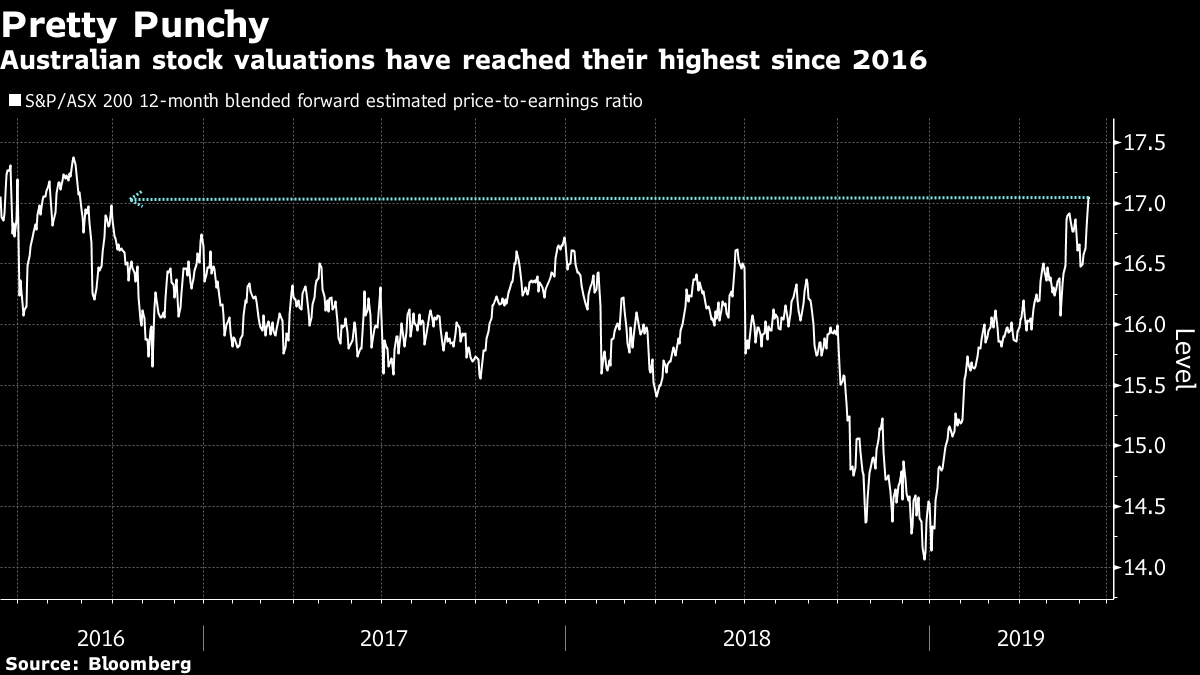

| The U.S. blamed Iran for tanker attacks near the Persian Gulf. Asian futures are mixed following a turnaround in U.S. stocks. And Broadcom trimmed its sales forecast, citing the U.S.-China trade war. Here are some of the things people in markets are talking about today. Blame it on Iran The U.S. blamed Iran for attacks on two oil tankers near the Persian Gulf, further raising the risk of a military conflict. American officials have determined Tehran was responsible, Secretary of State Michael Pompeo said, without providing evidence. Iranian Foreign Minister Javad Zarif suggested his country's enemies may be culpable and reiterated calls for regional dialogue. Here's more on what the friction is about. Oil Jumps on Supply Fears Oil spiked on the attacks, with WTI surging as much as 4.5% from a five-month low before paring gains. OPEC also cut its first-quarter demand growth estimate to less than 1 million barrels a day as the trade war hurt economic growth. The cartel kept its 2019 estimate mostly unchanged, saying consumption will accelerate the rest of the year. Hong Kong's Possible Pause Hong Kong may be edging toward delaying the proposed extradition law that triggered protests, but its financial elite are sweating. Chief Executive Carrie Lam's political allies said they don't see the bill as urgent and legislative debate is on hold until further notice. Opponents have planned another march for Sunday. Members of the U.S. Congress have reintroduced a measure defending Hong Kong's autonomy, while China's hard line approach may be giving its critics in Taiwan a boost too. It's all helping create a new kind of pressure on President Xi Jinping. Asian Futures Mixed Hang Seng futures are looking slightly lower, while the Nikkei and Australian markets are poised for higher opens after U.S. stocks halted a two-day decline. The S&P 500 hit a five-week peak as a surprise uptick in jobless claims supported the idea the Federal Reserve could take a dovish turn. And Larry Kudlow kept the trade war embers burning with a warning to China that there will be "consequences" if Xi doesn't agree to meet with President Donald Trump at the G-20 summit later this month. No More Day Drinking New rules will prohibit floor traders at the London Metal Exchange from drinking during the workday, according to people familiar with the matter. While the LME already bars dealers from engaging in drunken behavior on the floor, the policy would go further to break an association with heavy drinking that stretches back to the bourse's origins in Victorian times. The Brexit Party's Nigel Farage, who has often recounted details of his booze-fueled exploits in the city before he moved into politics, has helped to perpetuate the image of the hard-drinking metals trader. What we've been reading This is what's caught our eye over the last 24 hours. And finally, here's what Cormac's interested in this morning Stocks are looking a little over-priced Down Under. Australia's benchmark S&P/ASX 200 Index has climbed about 16% this year, comfortably outperforming the 12% rise in the MSCI AC World Index and hitting a 12-year high in the process. Valuations have reached their highest since 2016 — the gauge's 12-month forward price-earnings ratio of 17.1 compares to just 14.8 for the global stocks benchmark — a 16% premium.  The issues facing Australian equities aren't new, but they are worth repeating. On the domestic front there is an ongoing property slump and consumer spending is under pressure, while abroad the risks of a synchronized global slowdown are growing. The Sino-American trade war directly impacts Australia's biggest trading partner China. The Aussie stock market has shaken off these concerns for now and bulls have been rewarded. That doesn't mean it can defy them forever. Cormac Mullen is a Cross-Asset reporter and editor for Bloomberg News in Tokyo. Even before Trump's trade war, China was the world's biggest story. It's reshaping the global economy — but its ascent hasn't come without major problems. Sign up to get Next China, a weekly dispatch on where the country stands now and is headed next. Before it's here, it's on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can't find anywhere else. Learn more. |

Post a Comment