Welcome to the Weekly Fix, the newsletter wondering if Bill Dudley has fallen off Jerome Powell's Christmas card list. – Luke Kawa, Cross-Asset Reporter

Something in the Water

The Pure Alpha fund of Bridgewater's legendary Ray Dalio has seen better days - it's down about 6% year-to-date. The proximate cause of his woes, according to Bloomberg's reporting: bearish bets on global interest rates gone awry.

He's certainly not alone in this camp, but the positioning is curious given the macro views he's espoused.

Dalio estimates there's a 40% chance of a U.S. recession prior to the 2020 election (an outcome which would seem to be bullish for bonds). He's been bullish gold (which has been rallying in part thanks to sinking global real yields).

Recently, he's also been pounding the table on the idea that central banks will be impotent in stimulating activity in the real economy.

That view is one the market seems wholly on board with; in fact, it's the defining market dynamic in August. That's why the long end has rallied globally as investor doubts grow over the prospects for longer-term growth and inflation. Even in the U.S., while the gap between the Fed funds rate and the December 2020 Fed funds futures yield has remained fairly steady at around 100 basis points, the spread between where the 10-year yield currently trades and its five year forward rate has meaningfully compressed.

However, signs that accommodative monetary policy is bearing fruit stateside have emerged, through both direct and indirect channels.

First, banks are gearing up for a refinancing boom as lower rates prompt homeowners to improve their financial positions.

Second, the lower path of Fed funds pricing has eased financial conditions and helps "explain why the outlook for inflation and employment remains largely favorable," according to Fed Chair Jerome Powell's speech in Jackson Hole.

Granted, Dalio's been looking for a paradigm shift out of this environment to a more muscular fiscal policy. But without any signs this is at hand, a bearish stance on bonds seems to clash with his characterization of the state of global economics and markets as they currently stand. And that's been an expensive bet to carry.

Fed and Stocks

Since the Chinese yuan broke 7 versus the greenback, market-implied odds of Fed easing have been both incredibly sensitive to short-term swings in stocks while also completely ignoring the equity market's resilience.

On the one hand, the yield on the October Fed funds futures contract – a gauge of how aggressive the Fed will ease in the short term – has moved in near lockstep with the benchmark U.S. stock index.

