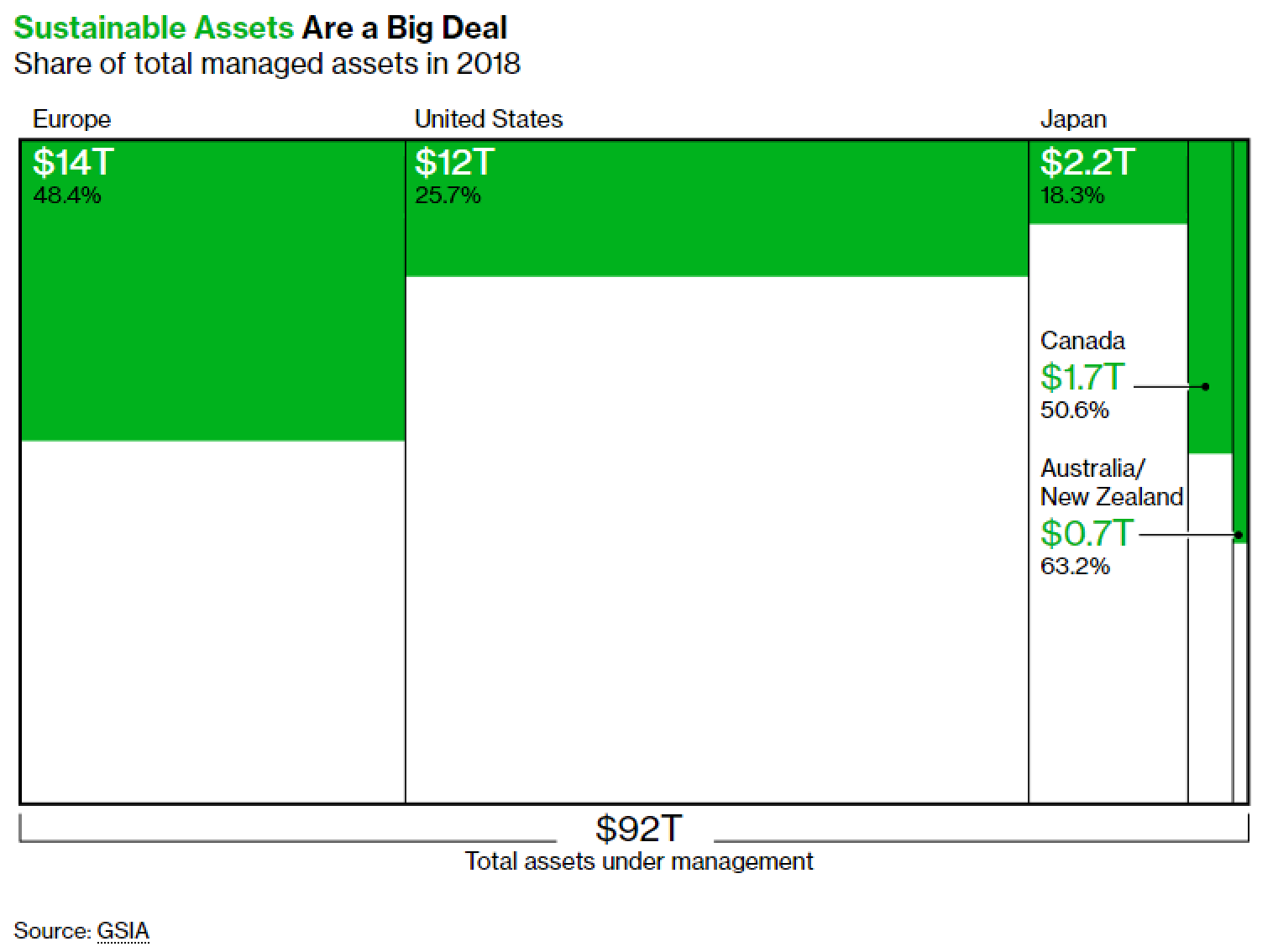

Inside: Global energy use and emissions are on the march. Impact investing should act as if the world depends on it. Money is pouring into green assets. Electric vehicles may save the world, except for this desert. A fast-food franchise draws U.S. senators' ire. — Eric Roston Sustainable FinanceThe 17 UN Sustainable Development Goals require annual commitments of private capital from $5 trillion to $7 trillion globally over the next decade. Can impact investing make the difference? The approach has earned a cultlike following among parts of the wealthy elite, but needs to act as if the world depends on it, writes Bloomberg's Emily Chasan. Norway's $1 trillion sovereign wealth fund is expected to agree to dump more than $13 billion in stocks linked to fossil fuels. A broad coalition in Parliament will vote on and likely approve a watered-down plan to jettison carbon-heavy investments, but spares the largest oil majors, such as Royal Dutch Shell and Exxon Mobil. Young, extremely wealthy do-gooders have started taking advantage of a joint Harvard-University of Zurich crash course, called "Impact Investing for the Next Generation." Freddie Mac is stepping into the green-bond market, starting a new commercial mortgage-backed security program that is backed by loans to apartment building owners who improve their properties' environmental performance. In general, money is gushing into any kind of asset labeled green or sustainable, with holdings reaching $31 billion, according to Bloomberg Graphics.  Michael Bloomberg announced during an MIT graduation address that he and Bloomberg Philanthropies are committing $500 million to launch a nationwide climate initiative called Beyond Carbon (he is the owner of Bloomberg LP, which publishes Bloomberg News). In Brief - Bank of Montreal plans to double its small-business lending and support for female entrepreneurs within the next six years as part of a companywide effort to support economic growth and inclusiveness.

- The Manhattan Institute has updated its database of shareholder proposals, called Proxy Monitor, for 2019. Forty-five percent of resolutions carried social, environmental or religious messages.

- EDP Finance has ginned up meetings for its debut green bond.

