| Inside: Don't look for a climate-risk discount in Florida. New eye in the sky watches CO2 polluters. Facebook governance under scrutiny. The Fed weighs in on inequality. Why doesn't everybody have an electric car?

— Eric Roston Sustainable Finance Florida's economy can be expected to "go to hell" as lenders begin to realize many properties financed with 30-year mortgages may be either literally or figuratively under water within that time, according to Spencer Glendon of the Woods Hole Research Center. A quick comparison of Miami Beach and Charlotte bonds suggests Florida investors may be ignoring "insane" climate risk. Either way, $1 trillion is on the line. Companies may face $1.2 trillion in losses globally if they delay addressing climate change during the next 15 years, according to a UN Environment Finance Initiative analysis. That's also a rough estimate of what the U.S. may need to spend a year by 2050 to help avoid untold higher costs from unchecked warming. The founders of Quadrature Capital said they will commit as much as $100 million a year to fight climate change, one of the most ambitious pledges in the industry. Germany may start playing catch-up with France, Ireland and other European peers in green-bond sales, according to a Federal Finance Agency spokeswoman. The country's farewell to coal-fired power plants could lead to blackouts in the 2020s if new plants aren't built to replace them. In Brief - S&P Global Ratings put on "CreditWatch" 240 municipal bonds backed by cash from the 1998 settlement with tobacco companies. Cigarette sales that fund the bonds have declined.

- BlackRock debuted its latest values-oriented ETF, with more than $800 million from Finland's largest pension insurance company.

- Calvert Research and Management has hired John K.S. Wilson to become its first vice president and director of corporate engagement, based in Washington, DC.

- The rise in sustainable investing has led the CFA Society of the U.K. to offer ESG accreditation to asset managers.

- Demand for corporate green bonds can be expected to rise after Poland's issuance was significantly oversubscribed in February, according to ING Bank Slaski.

