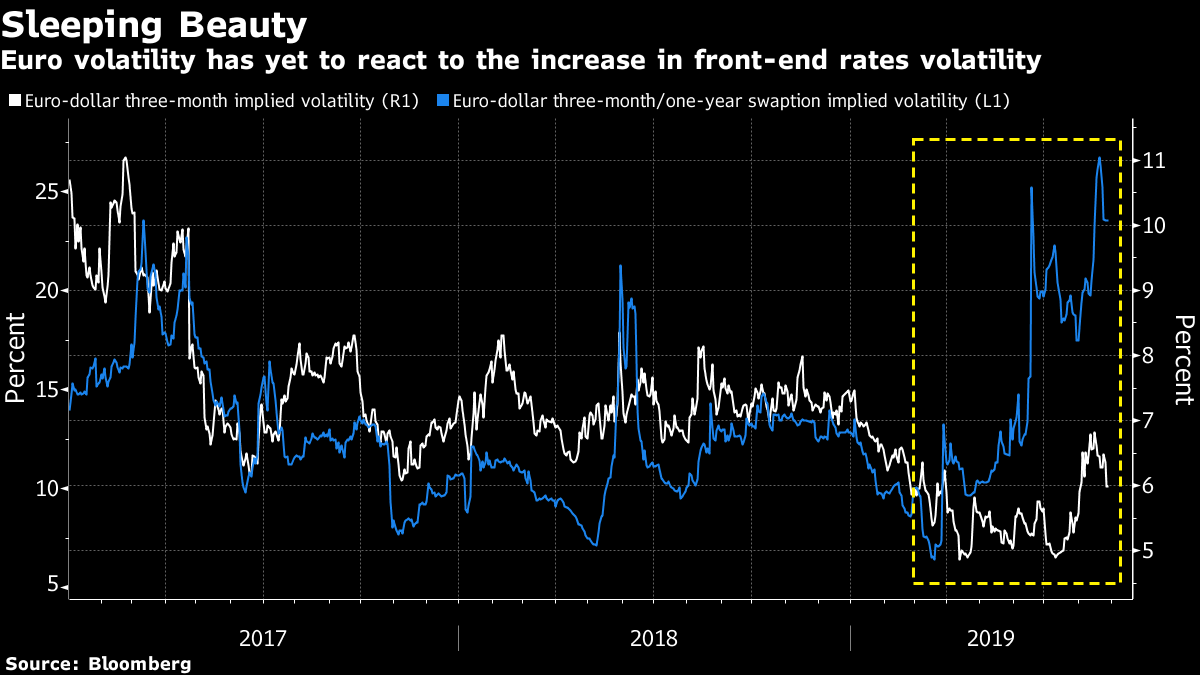

| Welcome to your morning markets update, delivered every weekday before the European open. Good morning. It's deadline day for Italy's government, big tobacco is about to get bigger and the debate rages on when one should buy stocks. Here's what's moving markets. Deadline Day It's crunch time for Italy's political class. Tuesday brought brinksmanship, finger-pointing and recriminations between the two main parties attempting to form a government. On Wednesday, President Sergio Mattarella will give Five Star and the Democratic Party a final chance to carve out an agreement, otherwise a set of likely market-unfriendly elections will have to happen, casting uncertainty over the outlook for the country. Watch the headlines roll out from Rome and keep a close eye on what Italian government bonds are doing, because that will give a clear signal on how traders feel about how it's all progressing. Or not. Brexit Optimism Optimism was Boris Johnson's sales pitch when he was vying to become U.K. prime minister and that approach now seems to be pleasing currency traders. The pound extended gains on Tuesday after a U.K. official said the government is optimistic about restarting Brexit negotiations with the European Union and the currency barely reacted to news that opposition lawmakers had agreed to new plans to try to thwart Johnson's attempt to leave without a deal. Elsewhere, Chancellor of the Exchequer Sajid Javid appeared to backtrack on the government's promise to end austerity, putting his Sept. 4 budget plans firmly on the calendar as a key date. Bigger Tobacco Former partners Altria Inc. and Philip Morris International Inc. are considering getting back together in a deal that will once more reshape the global tobacco market. Wall Street is divided on the issue, with investors questioning whether this is a good plan given the regulatory scrutiny it would face and, indeed, the regulatory scrutiny the whole industry faces all the time. For Europe's tobacco names, it would create an even bigger competitor as everyone races for supremacy in the next generation of vaping and smokeless products, so watch closely for a reaction. When to Buy Stocks An evergreen debate rears its head again. Should you buy equities and, if you should, when should you pull the trigger? JPMorgan Chase Co. thinks the time to buy is near and that September will mark a point for markets to start on an upward trajectory again. UBS Wealth Management disagrees and went underweight stocks this week, seeking to avoid the risks brought by the trade war and political uncertainty. It's a tough sell. The view on the U.S. profit outlook is getting worse and, with corporate news a little thin on the ground, the correlation to macro news is high, so be prepared for plenty of days when stocks move as one. Coming Up... Asian stocks drifted on Wednesday as the path for trade talks remains unpredictable. A slightly busier earnings day is on the cards, with high-street and airport newsagent WH Smith Plc, oil-services firm Petrofac Ltd. and broadcaster RTL Group all coming up and Italian luxury house Brunello Cucinelli after the close. Italian manufacturing data is scheduled and weekly U.S. crude inventories will arrive in Europe's afternoon. Oil, incidentally, jumped on Tuesday after American Petroleum Institute data showed a larger-than-expected fall in inventories last week. What We've Been Reading This is what's caught our eye over the past 24 hours. And finally, here's what Cormac Mullen's interested in this morning Turbulence in the euro-zone interest rates market has yet to be reflected in the region's currency. Despite a spike in volatility in shorter-maturity rates, price swings in the euro against the dollar remain close to multi-year lows, according to data compiled by Bloomberg -- an unusual disconnect. With the European Central Bank's monetary policy meeting looming and a no-deal Brexit only partly priced in, euro volatility looks too low and could well climb, Societe Generale SA strategist Olivier Korber wrote in a note Tuesday. With economic clouds in Europe darkening, traders are looking to see what the ECB will propose, having hinted at the prospect of more monetary stimulus as early as next month. On the dollar front, there is still great uncertainty as to the pace of rate cuts at the Federal Reserve. And the Brexit process is hurtling toward some sort of denouement by the end of October, with plenty of chances for surprises along the way. Euro traders should be prepared for a bit more volatility than they've gotten used to.  Cormac Mullen is a Cross-Asset reporter and editor for Bloomberg News in Tokyo. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. Before it's here, it's on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can't find anywhere else. Learn more. |

Post a Comment