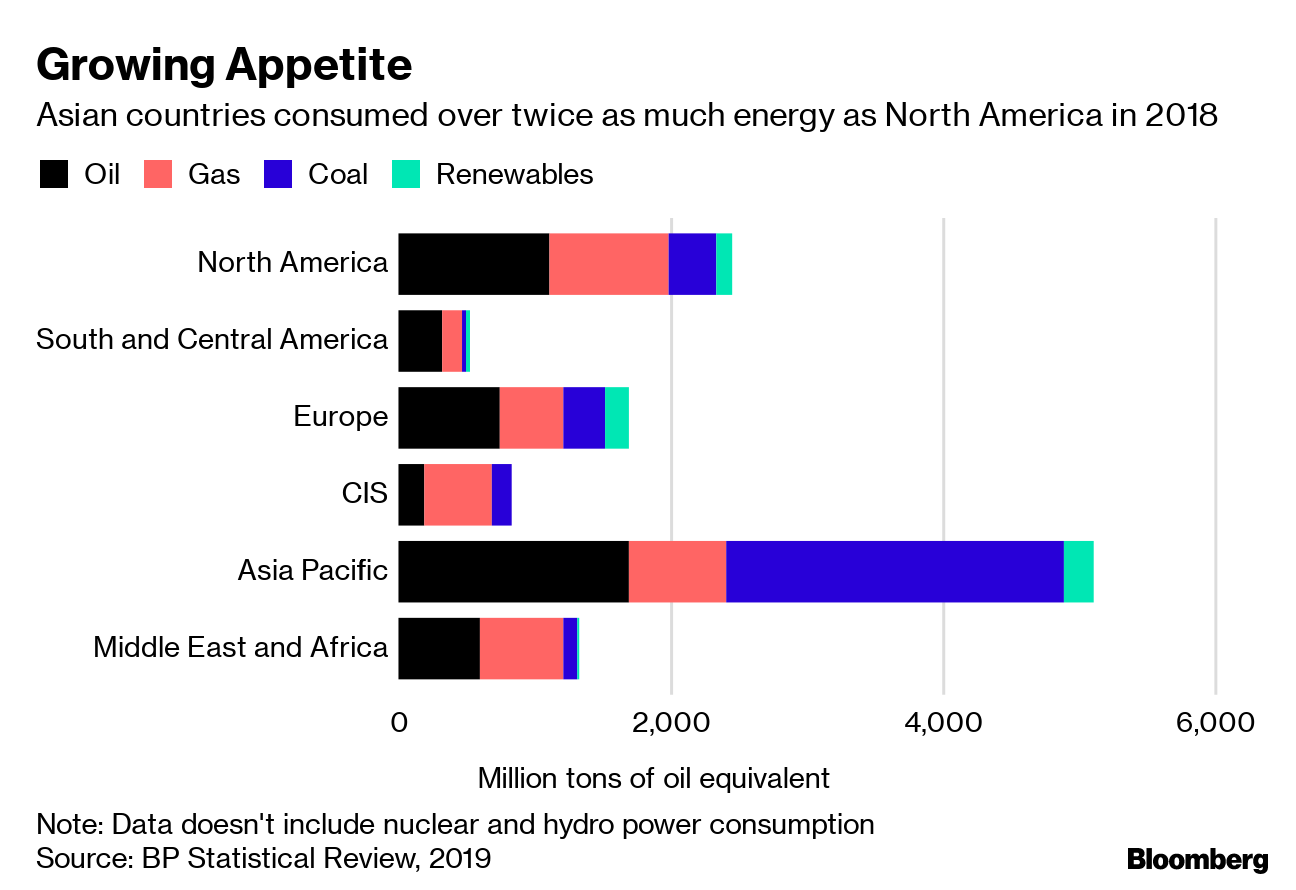

EnvironmentFights to limit climate change are frustrated by global energy use, which rose 2.9% last year, and CO2 emissions with it. The jump in greenhouse gas emissions was the largest in seven years, according to the 2019 BP Energy Outlook  Electric vehicles might just make a dent in oil demand, possibly at the expense of Chile's Atacama desert. Mining companies have moved into the region to stay, drinking up precious water to unearth lithium for use in batteries (Chile is increasingly on top of recycling issues). At the other end of the supply chain, Volkswagen is recalling Audi electric SUVs because of fire risk. Wildfire season has barely started, and PG&E is already taking the precaution of plunging thousands into darkness in Northern California when high winds threaten to knock down its power lines and spark wildfires. Temperatures have spiked in the area, also prompting fears about new wildfires. Power suppliers who contracted with PG&E lost a bankruptcy court fight. Gap wants to address water scarcity in drought-savaged India, and is funding a solutions center and water-treatment facilities. Chanel has taken an undisclosed minority position in Evolved by Nature, which has developed a process for extracting silk from cocoons, liquefying it and commercializing it as fabric. The idea that natural capital can be managed like human-made assets finally arrives on Capitol Hill. Social McDonald's has drawn the ire of several U.S. senators — including four Democratic presidential candidates — for what they call "unsafe and intolerable" working conditions and "unacceptable" behavior in the chain's restaurants. Last month, CEO Steve Easterbrook had sent a letter to Sen. Tammy Duckworth (D-Illinois; above), who leads the group of lawmakers, saying that McDonald's is committed "to ensuring a harassment and bias-free workplace."

