The Aftermath

Trading Treasuries was hard enough after the Fed decision. The curve continued to bull-flatten while America slumbered and ate breakfast amid a rash of data overseas that highlighted the global weakness that spurred the Fed's move.

Then, U.S. ISM manufacturing index missed expectations -- while stopping short of contractionary territory -- underscoring the legitimacy and rationale of the prior day's Fed move. Stocks still managed to erase the Powell-linked decline once the dust settled, while the greenback and yields tumbled. Investors were beginning to accept that nothing had really changed: the Fed stood ready to respond to external threats, the domestic economy wasn't falling off a cliff, and earnings results from corporate America had been better than expected.

Then President Donald Trump kicked up a new cloud. In a tweet around 1:30 p.m. New York time, he announced that tariffs on a further $300 billion in Chinese imports would go into effect at the start of September.

These are the tariffs that hurt. The ones that hit a wide range of consumer goods; the ones that will be more highly visible.

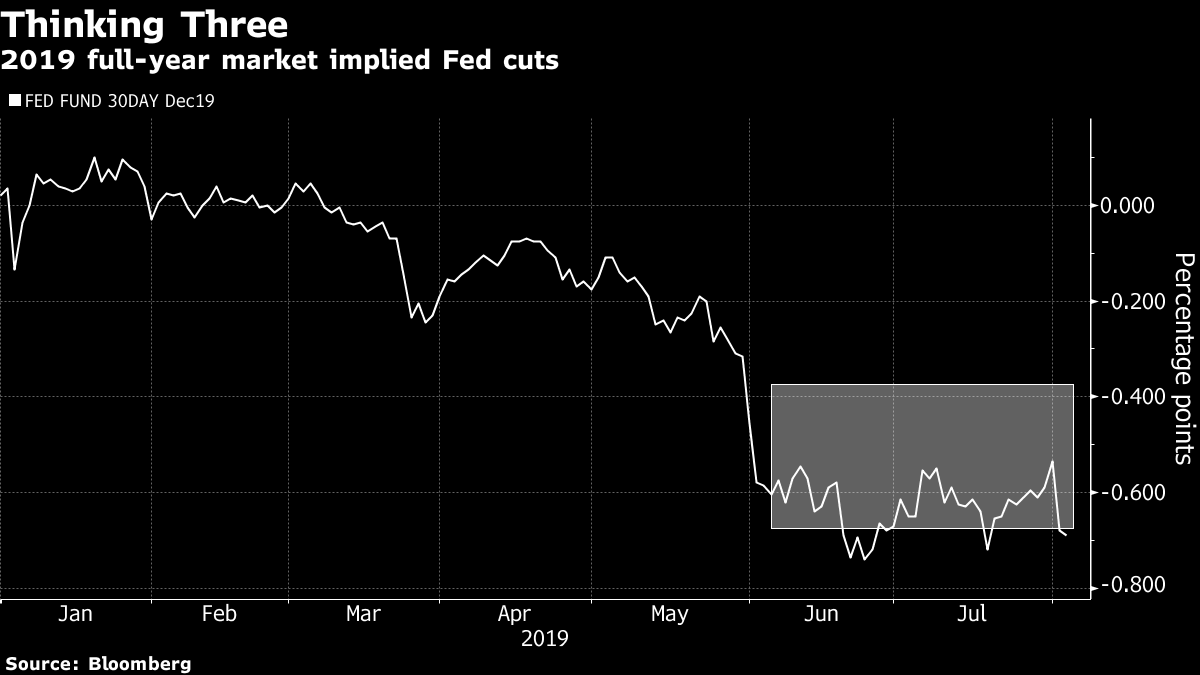

Yields tumbled, as did stocks. There was a slight steepening in 2s10s, but the biggest downward move in the three-month, 10-year spread in over a year. Translation: thanks to an escalating trade war, the easing cycle will be deeper – but not longer – than investors previously thought. Three cuts for full-year 2019 is now the modal scenario.

It was difficult enough for rates traders to contemplate curve trades after the Fed, before trade policy was thrown into the mix. Different curves have spent this week quickly contorting themselves into and out of positions that would earn the admiration of the most experienced yogis.

