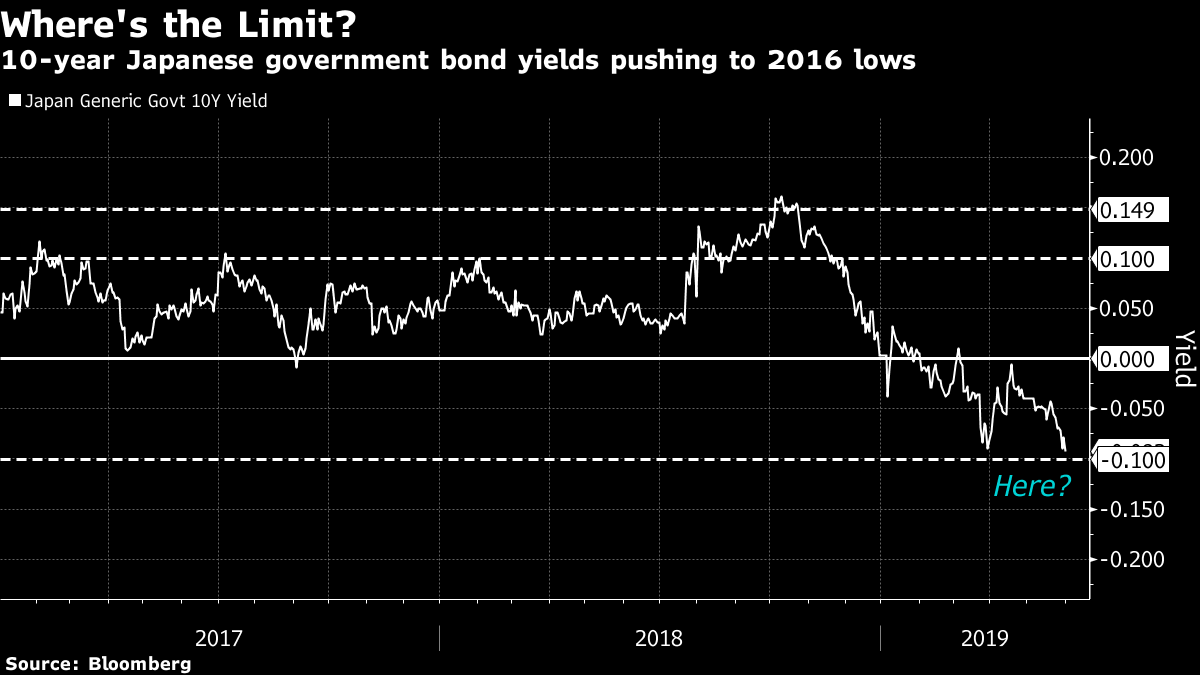

| China asks for respect and blames the U.S. for trade war, investors are on alert as tensions rise, and the world's most resilient economy has got the wobbles. Here's what's moving markets. China Demands Respect China's government says it's willing to work with the U.S. to end an escalating trade war, but blames President Donald Trump's administration for the collapse in talks and won't be pressured into concessions. Beijing released a white paper on Sunday saying the escalating trade war have done serious harm to the U.S. economy by increasing production costs, causing prices hikes, damaging growth and people's livelihoods and creating barriers to U.S. exports to China. The comments come as both sides escalate their dispute before Presidents Xi Jinping and Trump may meet this month at the Group of 20 summit in Japan. Markets Open Asian stocks were poised to start the week on the back foot after the feud between the world's two-largest economies grew over the weekend. The yen held near a six-month high. U.S. futures retreated and contracts signaled modest declines for equities in Japan and Australia. The S&P 500 Index sank 1.4% on Friday and the yield on 10-year Treasuries slumped to 2.13% after a new front from the Trump administration started with Mexico. On traders' radar this week, a raft of central bank meetings: the European Central Bank sets monetary policy and new forecasts, the Reserve Bank of Australia is widely expected to cut interest rates, and India's central bank also has a rate decision. U.S. jobs report is out Friday. Federal Reserve officials gather in Chicago. U.S. Targets India President Donald Trump opened another potential front in his trade war on Friday, terminating India's designation as a developing nation and thereby eliminating an exception that allowed the country to export nearly 2,000 products to the U.S. duty-free. The action, which the administration has foreshadowed for months, ends India's preferential treatment under the Generalized System of Preferences, a decades-old program designed to promote economic development around the world. India said that it had offered resolutions to the U.S. during bilateral trade discussions, and it's "unfortunate" that those weren't accepted. Cracks Down Under Australia hasn't recorded two straight quarters of economic contraction since the first half of 1991, meaning it's just a month away from overtaking the Dutch record and posting 28 years of continuous expansion. With home prices sinking, households swimming in record debt and the escalating U.S.-China trade war eroding confidence, bond and foreign exchange traders are betting that streak is now in jeopardy. Traders are betting RBA Governor Philip Lowe will cut rates at least twice to underpin employment and return inflation to target, with the first move expected Tuesday. German Coalition Woes The leader of German Chancellor Angela Merkel's junior coalition partner stepped down in a surprise move that puts into question the survival of the government itself. Andrea Nahles, head of the Social Democratic Party, said she will resign as chief and parliamentary caucus leader after losing the rank and file's backing. The party suffered a devastating defeat in the European Parliament elections last week. Her departure could prompt her party's exit, forcing Merkel to lead a minority government, form an alliance with the Liberals and the Greens, or face a snap election. What We've Been Reading This is what's caught our eye over the weekend: And finally, here's what David's interested in this morning Treasuries are coming off their biggest week since the global financial crisis. Looming U.S. tariffs on Mexican exports and China's locked-and-loaded plan to retaliate using rare earths add to the already lengthy list of reasons why bonds are likely remain supported and equities on offer. In stocks, Japan's TOPIX, Singapore's Straits Times Index and the Hang Seng China Enterprises Index look set to be the next three benchmarks to erase 2019 gains, about 2-3 percent away.  In sovereigns, this global rally is suddenly making Japanese government bonds look relatively cheap, maybe artificially. Let me explain. Under the Bank of Japan's yield-curve control policy, the 10-year yield is kept near 0 percent. Yields have flirted with the upper end of that range long enough for markets to know roughly where the bank's line in the sand is. It used to be at about 0.1% but following the BOJ's flexibility pledge, it's now at about 0.15%. But yields have only headed down recently, to what may turn out to be the other end of the playground. No one knows for sure. We touched or passed -0.09% twice last week, which has only happened once before this year. Our jump-off point today is at -0.105% while bunds are at a whopping -0.205%. With German yields now further in negative territory than Japanese, and Australian ones — along with New Zealand's — closer to zero than ever before, it's worth asking whether BOJ policy is making traders fearful to buy beyond a certain point. I could be wrong of course. What do you guys think? You can follow Bloomberg TV anchor David Ingles on Twitter at @DavidInglesTV. Even before Trump's trade war, China was the world's biggest story. It's reshaping the global economy — but its ascent hasn't come without major problems. Sign up to get Next China, a weekly dispatch on where the country stands now and is headed next. Before it's here, it's on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can't find anywhere else. Learn more. |

Post a Comment