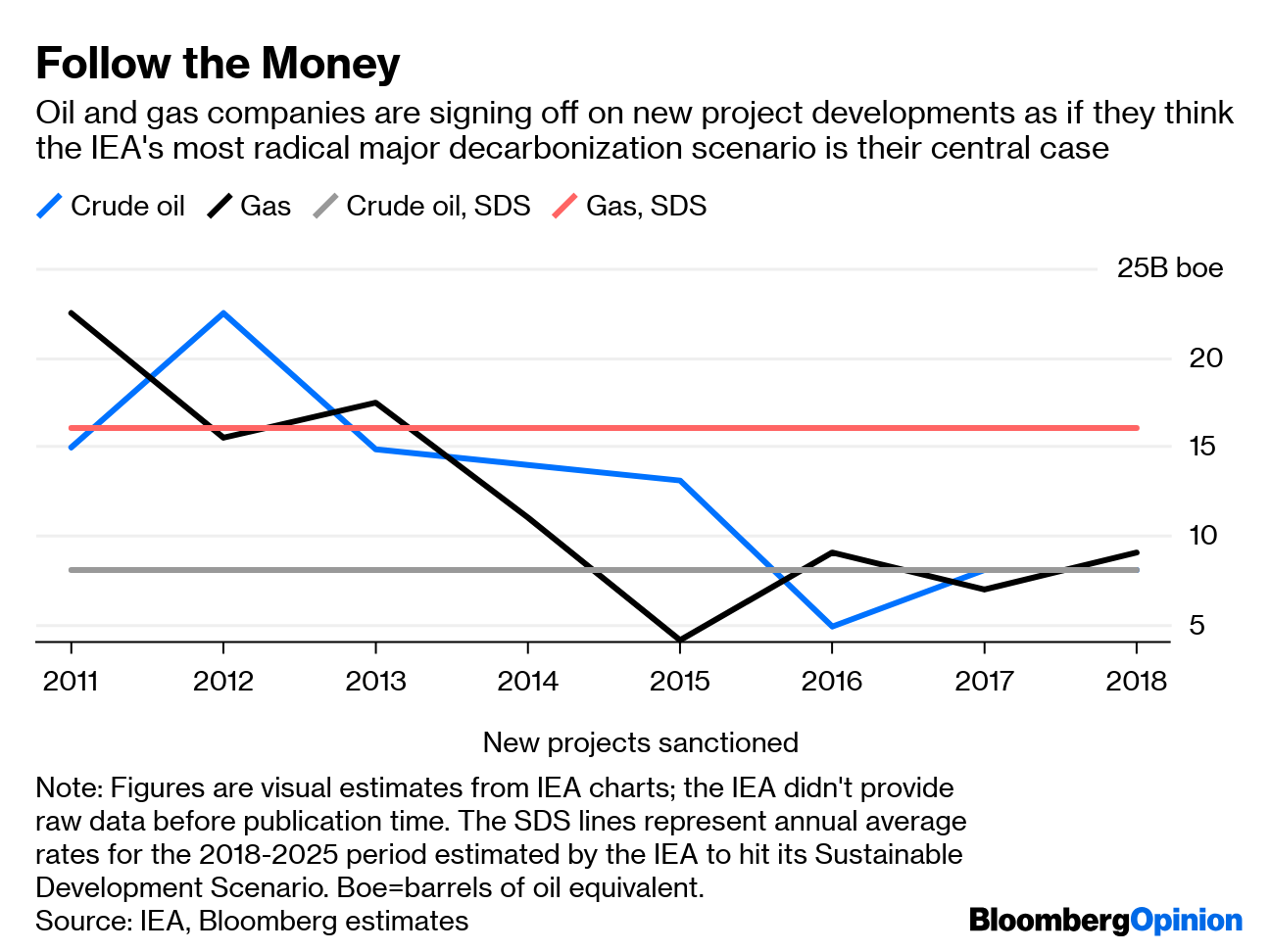

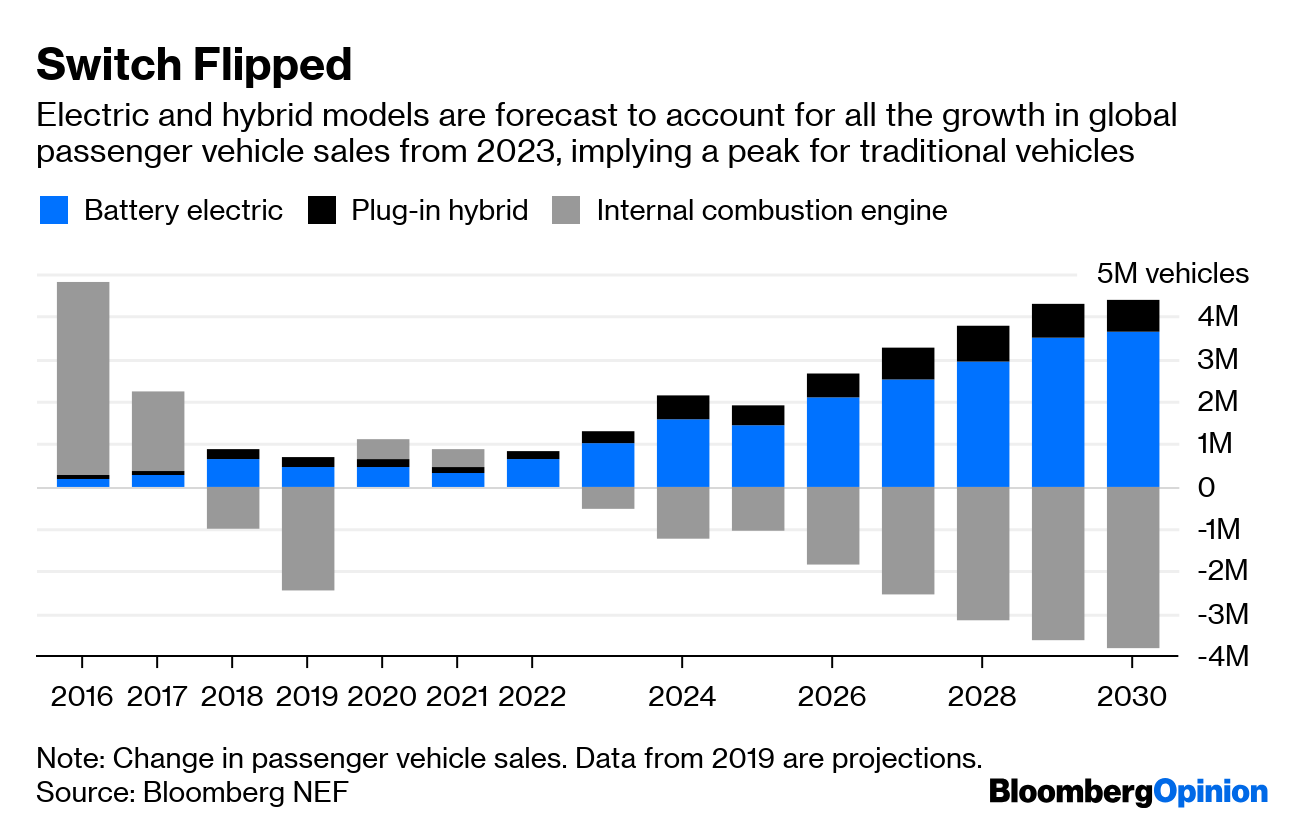

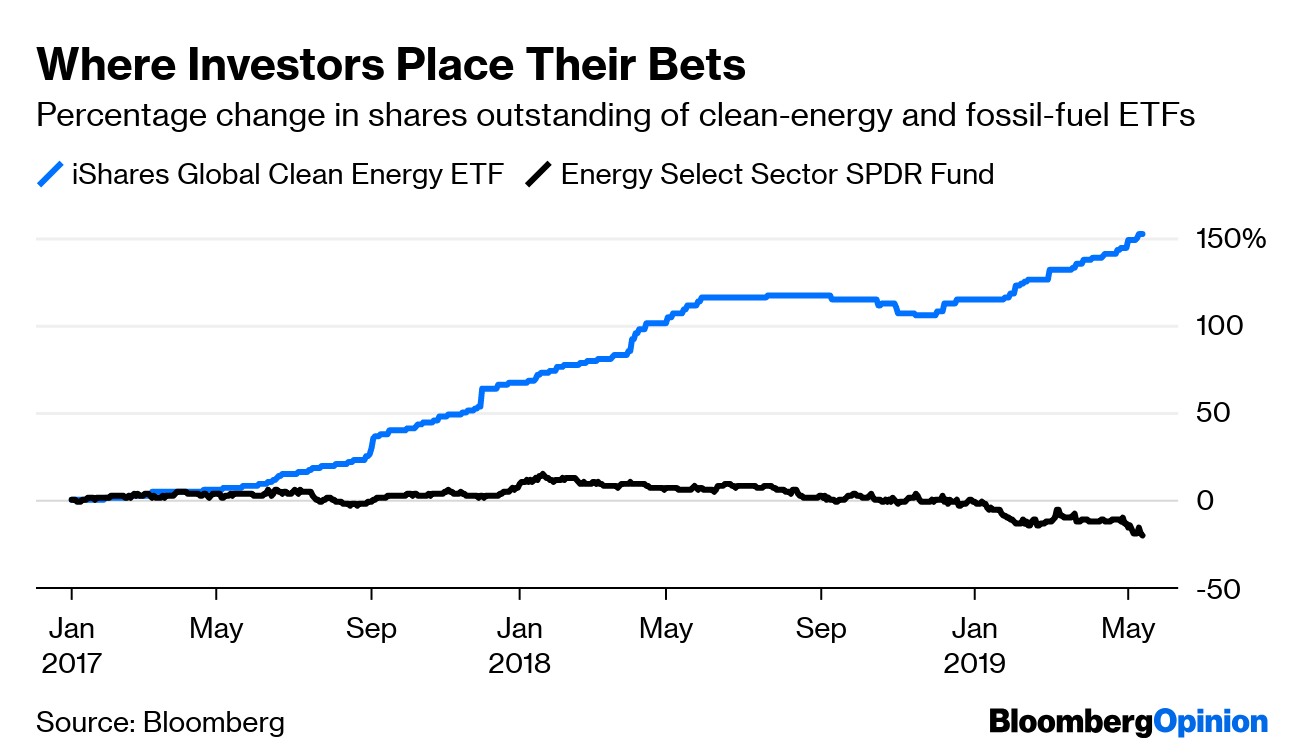

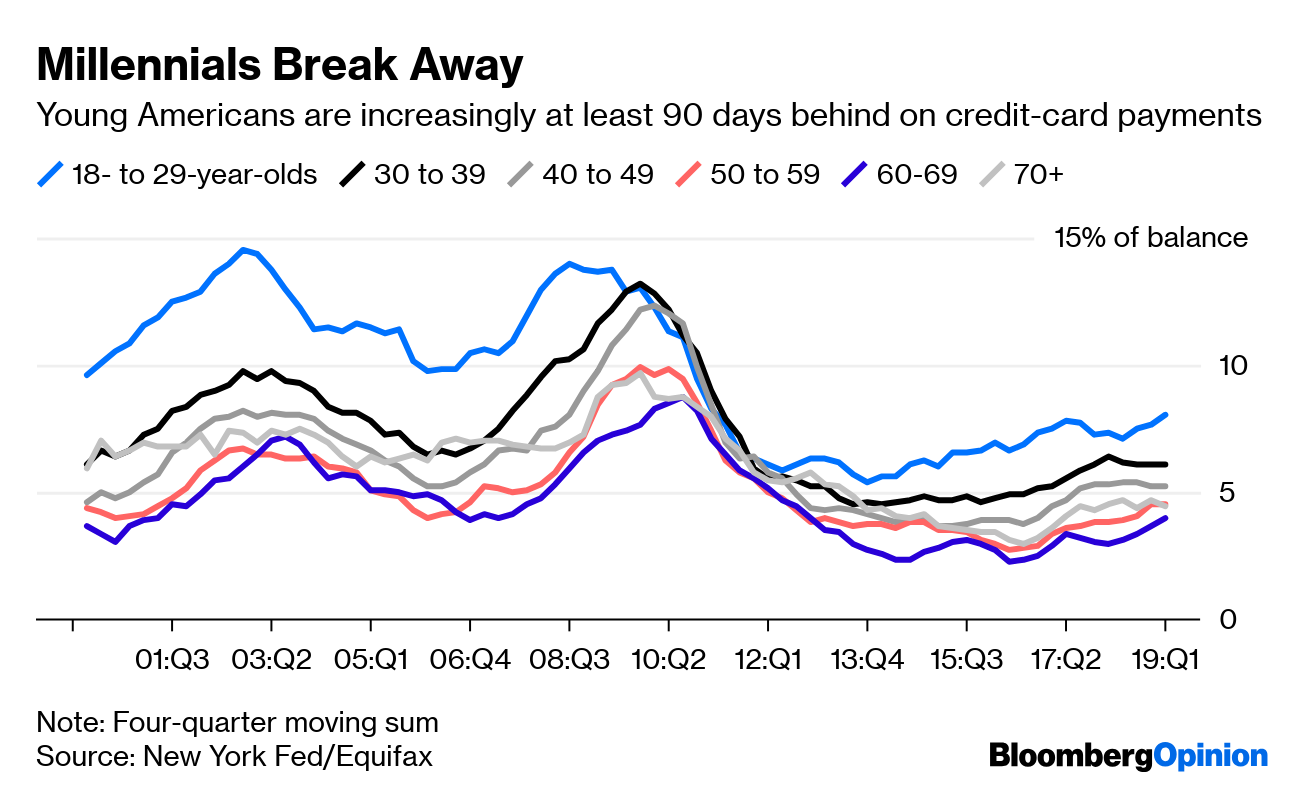

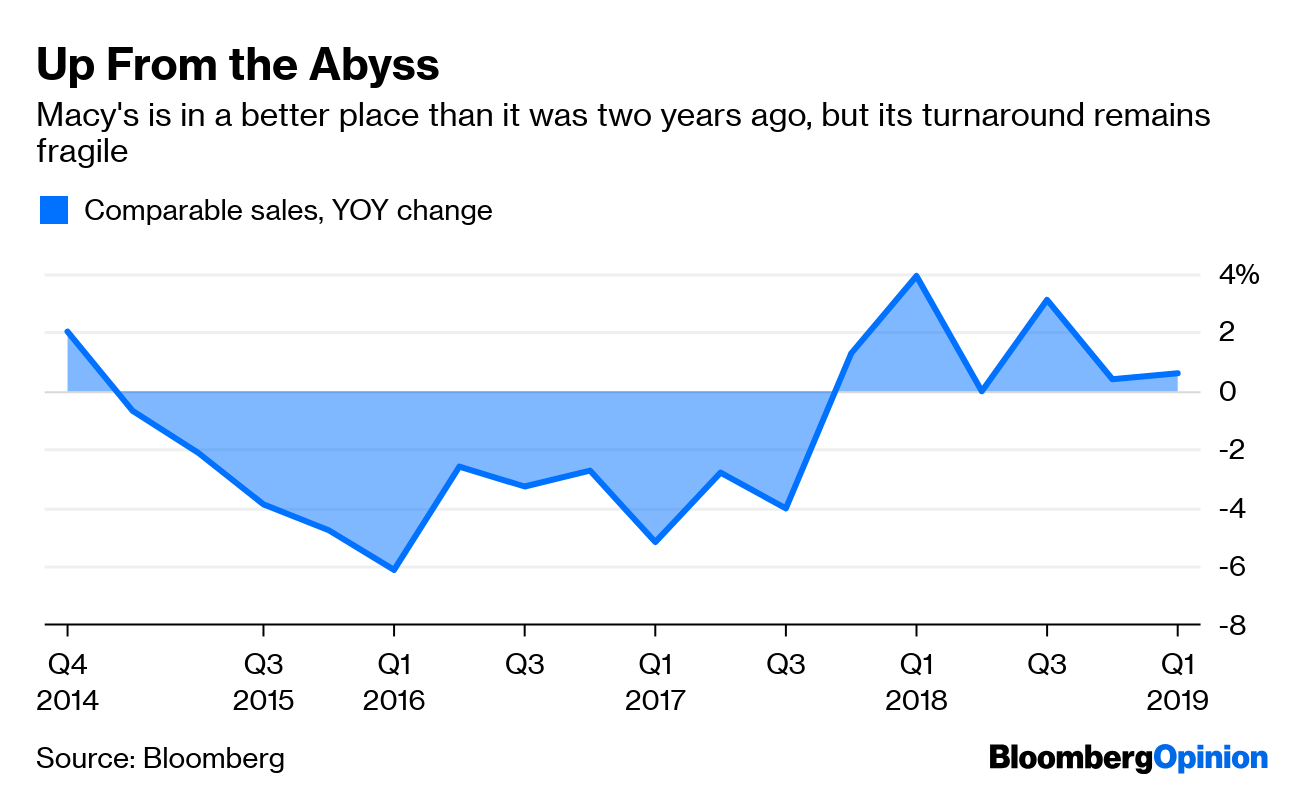

Today's Agenda  Fossil Fuels Fall From Favor With atmospheric carbon soaring and temperatures rising, the world needs leadership to curb emissions and fend off worst-case climate scenarios. President Donald Trump sure won't help, but another seemingly unlikely hero — capitalism — might come to the rescue. Capitalism helped get us into this mess by building a global economy around fossil fuels. But change seems to be coming, even if you must squint at the margins to see it. Take coal: Around the world, power plants that burn the stuff are still being built at a depressingly high rate. But coal-plant closures outpaced new approvals for the first time in a long time last year, notes David Fickling. And the pace of new oil and gas development has slowed dramatically, David writes, to a pace roughly on track to help the world avoid runaway climate change:  Electric vehicles are still just a sliver of the car industry and may