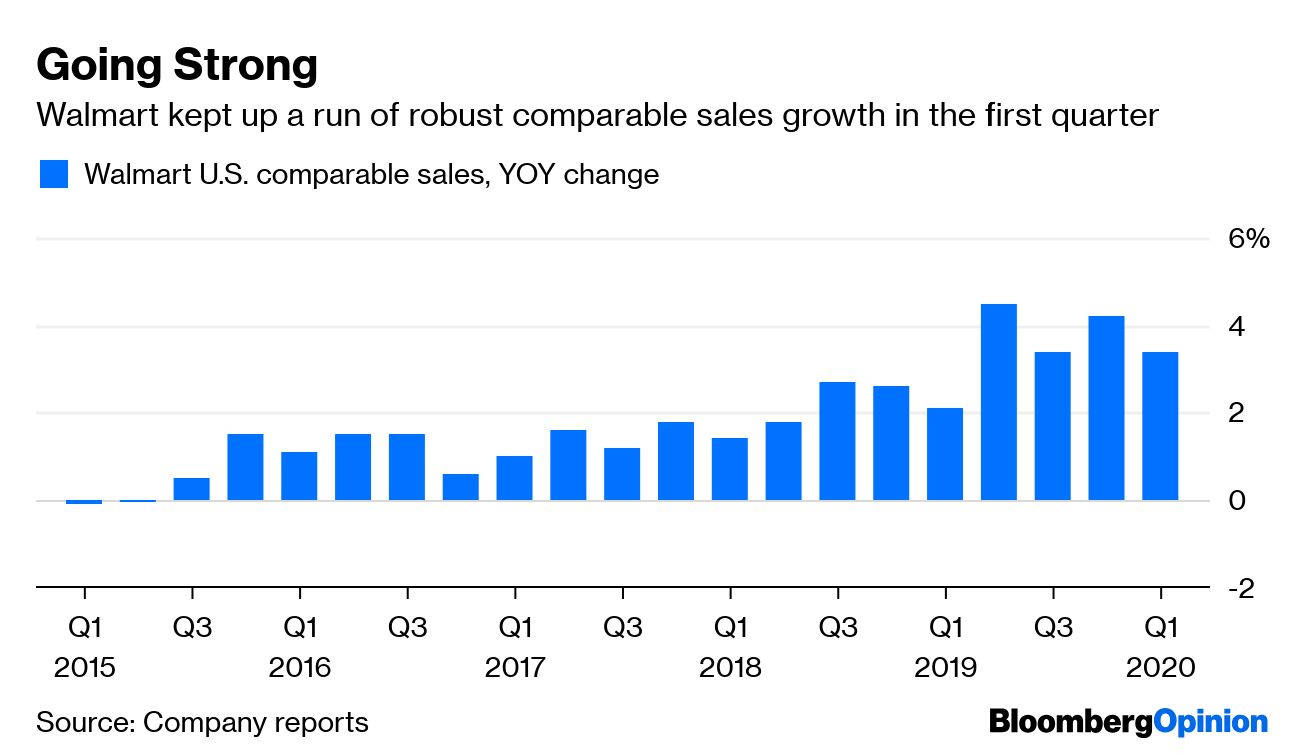

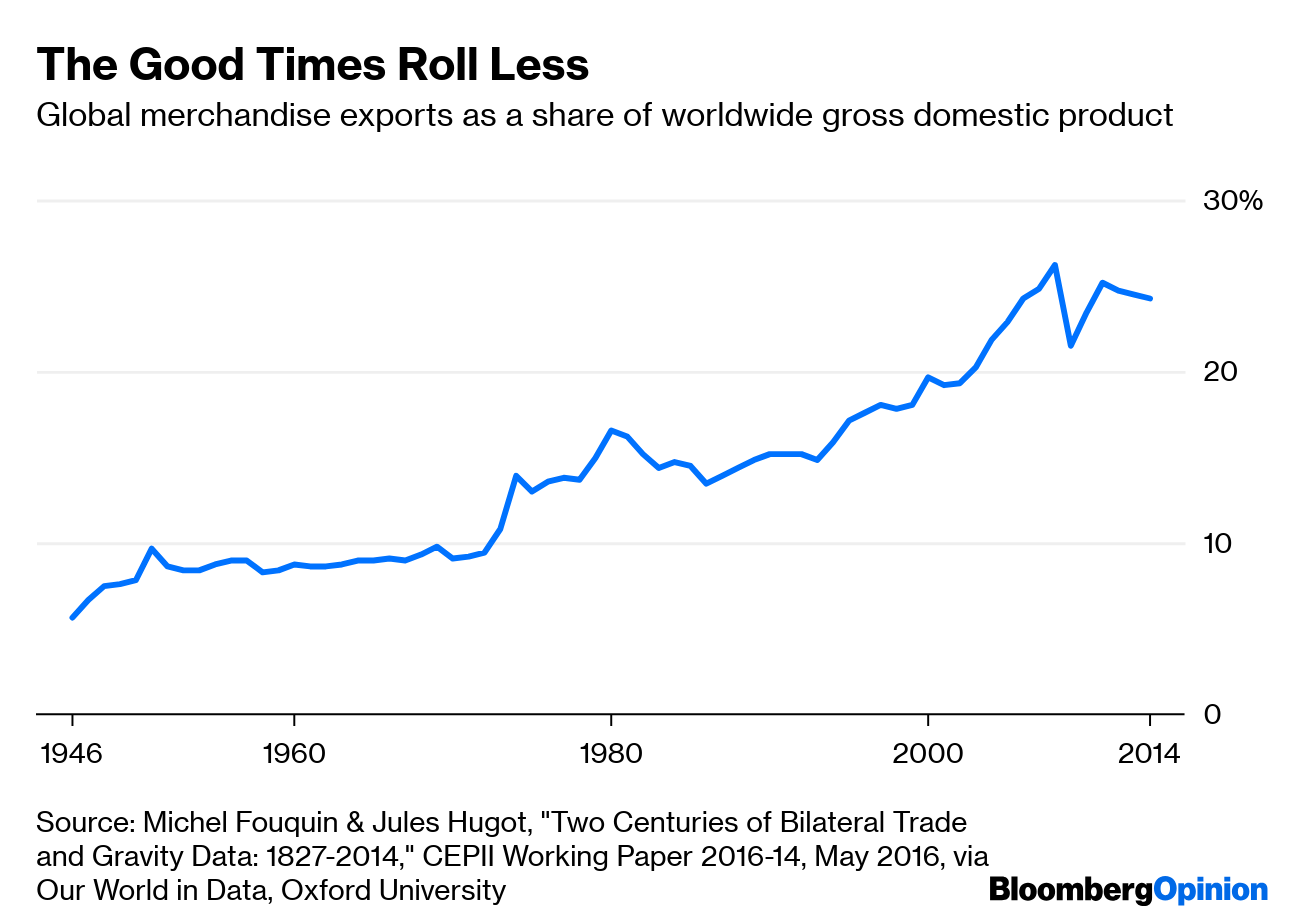

Today's Agenda  Trade War: The Huawei Front Wall Street may have learned to stop worrying and love President Donald Trump's nuclear option in his China trade war, but make no mistake: His threats to Huawei Technologies are a significant escalation. The stock market rallied hard for the third straight day, despite the Trump administration threatening to stop China's controversial telecom giant from doing business in the U.S. or buying components from American suppliers. Following through could cripple China's national champion and turn a trade spat into something more like a Cold War. Of course, this may be nothing more than further bluster meant to drive China to make a trade bargain, but Tim Culpan writes it gives oxygen to Huawei's claims that it's not a real security threat and is only being targeted for political reasons. Trump's attack could also boost sympathy for the company around the world, Tim suggests, which could be good for business. Of course, losing out on the U.S. market wouldn't be nothing. It's a tiny portion of Huawei's business right now, Alex Webb notes, but a major growth opportunity. Rivals such as Cisco Systems Inc., Ericsson and Nokia stand to benefit from Huawei's loss, Alex writes. Further Trade War Reading: China's Southeast Asian neighbors may seem like possible trade-war winners; but for now their currencies and stocks are taking a beating. – Shuli Ren Trade War: The Auto Front One of the things boosting the market this week was Trump's delay of a decision to slap tariffs on European and Japanese car imports. But Lionel Laurent warns those tariffs are still loaded in Trump's Very Huge Tariff Cannon, which, like Chekhov's gun, could still go off later, badly wounding both exporters and U.S. consumers. In fact, Trump's escalating trade war with China is already hurting exporters, Lionel notes, and proves Trump won't hesitate to use tariffs if he thinks talks are going badly. Trump's threat is also evidence he doesn't