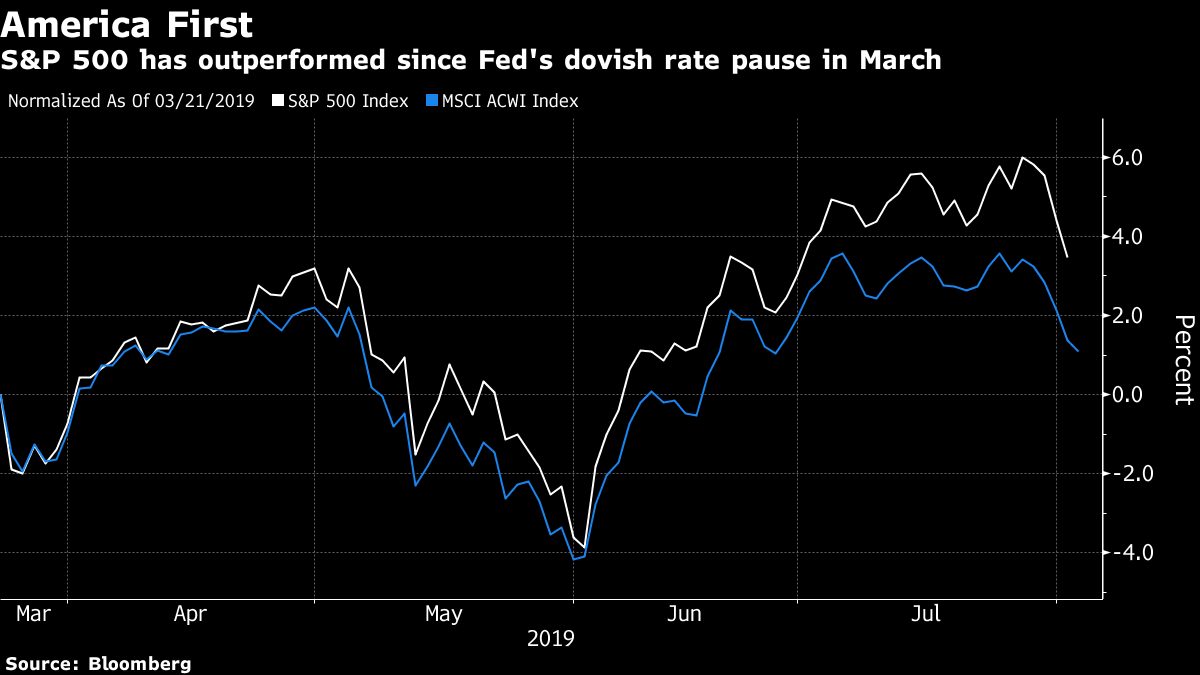

| Welcome to your morning markets update, delivered every weekday before the European open. Good morning. A new round of tariffs has roiled markets from government bonds to crops, the uncertainty around Brexit has increased yet further and it's U.S. payrolls day. Here's what's moving markets. More Tariffs Having waited all week for an update on how the latest round of trade talks between the U.S. and China were going, President Donald Trump answered that question emphatically with a series of tweets. Trump said the U.S. will impose 10% tariffs on another $300 billion of Chinese goods not already subject to levies, the final list of which has yet to be released but which is likely to include consumer goods and tech. Markets were hit hard on the news, of which more in a moment, and that's likely to carry over into cyclical sectors in Europe sensitive to this newsflow, including industrials, miners and cars. Still, Peter Thiel's probably happy. The Reaction The effect of Trump's quick escalation of the trade tensions with China was felt far and wide and could continue to be felt keenly going forward. Treasury yields dropped the lowest levels since 2016, oil took a beating and is now on track for a loss this week and stock traders were caught in the midst of a brutal 48 hours between the Federal Reserve decision and the tariffs. It leaves an already-struggling global economy steeling itself for more difficulties and has analysts asking questions about when China's currency may break through a key level against the dollar and what kind of opportunities it may bring for stock investors. Uncertainty Another topic on the tip of market watchers' tongues all week has been no-deal Brexit, the increased threat of which has sent the pound tumbling lower. The Bank of England decision on Thursday left markets confounded and likely only adds further to the uncertainty as the central bank effectively decided not to assume no-deal outcomes in its forecasts, even as markets do just that. No wonder given the signals from the U.K.'s government, which has doubled its spending on preparations for leaving the European Union without a deal in place, but that's been complicated by the government's majority being cut to one. Crops Drop A little check on agriculture markets, one of the sectors at the center of the trade dispute between the U.S. and China. Those Trump tweets announcing new tariffs on Chinese goods roiled most crop markets, in particular soybeans along with cotton and hogs as the tensions stoked demand fears. Add to that concerns about demand for the American ethanol industry if the trade spat continues. Note, however, that with or without the tariffs, the rise in the price of U.S. corn futures is such that the price advantage to domestic Chinese supplies has disappeared, so Chinese companies may not want American corn either way. Coming Up... Asian stocks were knocked lower by the tariff threat, with the yen strengthening on its safe-haven attractions. European stock futures are pointing to a distinctly negative open. The main event on the calendar will be U.S. payrolls, the denouement to an incredibly busy week for the global economy and an early litmus test for the Fed after its rate cut. More earnings still to come too from U.K. lender Royal Bank of Scotland Group Plc, telecoms firm BT Group Plc and later from luxury car maker Ferrari NV. What We've Been Reading This is what's caught our eye over the past 24 hours. And finally, here's what Cormac Mullen's interested in this morning Jerome Powell opened a window of opportunity for U.S. stocks to push higher Wednesday -- President Donald Trump threw a brick through it Thursday. The Federal Reserve's hawkish rate cut suggested a degree of comfort with the U.S. economy that hadn't been present in statements early this summer. For me, this had left U.S. risk assets back where they were in March, when the Fed pressed the pause button on rate moves but did so with a dovish bent. That tracked well with markets: From March 21 through Wednesday, the S&P 500 rose 4.4% versus a 2.1% gain in the MSCI AC World Index. Trump's tweets changed that bullish dynamic. For the first time, the new tariffs go to the heart of what has been keeping the U.S. economy relatively buoyant -- the American consumer. Of course it could be just a negotiating ploy aimed at getting concessions from the Fed and China. But the president is playing chicken with the U.S. consumer strapped in to the passenger seat. Investors will have to allow for an increased risk premium on U.S. stocks and price in the likelihood of lower economic and earnings growth. Despite disappointment in some quarters at the Fed's decision, it had set up a short-term sweet spot for U.S. stocks to push higher. Donald Trump has just turned it sour.  Cormac Mullen is a Cross-Asset reporter and editor for Bloomberg News in Tokyo. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. Before it's here, it's on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can't find anywhere else. Learn more. |

Post a Comment