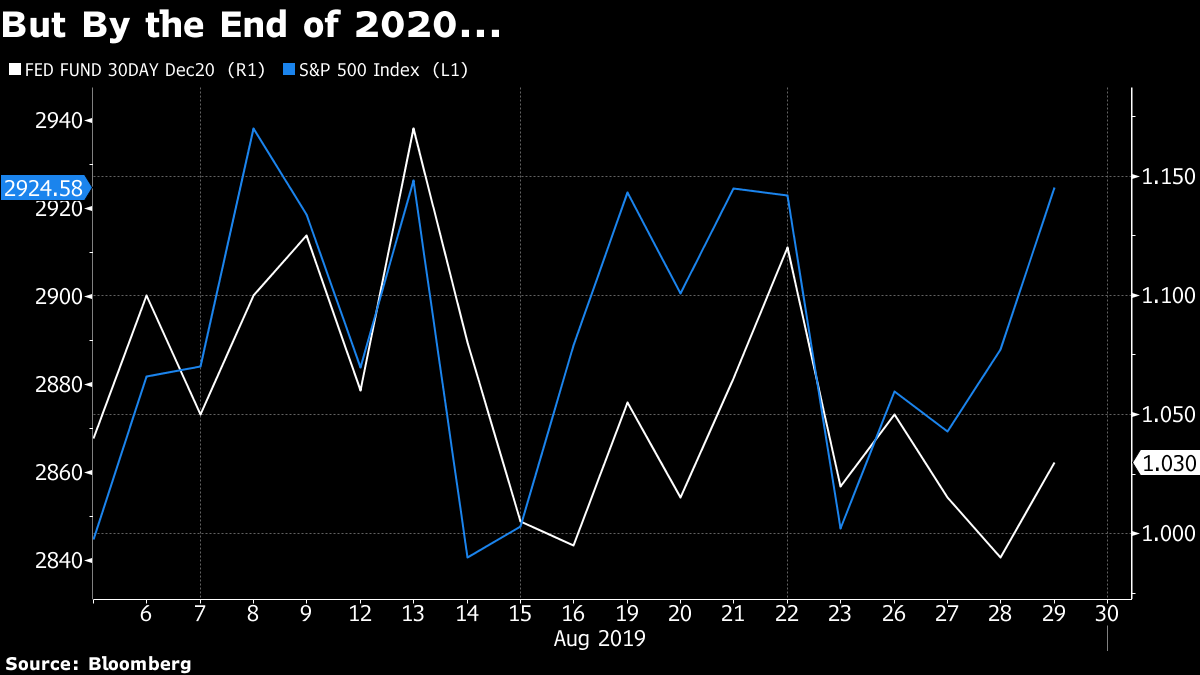

On the other hand, U.S. equities are up almost 3% since August 5, and the yield on the December 2020 Fed funds futures contract has dipped marginally over this span.

That's a sign that the market volatility hasn't altered traders' views on the extent of Fed easing that constitutes sufficient insurance to ward off an economic downturn. Less charitably, it's an indication that a market remains stubbornly split on whether the Fed will be delivering a mid-cycle adjustment or racing back to zero.

Rebalancing Act

It's tempting to chalk up moves in the last week of August to the same dynamics that have driven markets for most of the month: changes in the mood music around trade, no matter how off-key or flimsy some of the headlines might seem. There might be a different, if less exciting, explanation.

For instance, the U.S. equity advance on Monday was attributed to optimistic remarks from U.S. and French leaders about the trade war. And yet, U.S. stocks with a high degree of sales exposure to China lagged the advance in the benchmark index.

An alternative cause for the end of month about-faces in equities and fixed income:a $16-billion move from bonds to stocks by pension funds to right-size their market exposures is having a big impact in a market that's been lacking much in the way of volumes.

