| Inside: The U.S. is losing the Arctic. A green bond for more sustainable beef? Don't bet on inequality. A future for coal plants. The last all-male board in the S&P500 is a thing of the past. London broiled. — Eric Roston Sustainable Finance Moody's deal to buy climate research-and-analysis firm Four Twenty Seven, is a sign that investors and managers are becoming more sensitive to rising risks from climate change. "Up until now, these risks largely have been absent from investors' models, but if Moody's, a major rating agency, starts using Four Twenty Seven's methods in assigning ratings, that might quickly change," writes Leonid Bershidsky of Bloomberg Opinion. Pacific Life's decision to shutter Swell Investing, is a sign that millennials might just not be ready to devote serious assets to impact investing, even in an online robo-advisor platform made just for them.  The European Investment Bank proposed plans to stop funding fossil fuels starting in 2021 and wants to increase support for clean-energy projects. The proposal will head to a final vote in September. In the meantime, even oil magnate T.Boone Pickens is giving up on fossil fuels, converting an oil ETF of crude stocks to one focused on renewables. The "clean coal" of beef? Brazil's Marfrig Global Foods is selling as much as $500 million worth of "transition bonds" aimed to help the company fund a transition for Amazon cattle ranchers who comply with non-deforestation, animal welfare and fair-labor practices. Brazilian President Jair Bolsonaro last week dismissed the country's world-class satellite deforestation monitoring without citing any evidence that there's something wrong with it. In Brief - Goldman Sachs will open a Sustainable Finance Group, to be led by Josh Goldstein, the co-founder of Imprint Capital, which the bank bought in 2015.

- Latin America saw its first-ever revolving credit line tied to sustainability, worth $1.1 billion. BBVA signed the with Fibra Uno, the region's biggest real estate company.

- Schroders took a majority stake in BlueOrchard, the impact investment firm and commercial manager of microfinance debt instruments.

- M&G Investments launched a fund investing in corporate ESG bonds issued by companies in emerging markets.

Environment  The two most significant issues of the young century are the resurgence of competition among great powers and climate change. Both run squarely through the Arctic, and the U.S. is. losing, writes Hal Brands of Bloomberg Opinion. The U.K. sweated through its hottest temperature on record, 101.6 degrees Fahrenheit (38.7 Celsius) in the same heat wave that has smashed decades-old heat records across the continent. Swedish steelmaker SSAB is turning to hydrogen to replace coal in its production. The trick is to make sure that the hydrogen is also produced without burning fossil fuels. A bad wiring job 11 years ago led to a massive power loss in Manhattan this month that left more than 70,000 customers in the dark, including the subway system, Times Square billboard and Madison Square Garden during a Jennifer Lopez concert. Tesla is ramping up production of solar roofing tiles, even as conventional rooftop systems languish. The news, which Elon Musk tweeted July 29, is a test of his settlement agreement with the SEC in April. Tesla Chief Technology Officer and co-founder J.B. Straubel left the company last week, shortly after selling $30 million in shares.

