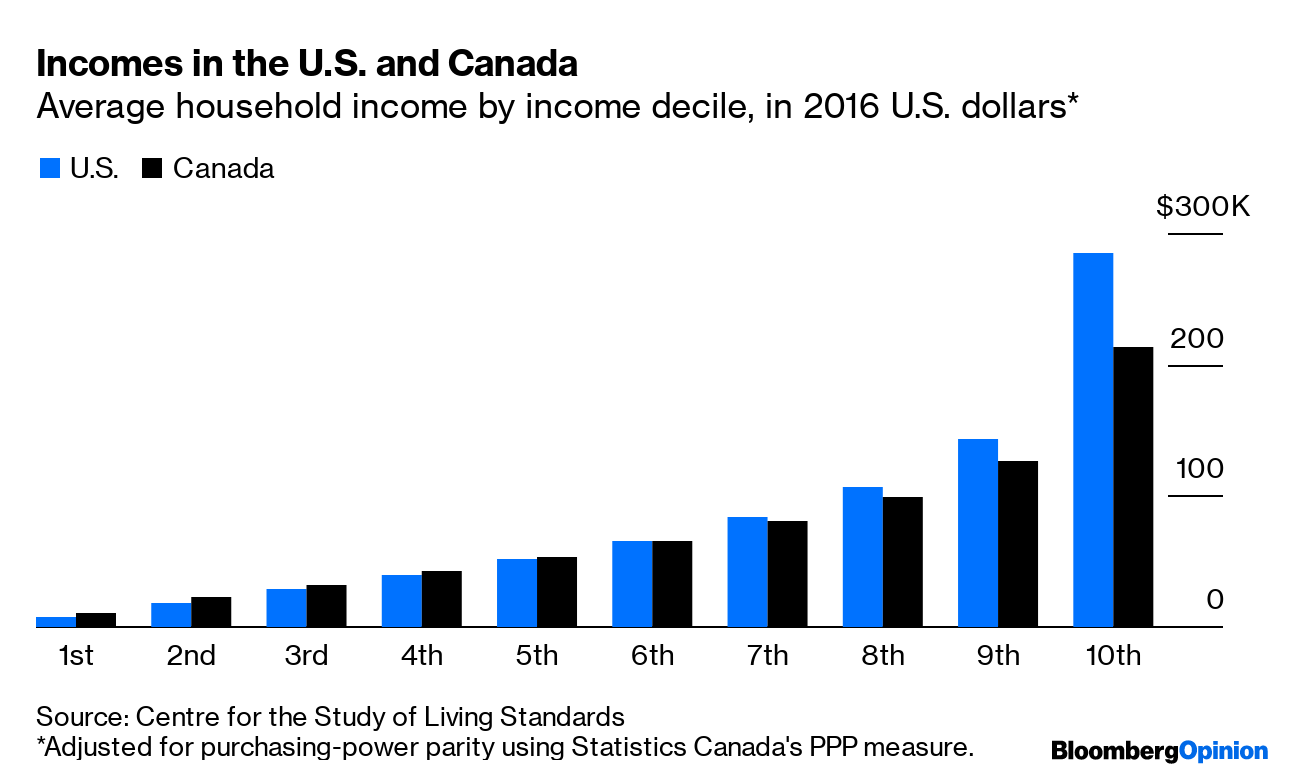

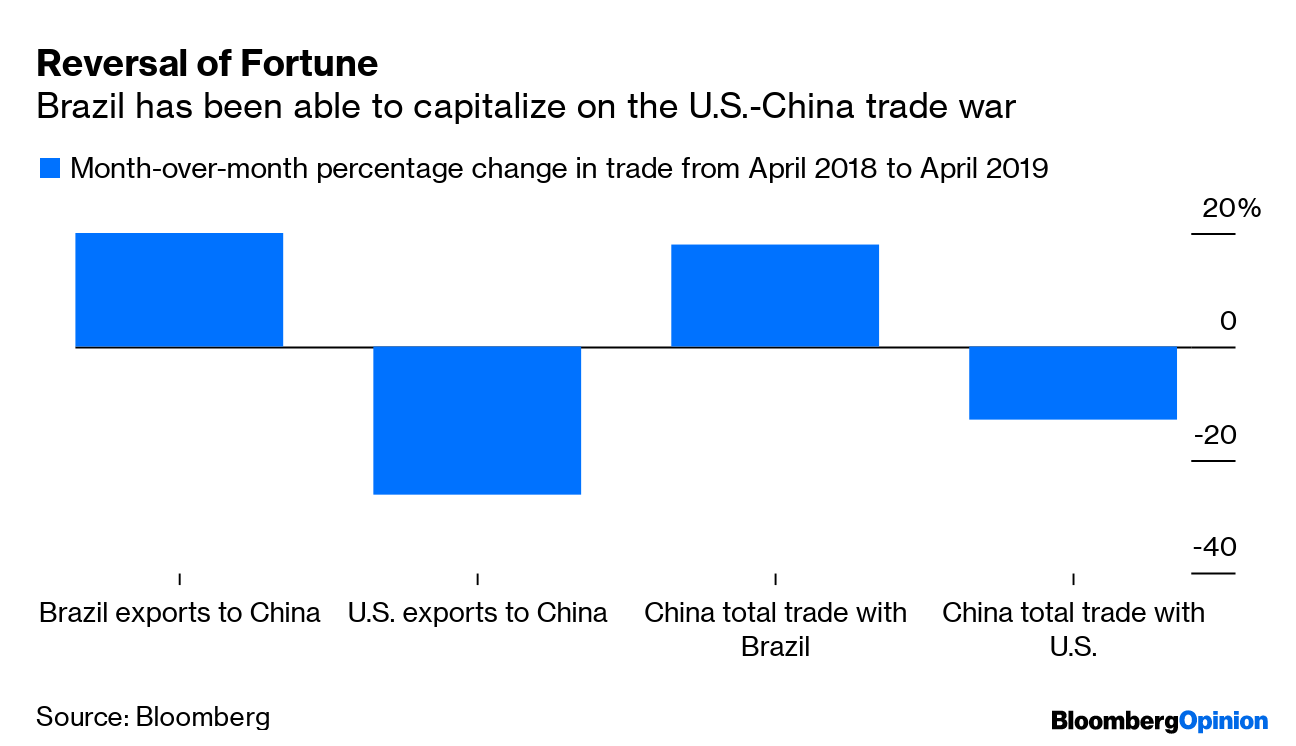

Today's Agenda  Trump's Rhyming History President Donald J. Trump will never be mistaken for President George H. W. Bush. One spoke of "a thousand points of light," the other of "American carnage." One was a war hero, the other had bone spurs. One was a Connecticut patrician, the other has gold-plated bathroom fixtures. But Trump may yet have one big thing in common with Bush the Elder: He too may end up being a one-term president thanks to the economy, writes Karl Smith. Bush's broken 1988 campaign promise — "Read my lips: no new taxes" — planted the seeds of his 1992 defeat. Trump has cut taxes, but mainly for the wealthy and corporations, and Karl notes that the effects of his trade war amount to an offsetting tax hike on consumers. A recession obliterated high approval ratings for Bush. Trump now faces the prospect of his own recession, but with approval ratings that have never threatened to crack the high 40s. This may help explain why Trump has lately dialed back his trade belligerence, a gesture reciprocated by China today, helping stocks rally. But as Mohamed El-Erian noted earlier this week, we'll need a real trade-war resolution to truly end tensions and help Trump avoid becoming another Bush. Is the Fed Helping or Hurting? Trump has also relentlessly pressed the Federal Reserve to cut interest rates so he can keep on trade-warring while avoiding recession. Don't anybody tell him this, but the Fed's target interest rate is now higher than that of any other rate in the developed world, notes Robert Burgess. Italy — Italy! — can today borrow money for 30 years at a lower rate than the fed funds rate. This might suggest the Fed is in fact a smidgen behind the curve, as Trump tweets five times a day. Then again, just how helpful are super-low interest rates, really? Japan's benchmark rate has been at or near zero for two decades, a period marked by blah growth. Japan also spent much of that time haunted by "zombie companies" shambling along well past their sell-by dates. In fact, long periods of rock-bottom rates might only encourage the spread of zombie companies, writes Noah Smith, or at least monopolies, which are a different kind of monster. Both hurt productivity and future growth. Unfortunately, the alternative — a long recession — might be even more destructive. Further Fed Reading: The Fed needs some political guidance to avoid thwarting the intentions of any president and Congress, regardless of party. – Conor Sen BoJo Goes Rogue Boris Johnson's supporters suggest his stunning suspension of Parliament to force a no-deal Brexit is either 3-D chess that will ultimately defeat both the EU and Jeremy Corbyn, or an heroic defense of the popular will to leave the EU under any circumstances. His critics call it an