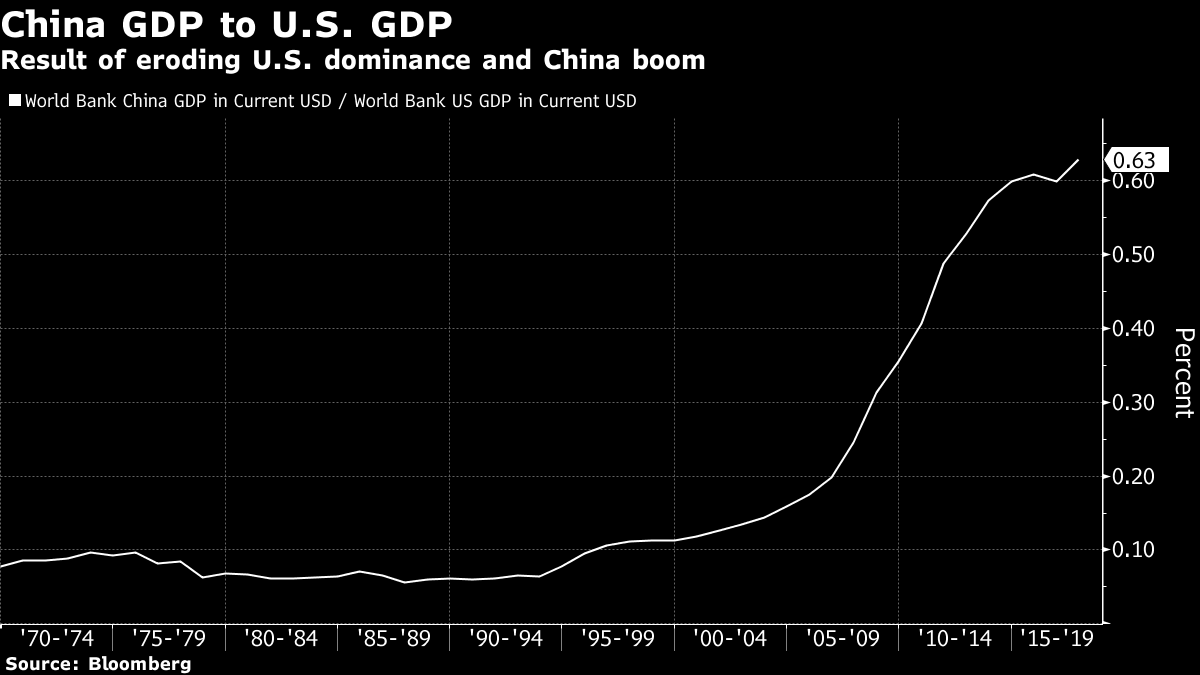

| Welcome to your morning markets update, delivered every weekday before the European open. Good morning. Central banks are signaling rate cuts may be on the horizon, Donald Trump made big proclamations about a post-Brexit U.K. and trade tensions continue to underlie it all. Here's what's moving markets. Dovish Signals The shadow of a potential interest rate cut from the Federal Reserve is looming large again. Chairman Jerome Powell acknowledged an openness to cut should trade tensions indeed start to sap economic growth. Still, the Chicago Fed's Charles Evans stopped short of that and hinted the data aren't telling him a cut is necessary yet, while lessons from Canada suggest changing policy is tough. A host of further Fed officials will be taking part in events on Wednesday and after bond bulls were stung by Powell's dovish words, they and happier stock investors given a fillip by the comments will be listening intently. Don't Forget the ECB Europe has rate headaches of its own to contend with too. Inflation is undershooting target and the state of the economy is looking precarious, prompting JPMorgan Chase Co. to push back its estimates on when Western Europe's central banks will start raising rates and ABN Amro to predict quantitative easing will kick off again next year. European services PMI data is coming up on Wednesday and the next European Central Bank decision is on Thursday, so once the future path of the Fed is more clear, the ECB will take center stage. Not the NHS U.S. President Donald Trump will move on to Ireland after his trip to the U.K. in which he promised a "phenomenal" trade deal, albeit one that many analysts say is likely to run into the same roadblocks as other talks the U.S. has held. One sticking point would likely be the National Health Service, which the president hinted could be opened to American companies before backtracking. The Conservatives also agreed to accelerate the process of replacing Theresa May, meaning the U.K. will have a new prime minister in place by July 26. Front-runner Boris Johnson warned the Tories face extinction should Brexit be delayed again. Global Growth The World Bank cut its global growth forecast due to trade growth slowing to the weakest since the financial crisis a decade ago, another indication of the pain that trade jitters are causing. Chinese President Xi Jinping remains staunch, however, saying China's economy is improving noticeably and can manage the risks it faces. This weekend, U.S. Treasury Secretary Steven Mnuchin will meet with China's central bank governor at the G-20 finance ministers summit, a chance to begin work on breaking the impasse between the two. Coming Up... Asian stocks were given a boost by Powell's comments and Treasuries steadied after the drop on Tuesday. Data on U.S. crude inventories will also drop later in the day and oil prices were knocked back by reports the numbers will signal a supply glut. JPMorgan Chase & Co. boss Jamie Dimon will speak at a biotech conference in Philadelphia and watch for any read-across for Europe's software sector after another set of decent numbers from Salesforce.com Inc. What We've Been Reading This is what's caught our eye over the past 24 hours. And finally, here's what Mark Cudmore's interested in this morning Thirty years ago, the U.S. held all the cards in any potential economic dispute with China. That's very clearly not the case today, but the true shift in the power dynamics is often underestimated. China's GDP has gone from being 6% of that of the U.S. to more than 60% as of the end of 2017, and the gap continues to narrow rapidly. There are a number of contributing factors from both sides. U.S. economic dominance has been slowly eroding since the 1950s, when it accounted for roughly 40% of the world economy. An acceleration has taken place since the collapse of the 2001 dotcom boom, and the U.S. makes up less than a quarter of global GDP today. In contrast, China has been riding its own credit explosion, from a very low base, for the past 15 years. This has helped transform its economy from being too export dependent into a domestic-consumption based model. China's 1.4 billion population now equates to a massive middle-class that will help the gap between the two countries disappear entirely in the coming decades. Context worth bearing in mind amid the intensifying U.S-China trade war.  Mark Cudmore is a Bloomberg macro strategist and the Managing Editor of the Markets Live blog. Bloomberg Terminal users can follow him there at MLIV <GO> Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. Before it's here, it's on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can't find anywhere else. Learn more. |

Post a Comment