understand how cars are made these days; curbing European and Japanese imports will actually hurt the American auto industry, write Anjani Trivedi and David Fickling. For example, 75% of Japanese cars sold in the U.S. are also made in the U.S., compared with just 12% in 1986. That means Japanese auto makers invest billions of dollars in the U.S. Tariffs could derail that money train. Too Many Cooks New York City Mayor Bill de Blasio this morning became the 24th Democrat to launch an almost certainly doomed campaign for president. Quick: Can you name the other 23? Here, I'll help by showing you a picture of them (which doesn't include Mike Gravel; you can have that one for free):  Still can't name them all, can you? So why do these candidates keep multiplying like rabbits? Jonathan Bernstein points out the Democratic Party made the hurdle for getting into the first debate unusually low. That gives even the most marginal candidate a low-cost shot at priceless national exposure and a lottery-ticket's chance of breaking through to the top tier. But don't worry: The winnowing will happen eventually, Jonathan writes. Further 2020 Race Reading: Don't expect a war with Iran to win Trump re-election. – Jonathan Bernstein It Ain't Easy Being Public Two companies with very different stock-market pedigrees have one thing in common lately: Both show how answering to public investors can be kind of a drag. Uber Technologies Inc. hasn't even been on the market for a week yet, but it's had a rough time, tumbling roughly 20 percent below its IPO price in just a couple of days before nearly clawing its way back to breakeven this week. Nir Kaissar suggests the ride-hailing company suffered from staying in the shelter of private money for too long. Public investors are far more persnickety, Nir writes, and might have forced Uber to solve its problems already if it had gone public in, say 2015. On the other end of the market-longevity spectrum is General Electric Co., which has been publicly traded since the 19th Century. It built up mountains of