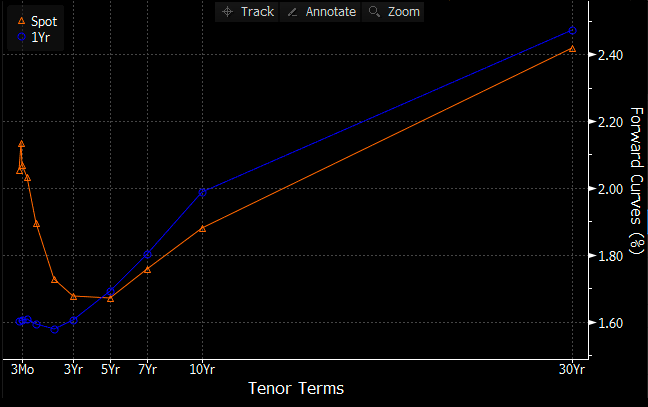

Steepening is still the default outlook, judging by the forward curve. It's sending Pollyanna signals, pointing to a front end that's poised to fall while the longer end rises over the next year.

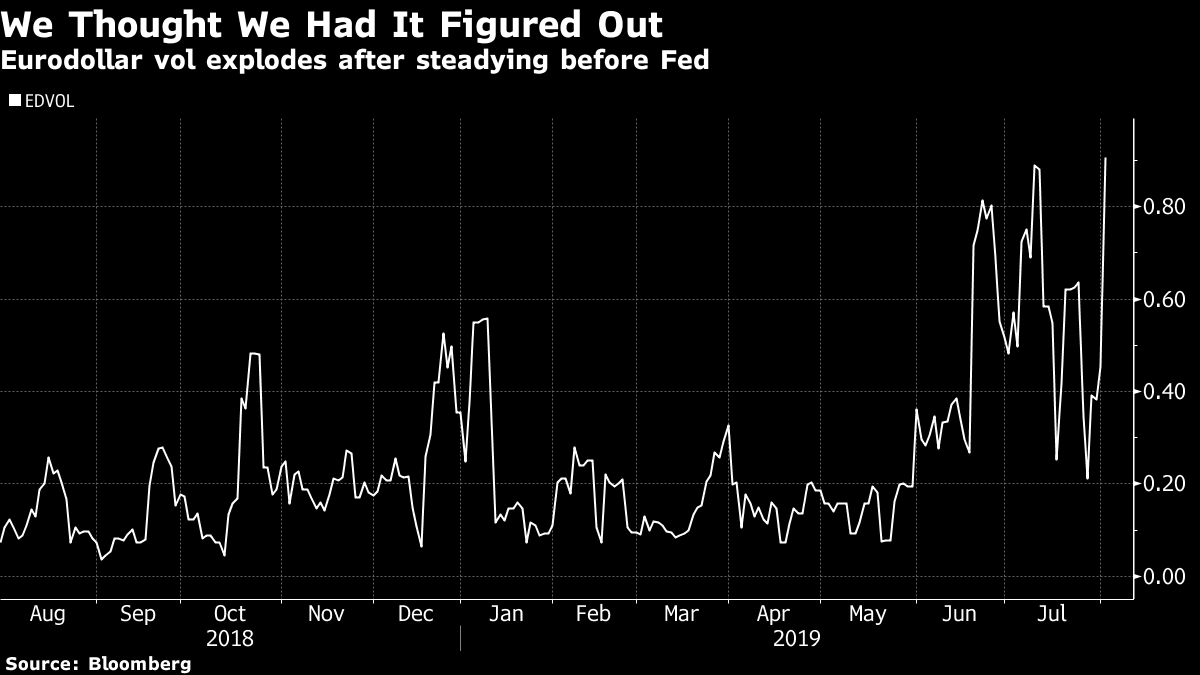

But the outlook for short rates -- which had been coalescing -- has been torn asunder.

Five-day front-month Eurodollar price volatility climbed to its highest level since 2010. Front-end vols had been on the verge of un-inverted relative to their longer-dated peers, and quickly spiked again. A fully-fledged trade war was a tail risk; this latest evolution means investors have been forced to attach higher odds to tail-risk scenarios.