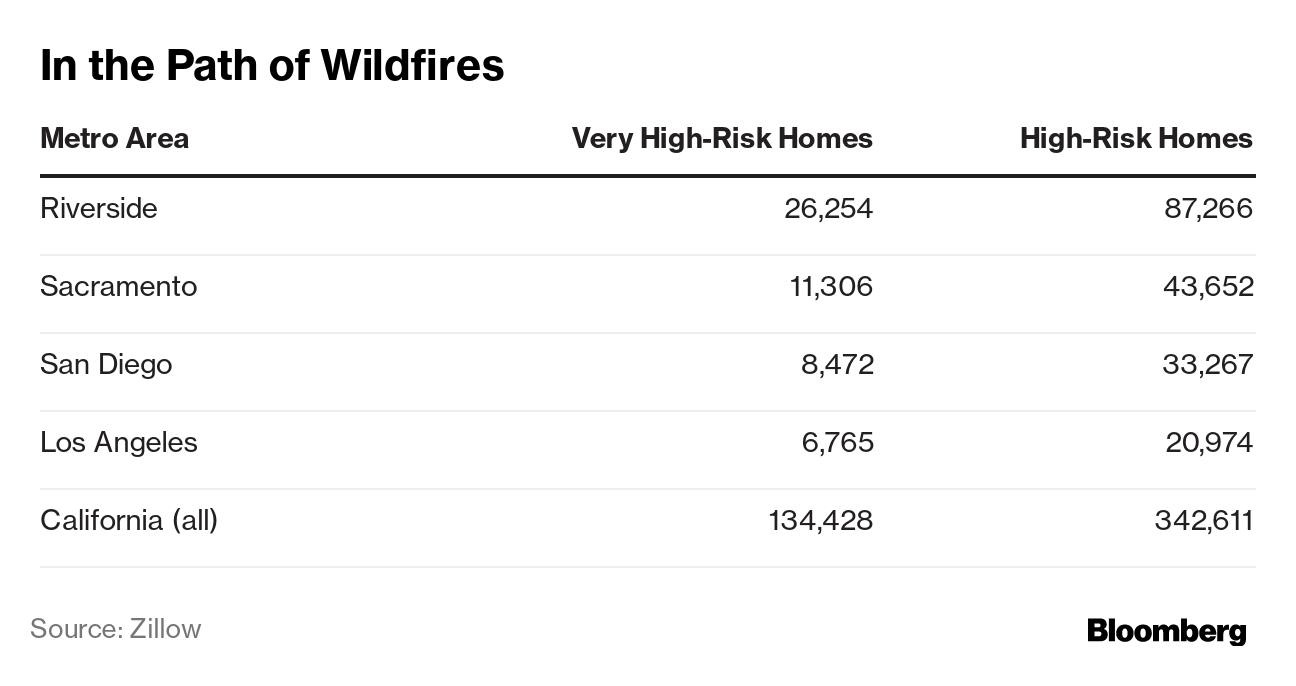

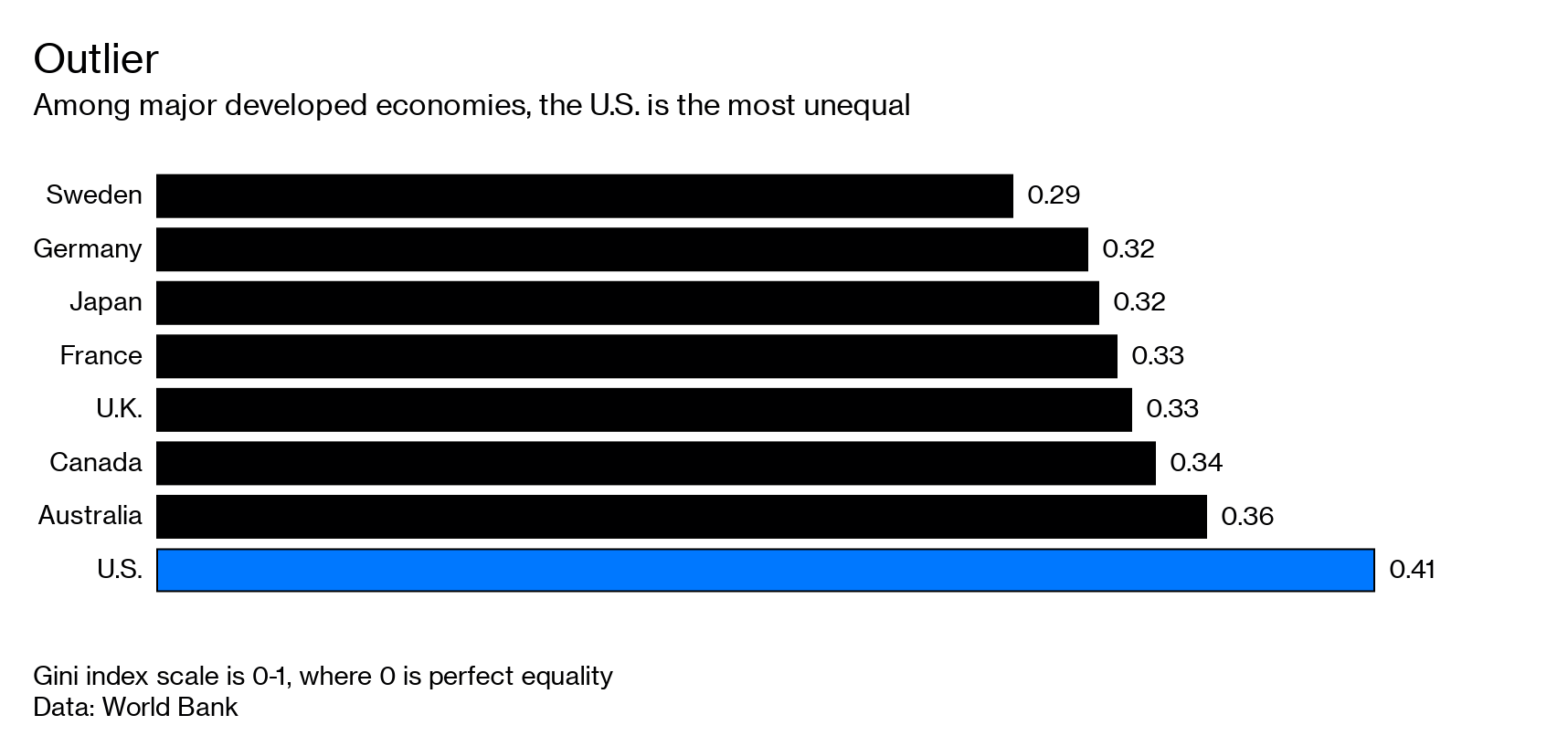

Almost a half-million California homes worth an estimated $268 billion are at a high or very high risk for wildfire damage this year, according to an analysis by Zillow.  Social For many years, betting on the rich, particularly in the U.S., has been good advice. That may be changing as political backlash to inequality builds, writes Katia Dmitrieva in Bloomberg Businessweek.  The last all male board in the S&P 500 index finally added a woman director last week. The final stretch of progress has been slow. In 2000, about 86% of S&P 500 companies had at least one women on their board, so its taken almost 20 years to close the gap. Companies that hold out too long on adding their first female board member are more likely to pick one who's already a director elsewhere, meaning she'll have less time to devote to the firm, a Bloomberg Intelligence study found. Each year, banks reap billions of dollars from overdraft and other fees. A new analysis found women pay a disproportionate amount of those penalties. Discrimination and harassment lawsuits filed anonymously doubled in the wake of the ongoing #MeToo movement, according to Bloomberg Law. They're on pace to reach 2018 levels, or 52 suits, this year. Recent cases in which workers have sought anonymity include lawsuits against Jones Day, Morrison & Foerster, JetBlue, the FBI, and Morgan Stanley.

Homeless people have literally dug in and taken up residence within Sacramento's 1,100 miles of earthen levees, leaving the city with a mounting social and environmental problem. Governance The mechanics of how shareholders vote at public companies, known as proxy plumbing, needs "immediate" fixes to ensure accurate results and clear outcomes, the agency's Investor Advisory Committee said in a recommendation considered at a July 25 meeting. Shareholders voted out shale-driller Nabors Industries' CEO Jim Crane. The board kept him on, and it wasn't the first time directors ignored shareholders.  Note: Please send tips, suggestions and feedback to Emily Chasan at echasan1@bloomberg.net. New subscribers can sign up here. To see this on the web, click here. Diversity is a business issue. Sign up now for our weekly Business of Equality newsletter to get the latest on how companies and institutions are confronting issues of gender, race and class. |

Post a Comment