investor goodwill during that time, but squandered much of it recently by trying to paper over its problems, notes Brooke Sutherland. Dramatically humbled and under new management, GE is trying to be more transparent, Brooke writes; but recent confusion about power-business orders shows progress is fitful at best. Telltale Charts Walmart Inc. just keeps cranking out great numbers, particularly in business lines where it has an edge on Amazon.com Inc., and even in some where it doesn't, writes Sarah Halzack.  Globalization's retreat since the financial crisis might just account for the sluggish productivity growth we've seen ever since, writes Noah Smith. If we're going to stick to the Trumpian trade-warring path, Noah writes, a stagnant economy is part of the bargain.  Further Reading Europe's migration crisis is over, but it's still not ready for the next one. – Bloomberg's editorial board A drug that helps prevent HIV infection shouldn't cost $20,000 a year. – Max Nisen Pentagon civilians are America's second-biggest workforce after Walmart, and they are demoralized. – Tobin Harshaw The Supreme Court is unusually fractious these days, which is bad for its legitimacy. – Stephen L. Carter In punishing Harvey Weinstein's lawyer, Harvard keeps up its proud tradition of caving to political pressure. – Stephen L. Carter Making a fortune on art investments is easy, if you have a time machine. – Barry Ritholtz Founding CBO director Alice Rivlin, who died on Tuesday, single-handedly changed Washington. – Karl W. Smith ICYMI These are heady days for dodgy Wall Street deals. Theresa May's time is just about up. Steve Mnuchin's dad bought a $91 million rabbit. Kickers Ultra-processed foods are making us obese, a study has shown. Bedbugs were bothering the dinosaurs. The moon seems to be tectonically active. "Game of Thrones" became just another TV show. Note: Please send rabbits and complaints to Mark Gongloff at mgongloff1@bloomberg.net. New to Bloomberg Opinion Today? Sign up here and follow us on Twitter and Facebook. |

Post a Comment