The status of trade talks remains unclear, Mnuchin is revisiting very long bonds, and political news in Europe is a mixed bag. Trade frontIt looks like the trade-talk clouds that have kept markets on edge this week are here to stay at least a bit longer. The White House says not to expect a deal anytime soon and China says it could retaliate on the planned tariff hike from U.S. President Donald Trump – though it prefers not to. "China has ample means for retaliation, but thinks the question that should be discussed now is about removing the new tariffs to prevent escalation," Commerce Ministry spokesman Gao Feng told reporters Thursday. Higher tariffs on Chinese exports to the U.S. are due to come into force on Sept. 1, and some retaliatory measures from Beijing are already planned. Meanwhile, Trump's trade adviser Peter Navarro said negotiators from China are set to come to Washington in September to talk about the big changes the U.S. is asking for, but it's "unlikely anything quick will happen." Long bondsThe Trump administration is giving careful thought to selling something Wall Street may not be ready to buy: ultra-long debt. Treasury Secretary Steven Mnuchin said in an interview with Bloomberg that issuing 50- or 100-year bonds is "under very serious consideration" despite being previously waved off the idea by Treasury Borrowing Advisory Committee members including JPMorgan Chase & Co., Bank of America Corp. and Goldman Sachs Group Inc. Mnuchin said his renewed interest in long bonds was unrelated to the drop in yields on shorter-term U.S. debt. That of 30-year Treasuries declined to a new record 1.9% on Wednesday having slid below 2% for the first time earlier this month. Europe's ups and downsGet ready for more turbulence in the pound as the risk of a chaotic Brexit increases. A measure of expected swings over the next three months surged to near the highest this year and the pound continued to fall after it took a beating on Wednesday's blockbuster Brexit news. Watch for the currency to react to political headlines as lawmakers trying to block no-deal spar with Prime Minister Boris Johnson over his plan to suspend Parliament. Things feel a bit more harmonious in Italy, where bonds surged and equities outperformed as the country's president tapped Giuseppe Conte to form a new government, excluding right-wing League leader Matteo Salvini from power for now. That might sound familiar: for the last 18 months, Conte has led an unstable coalition that collapsed in chaos earlier in August. Now he's got until next week to form a coalition with support from rival parties the Five Star Movement and the Democratic Party in order to avert the possibility of fresh elections which could put Salvini in power. MarketsMarkets seem to be looking at this morning's comments from China as a glass half-full. The MSCI Asia Pacific Index erased a drop to trade little changed as shares in Hong Kong posted a 0.3% gain and Japan's Topix finished largely unchanged. In Europe, the Stoxx 600 Index rallied 1.1% as of 6:18 Eastern Time. Futures on the S&P 500 pointed to a big jump at the U.S. open, the yield on 10-year Treasuries was 1.493% and gold was little changed. Coming up…A second reading of 2Q U.S. economic growth will take center-stage later, and is expected to be revised down slightly. It's another big earnings day for discount retailers with Dollar Tree Inc. and Dollar General Corp. due to report. Best Buy Co Inc., Ulta Beauty Inc. and firearms maker American Outdoor Brands Corp. will also post their numbers. Hurricane Dorian is heading for eastern Florida after slipping past Puerto Rico.

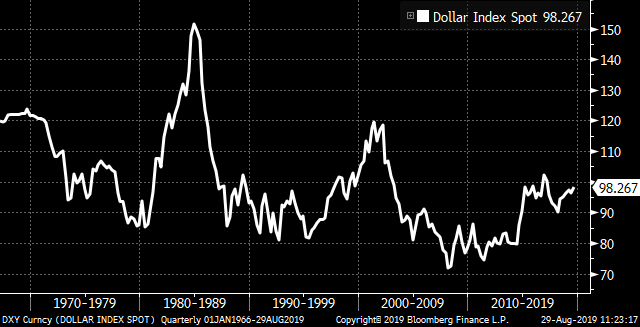

What we've been readingThis is what's caught our eye over the last 24 hours. And finally, here's what Joe's interested in this morningPeople are still talking about Mark Carney's speech at Jackson Hole, where he discussed the growing need to move to a post-dollar world order. In a note to clients, Standard Chartered strategist Steve Englander wrote that he was "struck" by the growing consensus to weaken the U.S. currency somehow, even if there were serious practical questions about the best way to get it done. What I find interesting is how talk of the end of the dollar used to be something largely confined to gold-bug message boards, Zero Hedge and other parts of the fever swamp. Now, it's something discussed in polite company among the world's top central bankers. But while the talk is superficially similar, it's actually very different. The old view was that the dollar was like Wile E. Coyote -- it had already gone off the cliff, everybody could see that, and so it was only a matter of time before a fall into the chasm. The new talk is very different. Yesterday on TV we talked to David Beckworth, a research fellow at George Mason's Mercatus Center. As he described it, the fundamentals of the dollar just keep getting stronger and stronger with every global cycle. Every time the world trips up, debt issuance by other countries goes down, and the supply of non-dollar safe assets shrinks. As such, the network effects -- the ability for people all around the world to transact with a lingua franca -- improves for the dollar, which is the only game in town. Definitely check out the clip with Beckworth, who describes it very clearly, and also read the latest in BusinessWeek from Peter Coy on the growing need to find a dollar rival.  Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. Before it's here, it's on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can't find anywhere else. Learn more. |

Post a Comment