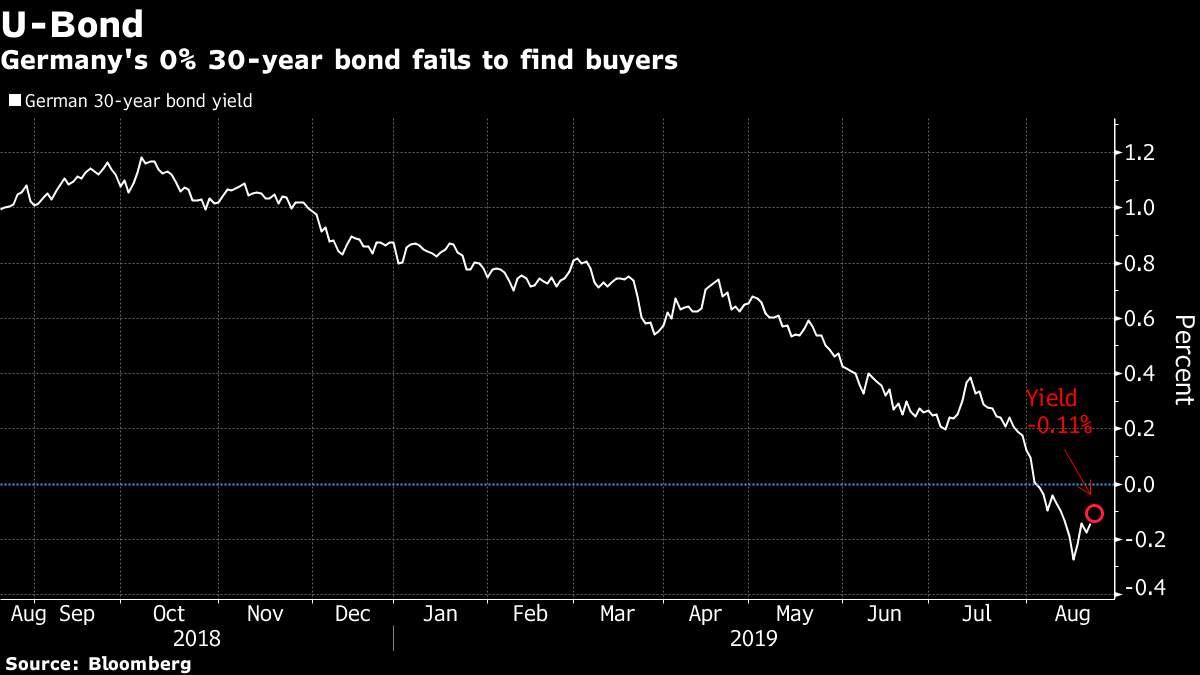

Welcome to your morning markets update, delivered every weekday before the European open. Good morning. There appears to be a growing acceptance that a no-deal Brexit is firmly back on the table, the latest Fed cut was insurance against a possible downturn and Germany's new bond issue fell flat. Here's what's moving markets. No-DealWith every passing day, the prospect of a no-deal Brexit appears to become a bigger part of the base-case scenarios for the U.K. outlook and both sides are talking tough. France now thinks the U.K. leaving without a deal in place is the most likely outcome of the negotiations, with Prime Minister Boris Johnson and President Emmanuel Macron due to meet on Thursday. Barclays Plc economists are taking a similar view, seeing no-deal and a rate cut from the Bank of England in the near future. Johnson, meanwhile, has a challenge from Germany's Angela Merkel to get the backstop disagreements solved in 30 days. InsuranceThe minutes from the Federal Reserve's latest policy meeting show officials cut rates as insurance against low inflation or a deeper decline in business investment driven by the trade war. The Fed also wanted at that July meeting to maintain flexibility in its arsenal and didn't see the reduction as the first in a series. Traders, however, still see lower rates ahead and anticipate a cut in September at least, with rates a full point lower within a year, and the reasons for the last decision do indicate another cut is on the way. All eyes turn now to Fed Chair Jerome Powell at Jackson Hole on Friday for some clear signals on the path ahead. Falling FlatThe world's first 30-year bond offering a zero percent coupon fell a bit flat. Germany's issue failed to hit its 2-billion-euro target and the country's debt agency conceded it may have been too large, but the overall outcome indicates rock-bottom yields are starting to turn off investors and that the global bond rally could coming to an end. The impact of negative rates elsewhere is also coming into sharper focus. In Bavaria, the local leader wants the practice of passing these on to retail customers banned while in Denmark, the world's biggest covered-bond market, the yield-curve inversion is starting to hit home. High StakesItalian President Sergio Mattarella will meet with parties for a second day but today is the one that will really count. He'll meet with the League, Five Star and the Democratic Party in an effort to carve out a new governing coalition for a country on the brink of recession and in need of a budget to be drafted that will adhere to strict European Union rules. None of the options available to Mattarella look particularly great, but if the talks do fail then new elections could be on the way, bringing new uncertainty and extending instability for the country. So far, the market reaction has been "puzzling." Coming Up...Asian stocks drifted lower following the Fed minutes as traders saw little to change the view that more cuts are coming. European and U.S. futures are pointing to similar drifts lower. Oil prices were broadly steady as the attention turned away from U.S. stockpiles data and onto monetary easing debates. The European Central Bank minutes are due today and the central banking symposium at Jackson Hole is getting under way. We'll also get euro area PMIs and consumer confidence data. What We've Been ReadingThis is what's caught our eye over the past 24 hours. And finally, here's what Cormac Mullen's interested in this morningIt's unlikely to be the Pets.com of the Great Bond Bubble but the fact that the world's first 30-year bond featuring zero income struggled to find buyers should mark a line in the sand of sorts, even if just for the short term. Germany failed to meet a 2 billion euro target for the notes, selling just 824 million euro worth at a still record-low average yield of -0.11%. It's probably more of a sign that issuers can get just as carried away as investors at times, as the further out the maturity ladder you go, the smaller and more specific the natural pool of buyers becomes. Still, the auction flop will likely concentrate minds and take some of the froth off the rally in Europe's bond markets for a time -- the question is for how long. The European Central Bank is readying a new wave of stimulus next month and none of the issues that have driven the demand for bonds have gone away -- including legitimate economic worries and an unresolved trade war. President Donald Trump might have hit the nail on the head when he compared the zero yield on German bunds to the positive yield still available on Treasuries -- the bond rally can continue anon, just with U.S. securities leading the charge.  Cormac Mullen is a Cross-Asset reporter and editor for Bloomberg News in Tokyo. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. Before it's here, it's on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can't find anywhere else. Learn more. |

Post a Comment