stay that way for a while, as Anjani Trivedi wrote yesterday. But again the margins tell a more hopeful story, Liam Denning writes: EVs will soon account for all of the growth in global car sales, according to a Bloomberg NEF forecast:  That same BNEF report notes EVs are far more efficient than gas-burning engines, Liam writes, making them even more attractive to drivers and investors. Both those pieces look at marginal changes, but you really don't have to squint that hard to see investors already favoring clean energy over fossil fuels, Matthew Winkler writes. In the two-years-plus since Donald "Clean Coal" Trump became president on a Fossil Fuels First platform, fossil fuel stocks are down 12 percent, lagging the S&P 500. Green-energy stocks are up 50 percent in that same stretch, Matt writes. The gap in related ETFs is even more glaring:  Trump may never stop rolling coal, but global capital is going green without him. Trade War Timeout Trade-war hostilities cooled for a second day, at least in the stock market, which rallied again on reports Trump will delay a decision to impose big tariffs on auto imports. It's a good thing: Bloomberg's editorial board had warned these tariffs would hurt American consumers and economic growth in Europe and Japan, which should be allies in Trump's trade fight with China. The delay is a hopeful sign that things aren't totally out of control. But the disagreements are still deep between the U.S. and China, meaning markets will have to wait for Trump's meeting with Xi Jinping in late June for any resolution, writes Robert Burgess. Meanwhile, Trump's trade war has smothered any of the market's "animal spirits" inspired by Trump's tax cuts, notes Stephen Gandel. The bond market is similarly spooked, pricing in three Fed rate cuts this year. But Tim Duy argues the conflict and the market reaction to it would have to get far worse for this to happen. Of course, Trump would prefer three Fed rate cuts this year; he's pushed the central bank to match Chinese stimulus measures. But Dan Moss notes the Fed is already on the same page with China; global economic slowdowns caused by trade wars tend to do that. Further trade-war reading: Iran War Watch The U.S. State Department today told nonessential personnel to leave