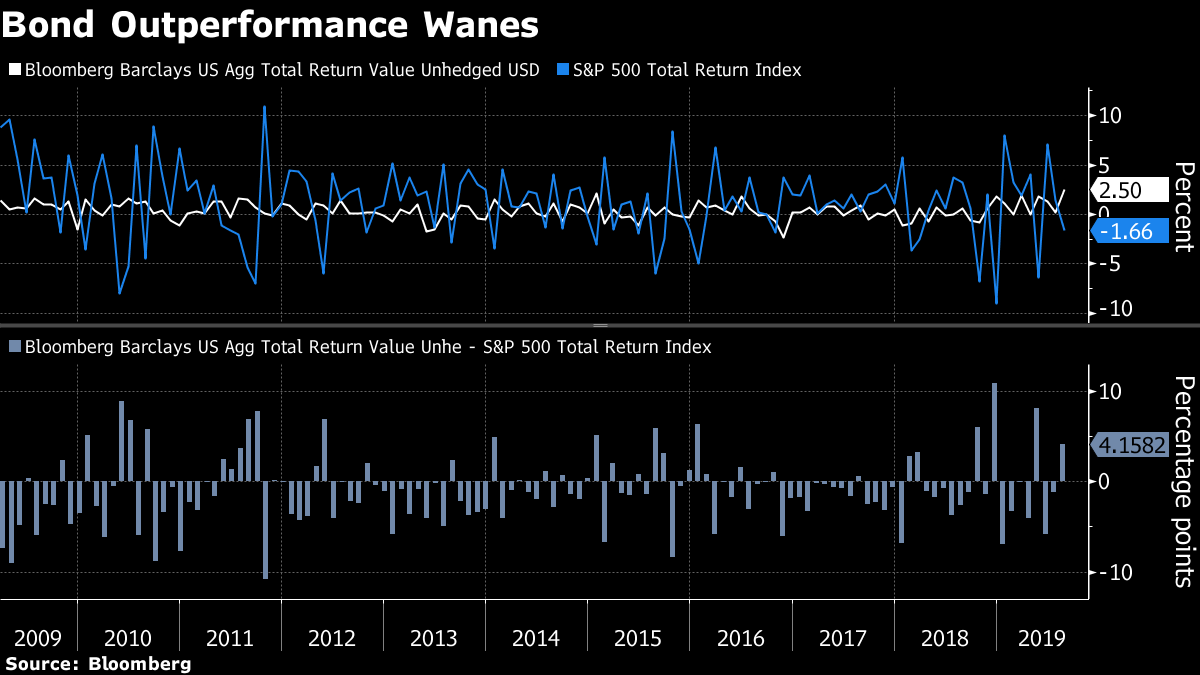

Wells Fargo's Pravit Chintawongvanich flagged this "fairly sizeable" looming shift in a note to clients on Wednesday. Heading into that session, U.S. bonds were besting stocks by more than 6 percentage points on the month, their ninth-best relative monthly performance since the bull market started in 2009.

Two sessions later, that gap is down to 4.2%.

In anticipation of a short-term boost to stocks, Macro Risk Advisors' Maxwell Grinacoff recommended buying the SPY 294/299 call spread that expires on September 6th, noting that stocks tend to rise more than 2% to end a month in which they had been thoroughly trounced by bonds.

Stepping back, if it's said to be unwise to reason from a price change, reasoning from a rebalancing-driven price change at month-end might prove doubly so for investors itching to call a turn in the global bond rally.

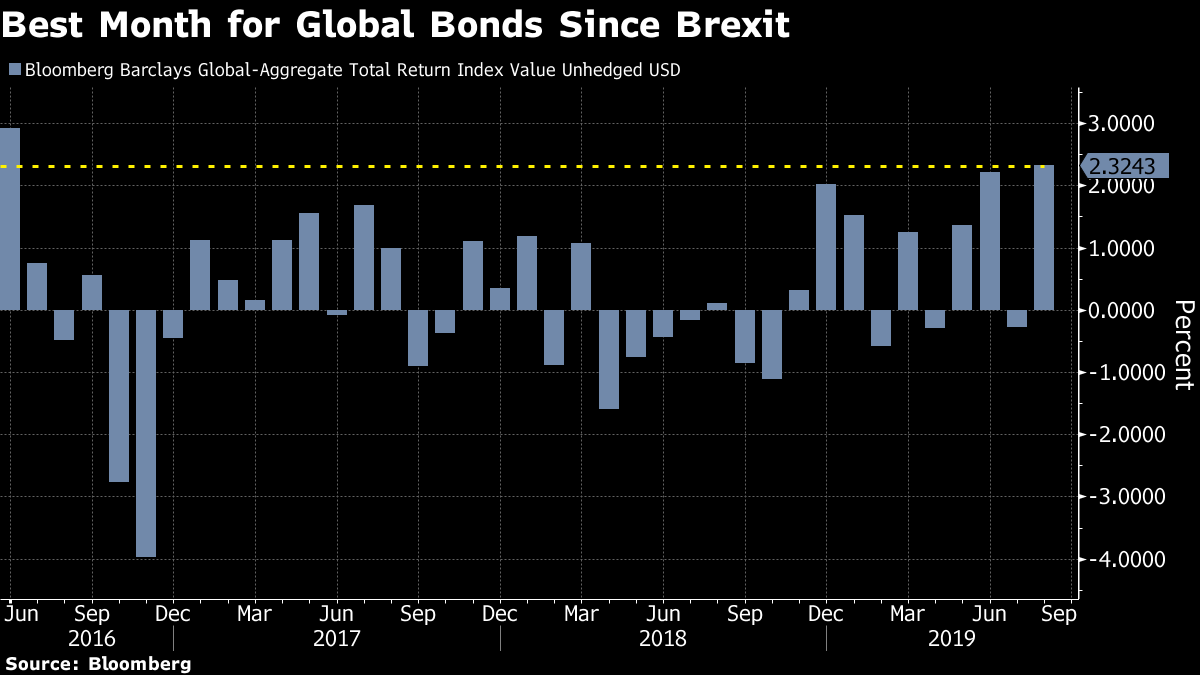

After all, it's still shaping up to be the best month for global bonds since the 2016 Brexit referendum.

Post a Comment