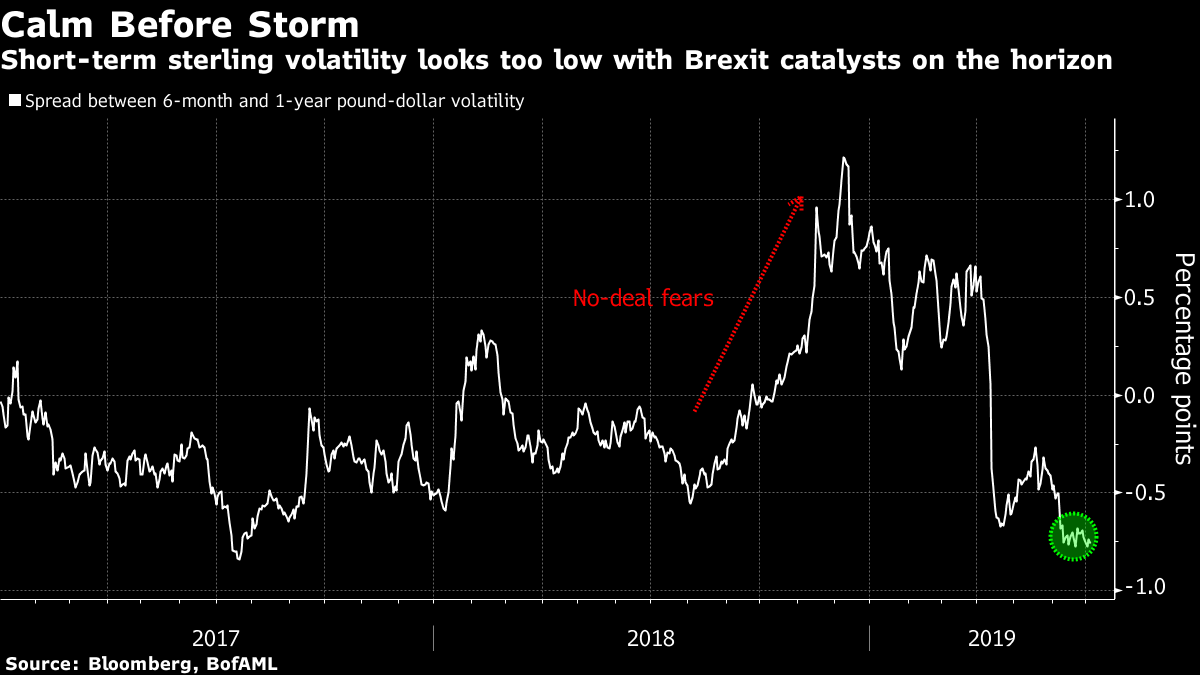

| Welcome to your morning markets update, delivered every weekday before the European open. Good morning. Two women have been nominated for the top positions in European institutions, the outlook for the economy looks rocky and Conservative candidates are promising a lot. Here's what's moving markets. Changing of Lagarde After a longer-than-anticipated bout of horse trading and wrangling among European leaders, Christine Lagarde has been nominated to replace Mario Draghi as the president of the European Central Bank. Lagarde, boss of the International Monetary Fund, is not a career central banker and could well bring a very different style of leadership to the ECB compared to Draghi, most notably the star quality that goes with being a prominent political figure. Market observers like the choice. Ursula Von Der Leyen, Germany's defense chief, was nominated for the other top job at the EU, heading up the European Commission, Bleak Outlook The economic outlook, according to most corners of the market you look to, seems pretty bleak. Oil markets could have been expected to rally more on the extra output cuts OPEC and its partners agreed to, but crude slipped back on concerns about future demand and did so ahead of U.S. inventories on Wednesday. Gold regained its momentum as investors sought out havens. Bank of England Governor Mark Carney also sounded a warning on the risks trade tensions pose and the Federal Reserve's Loretta Mester has said cutting rates now would reinforce the negative sentiment on the economy. Oh, and earnings forecasts keep getting worse. Sin Taxes It may not be hugely surprising during a leadership campaign, but the kind of giveaways the two candidates vying to be atop the Conservative Party are touting look surprising given the party they are battling to lead. Boris Johnson and Jeremy Hunt are promising a tax-cutting and spending spree which is sparking growing concern from Tories and which would be generous even for the Labour opposition. Johnson at least has targeted one area to raise revenue: "sin taxes" on salt, fat and sugar. Cyber Deal Chipmaker Broadcom Inc. is holding advanced talks to buy cybersecurity outfit Symantec Corp, another move by the former into the more profitable software business as its core semiconductor operations contend with a slowdown in demand and trade war-related headaches. The deal could reverberate through a few different stock sectors on Wednesday, opening up the possibility of more M&A activity from the chipmaking sector and the potential that software and cybersecurity names will become targets. Coming Up... Asian stocks were lower as investors took a breather after four weeks of gains. European futures look a touch inconclusive on the day ahead and U.S. Treasury yields hit a two-year low. Note, too, that German bund yields are on the verge of hitting the ECB's deposit rate. Sweden's central bank will announce its latest interest rate decision, with Riksbank-watchers not expecting any dovish turn and questioning whether the bank missed its chance to hike. Euro area and U.K. services PMIs are due, a particularly essential data point for the latter. What We've Been Reading This is what's caught our eye over the past 24 hours. And finally, here's what Cormac Mullen's interested in this morning It seems even currency traders have been infected with Brexit fatigue. Six-month expected volatility in sterling has slumped relative to levels anticipated in a year, suggesting the market is under-pricing a number of potential game-changing scenarios which could happen by December. As Bank of America Merrill Lynch strategist Kamal Sharma noted to clients Tuesday, the difference in expected price swings is close to a two-year low and well below levels late last year when no-deal Brexit fears were high. Without going over well-trodden ground, any number of permutations and combinations could cause pound volatility to spike in coming months -- a no-deal Brexit, a no-confidence vote in the government and a general election to name a few. Even the calling of a second referendum, while likely sterling positive, would lead to a volatility jump. With a new prime minister set to be announced in just a few weeks, pound traders would do well to get ready for some action.  Cormac Mullen is a Cross-Asset reporter and editor for Bloomberg News in Tokyo. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. Before it's here, it's on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can't find anywhere else. Learn more. |

Post a Comment