Efforts to make tech more inclusive haven't worked so far, Liz Fong-Jones, the principal developer advocate at Honeycomb.io and a former Alphabet Inc. engineer, told Bloomberg TV. Why pregnant women still have it so hard at work: The relentless pressure to devote more hours to the office hasn't gone away, even with anti-discrimination laws. Two executives at a top Lloyd's of London insurance company have resigned following allegations of sexual harassment. One was accused of groping colleagues at a booze-fueled party, the other of stalking a junior employee. Venture capital financiers are demanding a higher purpose from their funds, Atomico founder Niklas Zennström told Bloomberg's Sooner Than You Think conference in London. Managers of endowments and pension funds increasingly ask VCs to prioritize companies with an element of sustainability or humanitarianism, he said. GovernanceInvestor discontent with directors at public companies has soared to a nine-year high, according to International Shareholder Services. The proxy adviser keeps track of board elections that fall below 80 percent support. Nissan Motor investors should vote against the election of CEO Hiroto Saikawa to the company's board, according to both ISS and Glass Lewis. ISS said his close association with former Chairman Carlos Ghosn makes him a poor selection. Glass Lewis said he "should have taken greater steps" to prevent misconduct. Half of public company directors don't feel ready for disruptions to business triggered by technology, according to an Ernst & Young survey of 365 directors.  Note: Please send tips, suggestions and feedback to Emily Chasan at echasan1@bloomberg.net. New subscribers can sign up here. To see this on the web, click here. |

Post a Comment