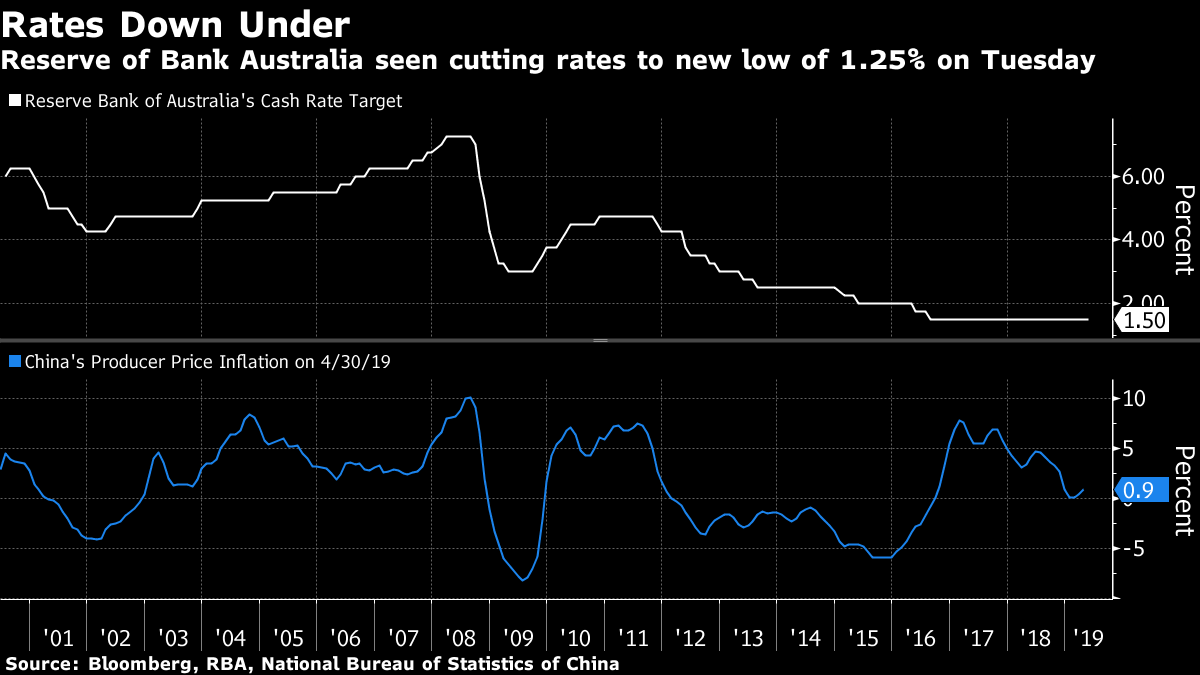

| The technology industry is girding for sweeping investigations into its business practices and FAANGS got hit by the news. Asia equities are in the green despite a U.S. selloff. And China warns students on the growing risks of seeking a U.S. education. Here are some of the things people in markets are talking about today. Silicon Valley Targeted Antitrust scrutiny rattled Big Tech. Regulators split up oversight in apparent preparation for probes into whether the firms' practices harm competition. The FTC will look at Facebook and Amazon as the DOJ examines Google, people familiar said. The Justice Department will also oversee Apple, Reuters reported. Google parent Alphabet fell to a five-month low and Facebook plummeted 7.5%, the most since July. Amazon and Apple also fell. FAANGS Hit Futures in Japan, Australia and Hong Kong showed modest gains despite a general U.S. equities selloff. The Nasdaq-100 Index extended losses from a record in May to more than 10% as the FAANG cohort of tech companies was said to potentially face federal probes on antitrust activity. The bond rally marched on, with 10-year Treasury yields dropped to their lowest since September 2017. The greenback lost ground against all of its G-10 peers after James Bullard became the first Fed board member to publicly call for a rate cut amid the trade war. Oil sank and gold jumped. Another Bad Report Card Australia's workplace productivity growth has slowed to a crawl as the economy struggles to shake off the drag from the end of its mining investment boom earlier in the decade. The labor productivity rate declined to 0.4% in year through June 2018, compared with an average of 2.2% since the mid-1970s, the Productivity Commission said. "The current weakness in labor productivity can be partly attributed to a marked slowdown in investment in capital," the commission said. It's not all bad — Australia is still performing well in maintaining productivity levels when compared with other developed economies. China's Warning to Students China warned its students and scholars to consider the risks before studying in the U.S., following Washington's recent restrictions on Chinese students. The Education Ministry pointed to extended reviews and shorter validity of visas, and an increased refusal rate. American universities still welcome Chinese, a ministry spokesman told CCTV. Still, several Chinese graduate students and academics told Bloomberg News in recent weeks that they found the U.S. academic and job environment increasingly unfriendly. Trump's Trip Donald Trump kicked off his U.K. state visit, saying a trade deal was possible once Britain "gets rid of its shackles" by leaving the EU. The president met Queen Elizabeth at Buckingham Palace, with protesters outside. He also took time to call London Mayor Sadiq Khan a "stone cold loser" and complain about CNN's coverage of his visit by suggesting a boycott of owner AT&T. What we've been reading This is what's caught our eye over the last 24 hours. And finally, here's what David's interested in this morning In a couple of hours, the Reserve Bank of Australia looks set to deliver its first rate cut in three years. If it doesn't, expect the Aussie dollar to punch the ceiling like a teenager at a rave. The country's government yield curve is now below the bank's cash rate target from the short end all the way to the 10-year. So a cut's virtually priced in, and arguably has been since the last RBA meeting in May. The debate's now about how many cuts we'll get for this easing cycle. Overnight index swaps are currently signaling almost two cuts by September. Westpac sees three by November, with a chance that that could become four. That's one every other meeting. JPMorgan sees four by the middle of next year, with senior economist Ben Jarman saying in a recent note that they expect the cash rate to fall to just 0.5%.  The RBA last brought rates down that quickly when China's commodity-gobbling factories entered a four-year period of deflation in 2011 (which, by the way, also coincided with the European debt crisis). Before that, it was during the global financial crisis. Now one has to ask oneself, are things about to get really bad in Australia? And more importantly for markets, can one afford to invest against that view right now if you don't agree with it? You can follow Bloomberg TV anchor David Ingles on Twitter at @DavidInglesTV. Even before Trump's trade war, China was the world's biggest story. It's reshaping the global economy — but its ascent hasn't come without major problems. Sign up to get Next China, a weekly dispatch on where the country stands now and is headed next. Before it's here, it's on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can't find anywhere else. Learn more. |

Post a Comment