immolation of British democracy. It is, in fact, none of the above, writes Bloomberg's editorial board. Johnson's move simply reveals his utter lack of power and of good Brexit ideas, while shoving the country closer to the brink of disaster. Just as an example of the chaos BoJo has inadvertently unleashed, Parliament now won't have time to consider a financial-services bill that would have helped the U.K. keep up with EU financial rules, notes Elisa Martinuzzi. The risk of breaking with the EU endangers the City of London, the source of about 7% of national output, which does about 20% of its business with Europe. Bonus Editorial: It's time to end the Afghanistan war, but it must be done carefully. Here's how. Time to Consider 100-Year Bonds One of Trump's major campaign promises was to rebuild America's decrepit infrastructure. Nearly three years after his election, it's still decrepit. One big problem is that nobody seems to want to make the very large investment — Trump aimed for $1.5 trillion at one point — such a project requires. But with borrowing costs low and falling again and investors thirsty for yield, Barry Ritholtz suggests ultra-long-term bonds could be the solution. It just so happens Treasury Secretary Steve Mnuchin has been thinking about issuing 100-year Treasury bonds. These would forever warp the bond market, notes Marcus Ashworth. But they could be just what America's crumbling bridges and lousy train service need. Telltale Charts Except for the very rich, most Canadians are doing better than most Americans, notes Justin Fox.  The Amazon may be burning, but at least Brazil is capitalizing on the trade war, notes Matthew Winkler.  Further Reading Silicon Valley must figure out how to deal with its brilliant jerks, who often turn out to be plain old jerks. – Shira Ovide Jack Ma has an AI vision that sounds a lot better than Elon Musk's. – Leonid Bershidsky Never-Trumpers should want people like Mike Pompeo to keep advising Trump, to check his worst impulses. – Eli Lake Italy's new ruling coalition is on shaky ground. Don't be surprised if chaos returns soon. – Ferdinando Giugliano The Cherokee Nation should have a voice in Congress. – Noah Feldman A new "gay gene" study doesn't tell us much. – Faye Flam ICYMI Ray Dalio's flagship fund made some bad rate bets. Hurricane Dorian could be a Category 4 by the time it hits Florida. Who said it: Biden or Trump? Kickers New species of bloodsucking metaphor found outside D.C. (h/t Alistair Lowe) StoryAI turns a few sentences into very strange stories. (h/t Scott Kominers) These kids today have much nicer dorm rooms. What happened to John Travolta's career? Note: Please send leeches and complaints to Mark Gongloff at mgongloff1@bloomberg.net. New to Bloomberg Opinion Today? Sign up here and follow us on Twitter and Facebook. |

Post a Comment