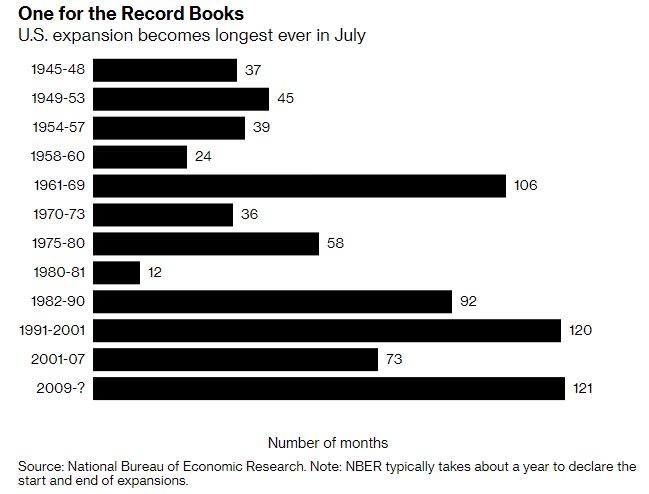

Trade truce, OPEC meeting, and global manufacturing continues to suffer. Talks to resumePresident Donald Trump declared that the U.S. is winning the trade war after he reached a temporary truce with Chinese President Xi Jinping. Trump said he would hold off imposing tariffs on an another $300 billion of Chinese goods and would delay restrictions on Huawei Technologies Co., letting U.S. companies resume sales to China's largest telecommunications equipment maker. Investors welcomed the truce and the promise of new talks, while warning that any lift in asset prices might be short-lived as the underlying conflict remains unresolved. Oil rallyCrude bulls are getting a double helping of good news: the trade detente and expectations that OPEC and its allies will agree to a long extension to production cuts as they gather in Vienna. Adherence to the output curbs remains high, with production dropping again in June, the seventh consecutive month of falls. A barrel of West Texas Intermediate for August delivery jumped as much as 3% this morning, adding to its 11% gains over the past two weeks. Output slumpWhile headlines on trade are good news, there are more signs emerging of the damage already done by the uncertainty caused by the standoff. China's Caixin manufacturing PMI, which is weighted toward the private sector, fell to 49.4 in June from 50.2. The weakness in Europe's manufacturing sector continued with PMI falling to 47.6 in the euro-area, and hitting the lowest level since 2013 in the U.K. Morgan Stanley downgraded its forecast for global growth saying the truce reached at the G-20 isn't enough to lift uncertainty. Markets rallyOvernight, the MSCI Asia Pacific Index climbed 0.8% while Japan's Topix index closed 2.2% higher with electronics makers proving the biggest boost as the yen fell against the dollar. In Europe, the Stoxx 600 Index had gained 0.8% by 5:50 a.m. Eastern Time with miners among the best performers in a broad-based rally. S&P 500 futures pointed to a decent pop at the open, the 10-year Treasury yield was at 2.021% and gold dropped. Coming up…Markit's U.S. manufacturing PMI for June is published at 9:45 a.m., with ISM June manufacturing and May construction spending at 10:00 a.m. European Union leaders continue their discussions in Brussels as the top jobs up for grabs are argued over. One outcome that is looking increasingly likely is that the European Central Bank may get its first female head, although that decision may be pushed to September. What we've been readingThis is what's caught our eye over the weekend. And finally, here's what Joe's interested in this morningThe ongoing U.S. economic expansion just hit 121 months old, officially making it the longest on record going back to 1854. With the Fed shifting to a more dovish posture, obviously it hopes it can go on much longer. But what's enabled this long cycle? Something that Fed Chairman Jerome Powell has touched on a couple of times is that recent recessions haven't followed the normal playbook, where the Fed tightens and the real economy starts to slow. Instead, recessions came in the aftermath of extreme financial imbalances, such as the housing crash and the internet bubble. If you look at the last 10 years, we've been slowly shedding the trauma of the Great Financial Crisis but with occasional bouts of panic, like the euro crisis, the oil crash, debt ceilings, fiscal cliffs, the Gulf oil spill, the Fukushima disaster, the taper tantrum, and the trade war. Amid an already anxious backdrop, these kinds of events have helped prevent any sustainable euphoria. That's not to say there aren't risks or areas of concern in financial markets, with corporate debt the area people are most like to point to. Still for the most part, the past decade has not been conducive to blowing bubbles, and that may help explain the longevity of the current run.  Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. Before it's here, it's on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can't find anywhere else. Learn more. |

Post a Comment