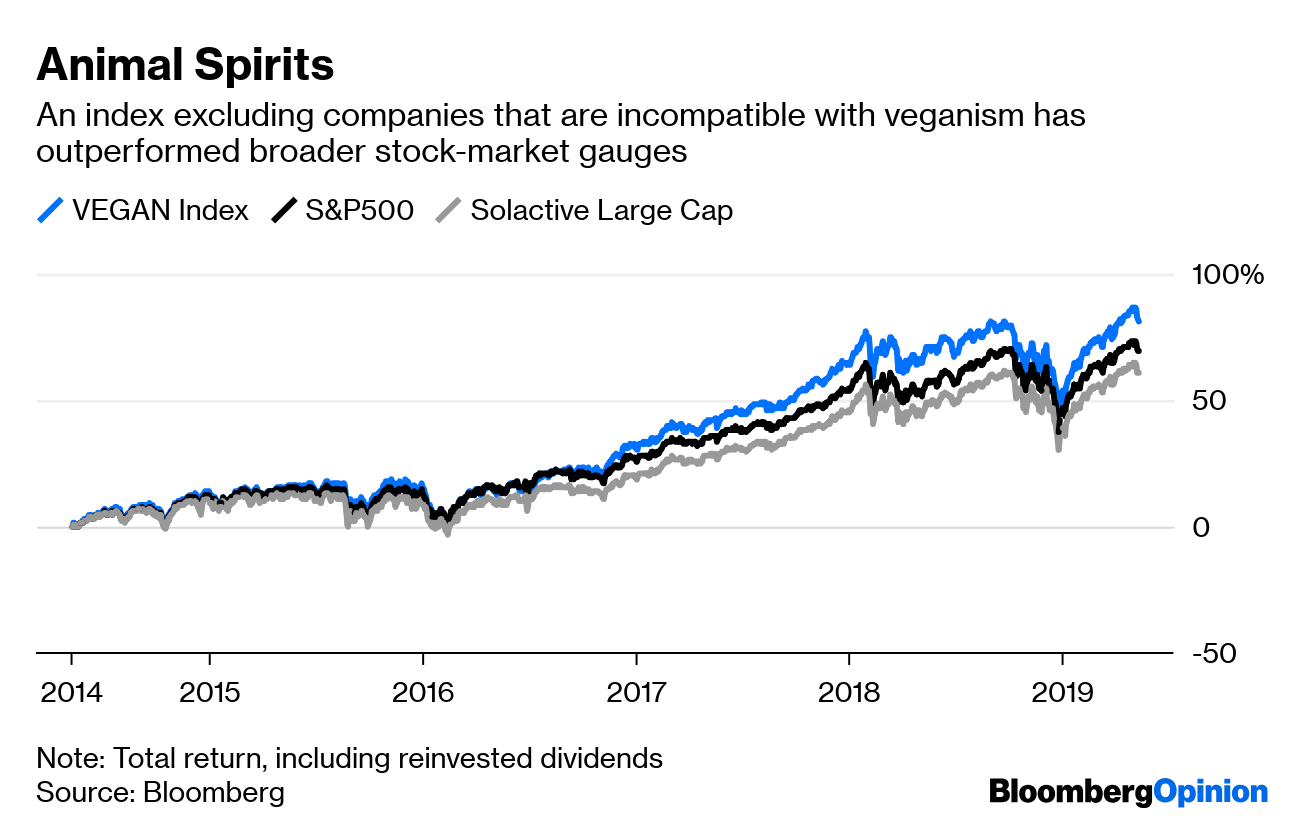

Environment  You're gonna need a bigger boat... to install new offshore wind turbines that are each almost as tall as New York City's Chrysler Building. Specialized ships are rare, $300 million beasts. The biggest turbine manufacturers, MHI Vestas Offshore Wind and General Electric, are increasing the size of their machines, and shipbuilders are slow to order up new vessels without knowing exactly how big they should make them. Utilities may be the only companies winning the U.S.-China trade war. Melting ice caps are a national security crisis, writes James Stavridis of Bloomberg Opinion. Pollution data will soon be available from every large power plant in the world, writes Nathaniel Bullard of Bloomberg Opinion. The nonprofit WattTime, thanks to $1.7 million from Google.org, will monitor emissions using satellite technology and crunch the data with help from artificial intelligence software. PG&E plans to cut Californians' power on windy days this summer to avoid sparking wildfires. San Francisco may offer to buy the local power grid owned by bankrupt PG&E Corp. The move would "eliminate the roadblocks, delays, and costs" the city has faced in working with the utility. Consol Energy and other major coal miners may be digging their way into a new supply glut. New York is killing off its last coal-fired power plants. Cloud Peak Energy, the latest bankrupt U.S. coal mining company, is likely to be sold off in pieces. Here's the real reason we're not driving electric cars, according to Anjani Trivedi of Bloomberg Opinion. Kering, owner of Gucci, Saint Laurent and other luxury brands, wants to improve the way its suppliers treat the animals used to make products from leather handbags to cashmere suits. Veganism is an idea whose time has come, thanks to trends in lifestyle, health and environmental awareness, according to Mark Gilbert of Bloomberg Opinion. It's showing up in market returns.  Social  The airline industry has a long history of sexualizing the role of flight attendants. It continues to this day, with a third of flight attendants saying they have experienced sexual harassment in the last year, according to a trade-group survey. The biggest tech companies for years have tried to out-fun each other with employee perks, from free meals to fitness classes. Missing from the offerings is what working parents need most, on-site child care, according to Kara Alaimo of Bloomberg Opinion. Facebook contractors will see raises by 2020 to help them live in pricey places like the San Francisco Bay area, New York, Washington and Seattle. Princeton is looking to break up the white male money monopoly. The biggest challenge with paid maternity leave is how to fund it, writes Daniel Flatley in Bloomberg Businessweek. Federal Reserve officials offered a damning take on rising inequality in America and the corrosive effects it can have on the economy. A journal study concluded that Coca-Cola had the right to look at findings of studies it funded and control their disclosure. The company denies that it has the right to prevent the release of research results and said that it does not condition funding on the outcome of research. Need female board members? Chile's government has a list for you. Governance Glass, Lewis & Co. weighed in on two high-profile shareholder resolutions in tech. The proxy adviser said Facebook shareholders should vote against lead director Susan Desmond-Hellmann for failing to oversee privacy problems and other risks dogging the company. Amazon should report to stakeholders its plans for coping with climate-related disruptions and reducing its reliance on fossil fuels. Volkswagen AG's Porsche brand agreed to pay $600 million last week to end a probe into rigged diesel engines. That result may not spare the German carmaker the ire of shareholders, who have been urged by Glass Lewis and Institutional Shareholder Services to vote against the company's leadership. BP shareholders face a resolution at next week's annual general meeting asking the company to demonstrate in a series of reports how its capital investments and overall strategy are compatible with the Paris climate accord. ExxonMobil opposes a shareholder proposal, submitted by the New York State Common Retirement Fund and the Church of England, that would separate the positions of CEO and chairman.  Note: Please send tips, suggestions and feedback to Emily Chasan at echasan1@bloomberg.net. New subscribers can sign up here. To see this on the web, click here. Read about Bloomberg LP's sustainability goals and achievements in the 2018 Impact Report. |

Post a Comment