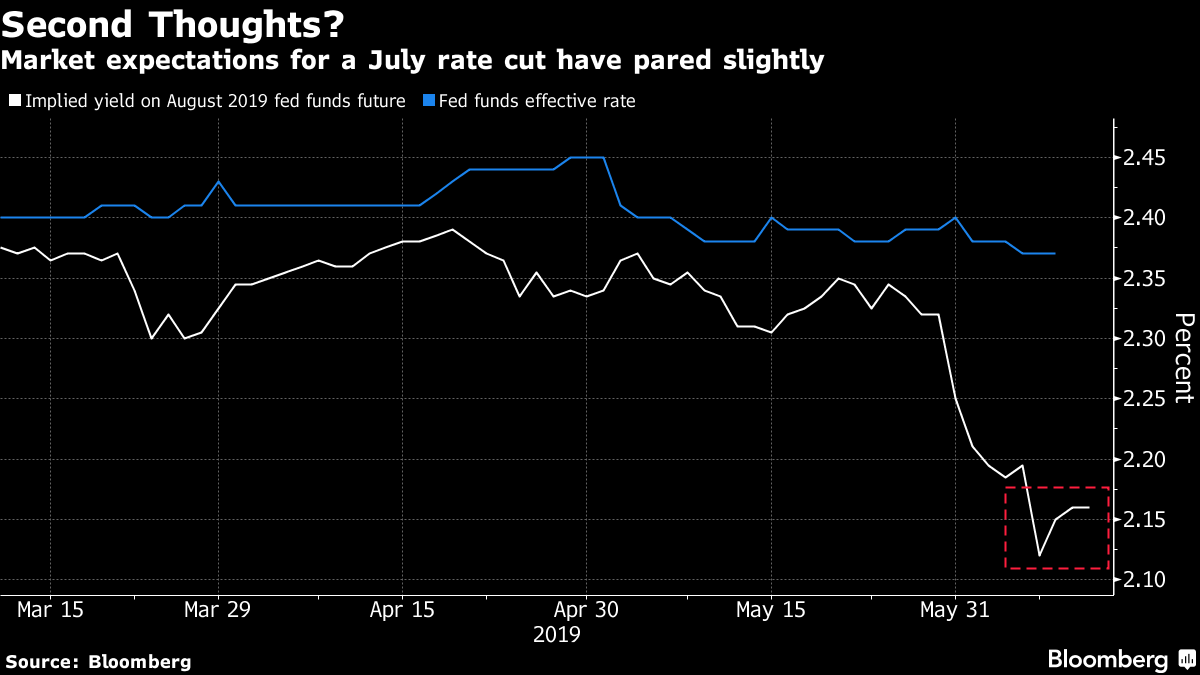

| Hong Kong's Carrie Lam urges a return to order after protests but refused to pull bill. Asia equity futures are pointing lower after U.S tech stocks led a stock slump. And India plans to launch a lunar mission by July 15. Here are some of the things people in markets are talking about today. Call for Calm Hong Kong is locked in extradition-bill stalemate. Leader Carrie Lam called for calm after demonstrations rocked the city and prompted police to fire tear gas and rubber bullets to disperse protesters, some of whom remained barricaded. She refused to withdraw the bill that triggered the conflict, which injured more than 70 people. President Trump expressed confidence that Hong Kong and Beijing will "be able to work it out." View videos, pictures and more from the protest. Stock Slump Asian equity futures are predicting more losses after U.S. stocks slumped, with tech shares leading the declines. Trade pessimism blunted optimism the U.S. Fed is closer to cutting rates. Treasuries extended the global bond rally, with 10-year yields dropping two basis points. The dollar rose against every G-10 peer save the yen, with the Aussie giving up the most ground. Oil fell to a four-month low as U.S. crude stockpiles unexpectedly hit a 20-month high amid subdued demand. Meanwhile, oil demand is shriveling as the trade war between the U.S. and China trips up the global economy. More Trade Threats Trump threatened to impose sanctions to stop construction of the Nord Stream 2 gas pipeline between Russia and Germany, sending the euro lower. "We're protecting Germany from Russia, and Russia is getting billions and billions of dollars in money from Germany," the president said. The Kremlin denounced the comments as "blackmail." Here's our explainer on why the world worries about Russia's natural gas pipeline. Meanwhile, Trump expressed optimism a China trade agreement can be worked out. "I have a feeling that we are going to make a deal," he said at the White House. Easing Policy Bank Indonesia will probably join other central banks in easing monetary policy to counter a global economic slowdown, Finance Minister Sri Mulyani Indrawati said. "When the situation has now changed, especially in advanced countries, including about the direction of monetary policies, and there is a signal of the global economy weakening, I think Bank Indonesia will also adjust its monetary policy stance," Indrawati told reporters in Jakarta on Wednesday. "How will BI do it? We will respect whatever they will do." Policy makers are scheduled to announce a rate decision on June 20. To The Moon India expects to launch a lunar mission July 15, which will make it the fourth country to land there. The Chandrayaan-2 aims to deliver a rover to an elevated plane close to the uncharted south pole to look for signs of water and potential new sources of energy. The nation's next priority is the $1.4 billion Gaganyaan mission, which would put three "gaganauts" — at least one of whom will be a woman — into orbit. What we've been reading This is what's caught our eye over the last 24 hours. And finally, here's what Cormac's interested in this morning If you're in the interest-rate cutting camp—and there is a strong argument for it—a lot is now riding on the Federal Reserve's July meeting. Fed funds futures have priced in 21 basis points of cuts and the S&P 500 Index has risen 3% since Chairman Jerome Powell's June 4 speech. However, traders betting on a July cut should be wary: While the narrative from Powell's comments has become "open to a rate cut," all he really said was that the central bank was closely monitoring trade developments and would act appropriately to sustain economic expansion.  If anything the trade developments since then have been net positive, with tariffs on Mexico averted and some sort of deal with China still a possibility. Outside of a disappointing jobs figure (which might have been affected by adverse weather) the most recent data have been patchy but not dire. Absent another bad economic datapoint or trade tweetstorm will enough have happened by next Wednesday for the Fed to turn impatient? Pricing in futures markets shows expectations for more than 50 basis points of Fed cuts by year-end, and that can still happen. But traders betting big on a July move will be on much shakier ground if it's not set up for them in June. Cormac Mullen is a Cross-Asset reporter and editor for Bloomberg News in Tokyo. Even before Trump's trade war, China was the world's biggest story. It's reshaping the global economy — but its ascent hasn't come without major problems. Sign up to get Next China, a weekly dispatch on where the country stands now and is headed next. Before it's here, it's on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can't find anywhere else. Learn more. |

Post a Comment