Iraq, citing tensions with Iran, adding to the growing sense the two nations are careening toward an armed confrontation. But Eli Lake suggests Iran is not itching for war: "Iran may be sinister, but it is not stupid." Trump, meanwhile, surely knows war would be a political disaster, Eli writes. He suggests Congress could help avoid it by getting on board Trump's pressure campaign. But there's still a very high risk of the U.S. and Iran stumbling into a dangerous military engagement, warns James Stavridis. To avoid this, we'll have to build a coalition, including Europe, to confront Iran by other means, James writes. Bonus war reading: We're not worrying enough about the risk of nuclear war. – Tyler Cowen Telltale Charts On a day when U.S. retail sales posted their second decline in three months, Brian Chappatta flags another reason to worry about the state of the American consumer: Young people are falling behind on credit-card payments.  Macy's Inc.'s turnaround isn't strong enough to handle a trade war, warns Sarah Halzack. The same goes for the rest of the shaky retail industry.  Further Reading Carlos Ghosn was right: Nissan Motor Co. needs new management. – Anjani Trivedi Supply-chain finance is a $100 billion industry nobody knows about. – Chris Bryant A biotech's stumble is another cautionary tale about gene therapy. – Max Nisen Nigeria is a fast-growing country with fast-growing poverty; to avoid catastrophe, it must quickly get over its aversion to free trade. – Noah Smith Another Trump-Putin meeting will probably accomplish nothing. – Leonid Bershidsky Not all suicidal people take that awful, final step. Why not? – Faye Flam ICYMI WeWork Cos. wants to be its own landlord. Tax write-offs don't fully explain Trump's massive real-estate losses. These are the highest-paying jobs for 2019 grads. Kickers Area brewery has van stolen, offers free-beer reward, gets van back in 42 minutes. (h/t Scott Kominers) Speed limits are usually too low. Scientists create first living organism with fully synthetic, redesigned DNA. Sample horror cinema's best soundtracks. Note: Please send soundtracks and complaints to Mark Gongloff at mgongloff1@bloomberg.net. New to Bloomberg Opinion Today? Sign up here and follow us on Twitter and Facebook. |

Post a Comment