There's speculation that Powell will call Trump's bluff -- that is, fail to accommodate an escalating trade war. This is far fetched to seasoned observers, as long as inflation expectations remain more at risk of being un-anchored to the downside than the upside. Powell doesn't control the weather, but he's the only umbrella salesman in town and storm clouds are forming on the horizon.

Still, there's puzzles abound for curve traders. Does a trade war put the zero lower bound within reach? The fed funds futures curve doesn't point to policy rates sinking below 1% yet, so a meaningful bull steepener would require traders placing some odds on the central bank having to slash rates close to the bone. And when, if ever, will breakevens treat the trade war as inflationary? Market-based measures of inflation compensation tumbled, along with oil, as Trump's tweet landed.

July's nonfarm payrolls report will serve as a test of the bond market's receptivity to good or bad data in the context of heightened trade tensions.

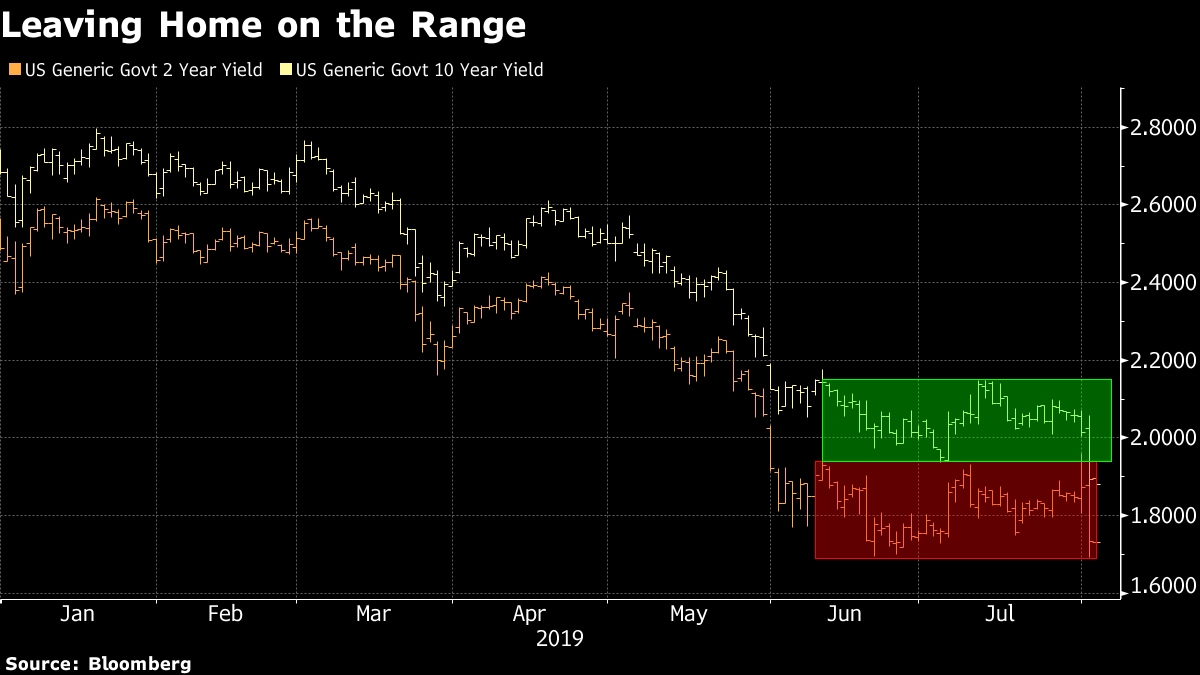

Heading into it, the market stands at a precipice: 10-year and two-year Treasury yields are flirting with dropping below their multi-month ranges.

Potpourri

Bond traders have never used this much data.

