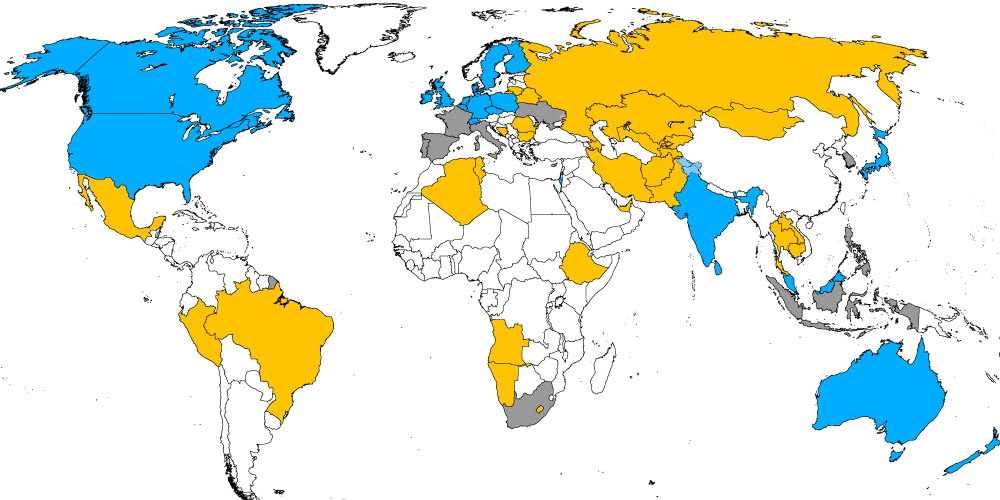

China's ascension and the implications of Beijing's growing clout were in focus again this week, though not in the context of trade. Tensions in Hong Kong over a proposal that would facilitate extraditions to the mainland boiled over into clashes between protesters and police. What began as a way to close a loophole that had prevented a suspected murderer from being sent to Taiwan for prosecution, became a confrontation over China's growing sway over the city. Critics worry the legislation will undercut the rule of law in Hong Kong and also the "one country, two systems" framework that's allowed the city to be China, but different. Such an outcome could have chilling implications for the city's business community and its position as a financial center. Supporters say those concerns are misplaced and that the legislation has been misunderstood. They also argue the bill is needed to keep Hong Kong from becoming a sanctuary for fugitives. The issue of extraditions highlights how different Hong Kong's historic alliances are from China's. The city has extradition agreements with 30 jurisdictions around the world. Only nine of those have similar pacts with China. (In the graphic below, countries shaded in blue have treaties with Hong Kong, those in yellow have agreements with China and those in gray have pacts with both.)  But two decades after its return to Chinese rule, Hong Kong is now also more interconnected with the mainland than ever before. That includes a high-speed rail link able to deliver passengers to Beijing in nine hours, as well as arrangements allowing investors in Hong Kong to trade Chinese stocks and bonds. And there's more to come. China in February published a blueprint for tying Hong Kong, Macau and the adjacent province of Guangdong more closely together, with the aim of creating a high-tech megalopolis rivaling California's Silicon Valley. As the city's integration with China continues, or even accelerates, the discourse in Hong Kong may well become more tumultuous. Talking TradeThe trade rhetoric from the White House has become more heated as well. President Donald Trump this week threatened to raise American tariffs on Chinese imports even further if Xi Jinping doesn't agree to meet at the G-20 summit in Japan at the end of June. Beijing has so far been coy on the issue, neither rejecting nor supporting the idea of a meeting. U.S. Commerce Secretary Wilbur Ross also warned that even if the presidents did meet, they are unlikely to strike a deal. Corporate ReactionCompanies aren't waiting for the G-20 to act. The tariffs have prompted Alphabet Inc.'s Google to move some production of its Nest thermostats and server hardware out of China. Foxconn, Apple's main manufacturing partner, said this week it has the capacity to produce all iPhones bound for U.S. markets outside of China. Vietnam, which has seen a recent surge in exports to the U.S., is increasing scrutiny of whether goods labeled "Made in Vietnam" are actually produced there. Concern has grown that Chinese companies are rerouting their exports through Vietnam to avoid tariffs.  Policy LeversA number of central bankers have likewise expressed a readiness to act if economic growth begins to falter. PBOC Governor Yi Gang said in an interview that China has "tremendous" room to adjust policy if the trade war deepens. That said, Yi also expressed confidence that measures Beijing has already introduced were sufficient to deal with the current headwinds facing the country. Hot StockThe power of monopoly was also on display this week. The international unit of China National Tobacco Corp., the state-owned company that controls the world's biggest cigarette market, surged 55% in its first two days of trading in Hong Kong. That was all the more impressive considering the city's broader market fell amid the extradition protests and tightened liquidity. Less clear are the company's future prospects. While China has 300 million smokers, the World Health Organization estimates it sees about 3,000 deaths a day because of tobacco use. Beijing's response has been to ban smoking in many venues, including cockpits.Hydrogen CarsAnd finally, a peek into the future. For Wan Gang, dubbed the father of China's electric car industry, that's hydrogen fuel-cells. The technology, backed by auto giants such as Toyota, allows for faster refueling and longer travel distances than electric cars. Water vapor is also the only emission. Expensive costs, however, have hindered its adoption. But if China throws its weight behind the technology, that could all change.  Know someone else who may enjoy getting this? They can sign up here. |

Post a Comment