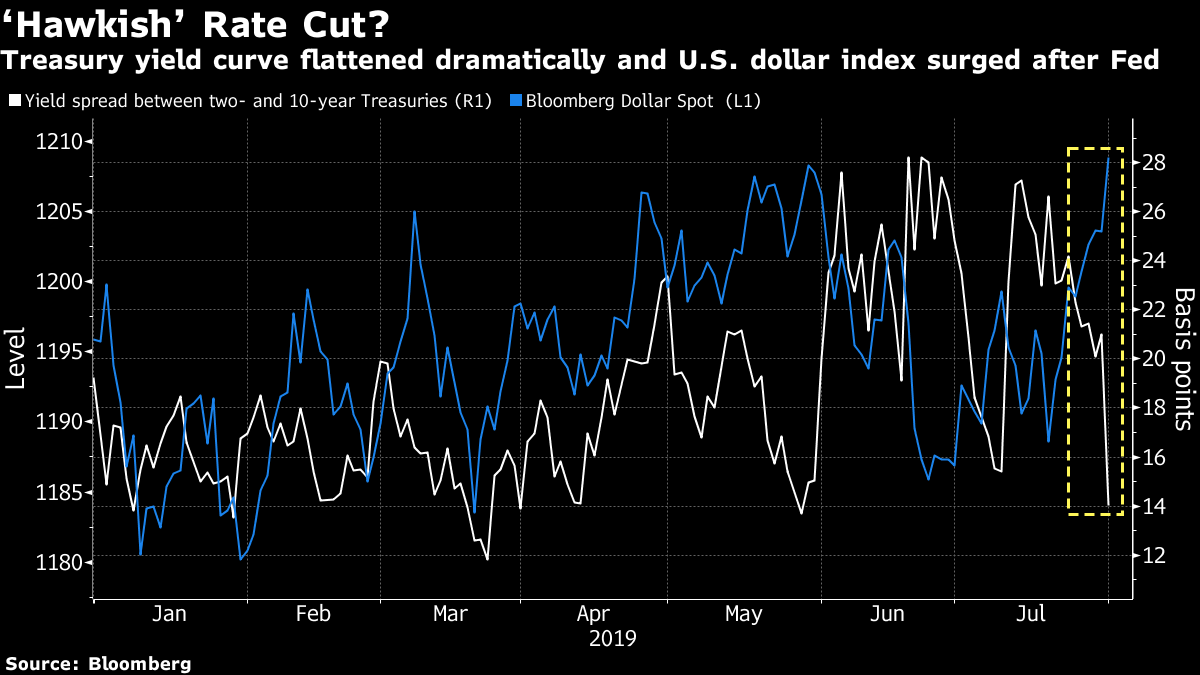

| Trump sends markets reeling with a new round of tariffs. The cull begins at Citigroup. And Hong Kong braces for more street protests. Here are some of the things people in markets are talking about today. Tariff Tweets Well that escalated quickly. Donald Trump abruptly tweeted he would impose a new 10% tariff on $300 billion worth of Chinese imports not yet subject to U.S. duties after setbacks in trade talks. The levy will go into effect Sept. 1. A total of $250 billion of China-made products are already subject to a 25% import charge. Peter Navarro had earlier called the talks this week in Shanghai "constructive." Trump said Xi Jinping isn't moving fast enough to resolve the trade war, and he warned that he might raise tariffs on Chinese goods beyond 25% if trade negotiations with Beijing remain stalled. Stocks Swoon As for market reaction, Asian stocks are expected to follow the U.S. lower, after the S&P 500 saw the biggest two-day drop since May, swinging 2% from gains to losses. The 10-year Treasury yield dropped to the lowest level since 2016, while two-year rates plunged 16 basis points. Haven currencies rose against the dollar, and gold was up more than 2%. Crude oil slumped 8%. Trump said he was "not concerned at all" about the markets' negative reaction. Cull Begins Citigroup has begun to make cuts to its trading workforce as it works toward culling about 400 people from the division. The company has dismissed dozens of employees this week, including cash equities and equity derivatives traders, according to people with knowledge of the matter. Roughly 50 people have been cut at Citigroup's New York office so far, and about 25 people are out in London, with more expected this year. Citigroup joins banks including Deutsche Bank AG and Societe Generale SA in eliminating hundreds of jobs across their equities and fixed-income trading divisions. Flash Mob Hong Kong finance staffers gathered in the city center after work Thursday for a "flash mob" protest in the pouring rain, the latest demonstration in a movement that's growing more creative. The city told its employees—some of whom plan to rally Friday—that they mustn't violate the civil service's political neutrality. None of this has been good for local retailers, and luxury brands are getting increasingly worried too. The nightmare scenario for Hong Kong is seeing Chinese troops on the streets, which is seen as a last resort but has set nerves on edge. Not-So Prime Time TV Couch potatoes in China, the next 100 days are going to be tough. Beijing ordered television channels not to broadcast shows that are "too entertaining" in the months leading up to the 70th anniversary of the founding of the People's Republic. Instead, the country's TV regulator provided a list of 86 approved programs that focus on patriotic themes, such as the rise of the Chinese nation, its growing affluence and power, and the stories of national heroes. What we've been reading This is what's caught our eye over the last 24 hours. And finally, here's what Tracy's interested in this morning When the Fed cuts rates you can usually expect two things to happen: the Treasury curve will steepen and the dollar will weaken. But market reaction after Wednesday's "hawkish" rate cut didn't see either of those things. Instead the Treasury curve (measured by the difference between two- and 10-year Treasuries) flattened dramatically, while the Bloomberg Dollar Index surged.  It probably wasn't the kind of reaction the Fed wanted to see. What makes the stakes particularly high for the central bank this time around is that the greenback has been stubbornly strong for some time, and in an environment dominated by trade tensions to boot! A stronger dollar probably isn't great for the U.S. economy in the midst of a manufacturing recession. But given that the Fed seems to have shifted its emphasis away from domestic factors and over to "global risks," it's worth pointing out that a strong dollar isn't great for the rest of the world either. That's because much of the world's trade and cross-border financing still gets done in dollars. (For an in-depth take on this, check out the works of economist Hyun Song Shin). Expect a bunch of Fed speak to try to walk this back soon. You can follow Bloomberg's Tracy Alloway at @tracyalloway. The best in-depth reporting from Asia Pacific and beyond, delivered to your inbox every Friday. Sign up here for The Reading List, a new weekly email coming soon. Before it's here, it's on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can't find anywhere else. Learn more. |

Post a Comment