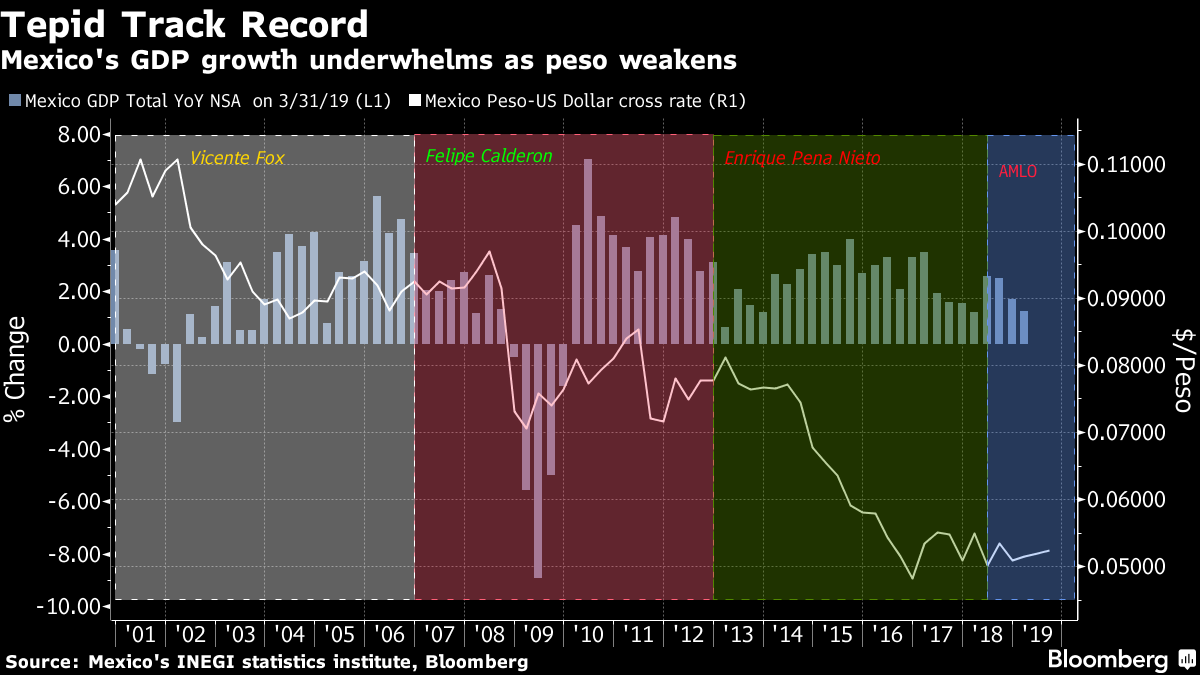

Add AMLO to the list of political leaders who'd like easier monetary policy.

