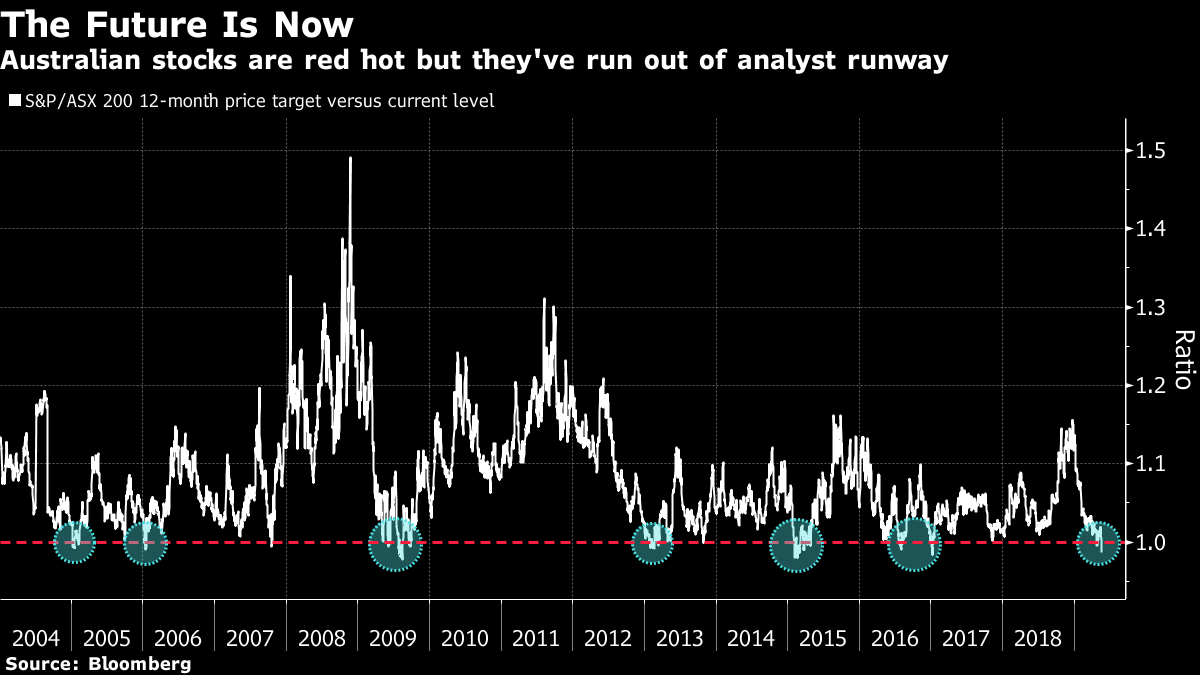

| China warns about "unwavering resolve" to fight U.S. "bullying." Asian equities are poised to follow U.S. stocks, which sank amid the Huawei fallout as tech shares got battered. And Ford is cutting back across the globe, eliminating 10% of its white-collar workforce. Here are some of the things people in markets are talking about today. China Hits Back China will retaliate after Trump blacklisted Huawei, Beijing's ambassador to the EU said. "This is wrong behavior, so there will be a necessary response," Zhang Ming told Bloomberg, describing the action as politically motivated. "The U.S. government is trying to bring down Huawei through administrative means." Meanwhile, Nike, Adidas and other footwear giants urged Trump to reconsider his tariffs on shoes made in China. Huawei-Fueled Selloff Asian stocks are set to decline Tuesday after U.S. tech stocks led a broad selloff. The fallout from the White House's moves against Huawei reverberated, hitting some of the biggest component makers and fueling more trade angst. The dollar fell against most major currencies, with the Aussie pacing gains. Treasuries declined, with 10-year yields up more than two basis points. Oil rose, while gold was flat. Ford Slashes Jobs The automaker will eliminate about 7,000 salaried jobs, or 10% of its global white-collar workforce. Carmakers are eliminating jobs as technological shifts, including the rise of self-driving vehicles, sweep the industry. The cuts, which will save about $600 million, will be completed by the end of August, and are far less drastic than the 25,000 that a Morgan Stanley analyst predicted last year. Australian Startup Snags Deal Mary Meeker, a Silicon Valley fixture thanks to her internet trends reports, chose an Australian online design platform for the first investment by her new venture capital firm. Meeker's Bond Capital, along with General Catalyst, joined a $70 million funding round for Canva, giving the startup a valuation of $2.5 billion. Uranium Enrichment Ramp Up Iran has quadrupled its enriched uranium production, the semi-official Tasnim news agency reported. The country hasn't gone beyond the agreed-upon limit set forth in its 2015 deal meant to prevent it from developing a nuclear bomb, but the move will only add to rising tensions in the Gulf. What we've been reading This is what's caught our eye over the last 24 hours. And finally, here's what David's interested in this morning Now that investors have had a full 24 hours to digest the shock election victory for Australia's conservative Coalition party, attention turns to Reserve Bank of Australia Governor Phil Lowe, who's scheduled to speak today. Can the RBA afford to be less cautious on the economy now that tax cuts loom nice and large for half the Australian population? The probability of a rate cut on June 4 has fallen to 55% as I write this from 70% last Friday, according to Bloomberg data. Perhaps that's simply a function of confidence screaming back into the stock market Monday. My colleague Michael Heath points out that the Aussie economy's underlying problems remain unaddressed. To his point, the probability of a cut — which would take the cash rate to a new record low — goes up to 90% by December. The debate over the short term is whether the central bank can wait until after June, possibly when those tax cuts are announced.  If Lowe still sounds dovish, it just might be what the stock market needs. Monday's rally took the index clear of strategists' current median 12-month price target. The rally may have just run out of runway, as the chart above (courtesy of my other colleagues Matthew Burgess and Divya Balji) indicates. Well, for you equity bulls, the good governor might be about to deliver truckloads of concrete. ETA is just after 1:00pm Sydney time. after 13:00 Sydney time. You can follow Bloomberg TV anchor David Ingles on Twitter at @DavidInglesTV. Even before Trump's trade war, China was the world's biggest story. It's reshaping the global economy — but its ascent hasn't come without major problems. Sign up to get Next China, a weekly dispatch on where the country stands now and is headed next. Before it's here, it's on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can't find anywhere else. Learn more. |

Post a Comment