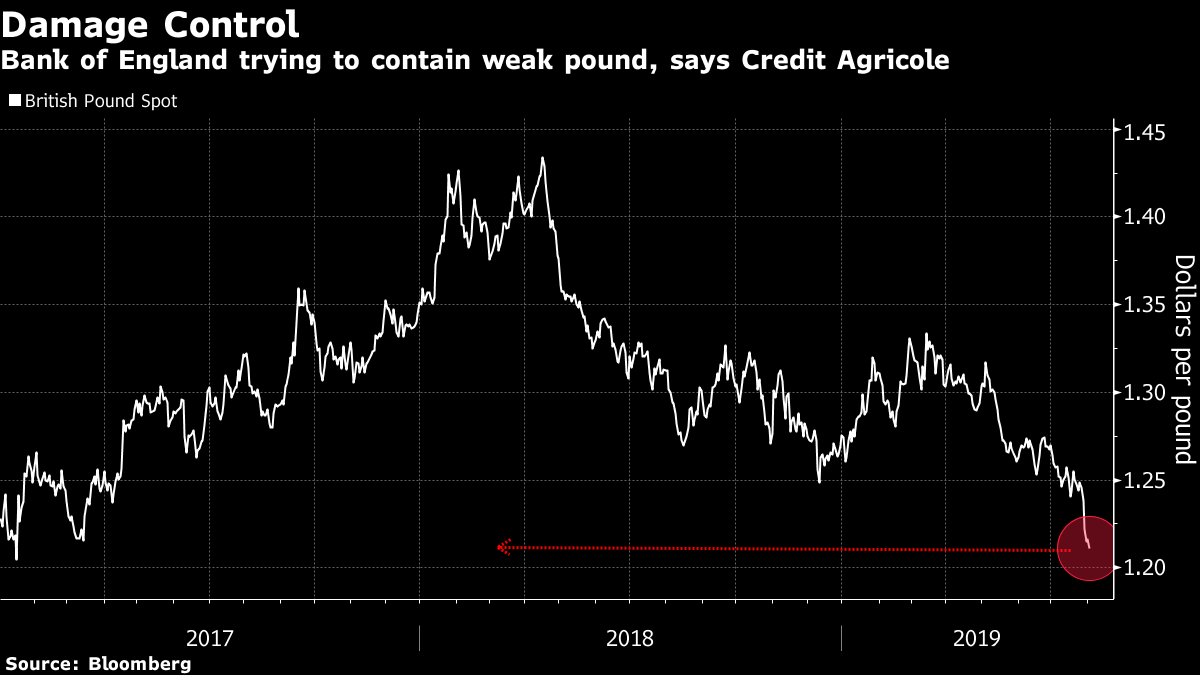

Carney won't assume a no-deal Brexit, to the consternation of markets.

A dollar funding squeeze is spreading.

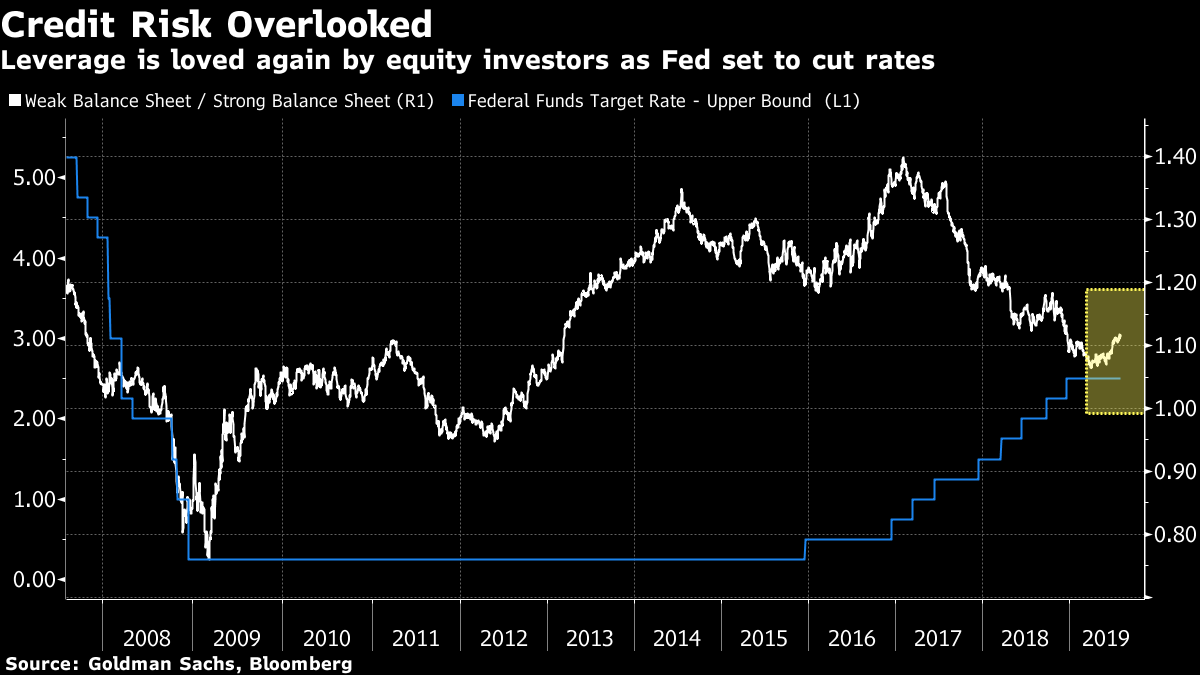

Leverage pays in U.S. stocks.

Turkey's priming markets for even more rate cuts.

New ETF feeds the steepening-curve craze.

Wall Street's CLO managers extend foray into distressed debt.

Post a Comment