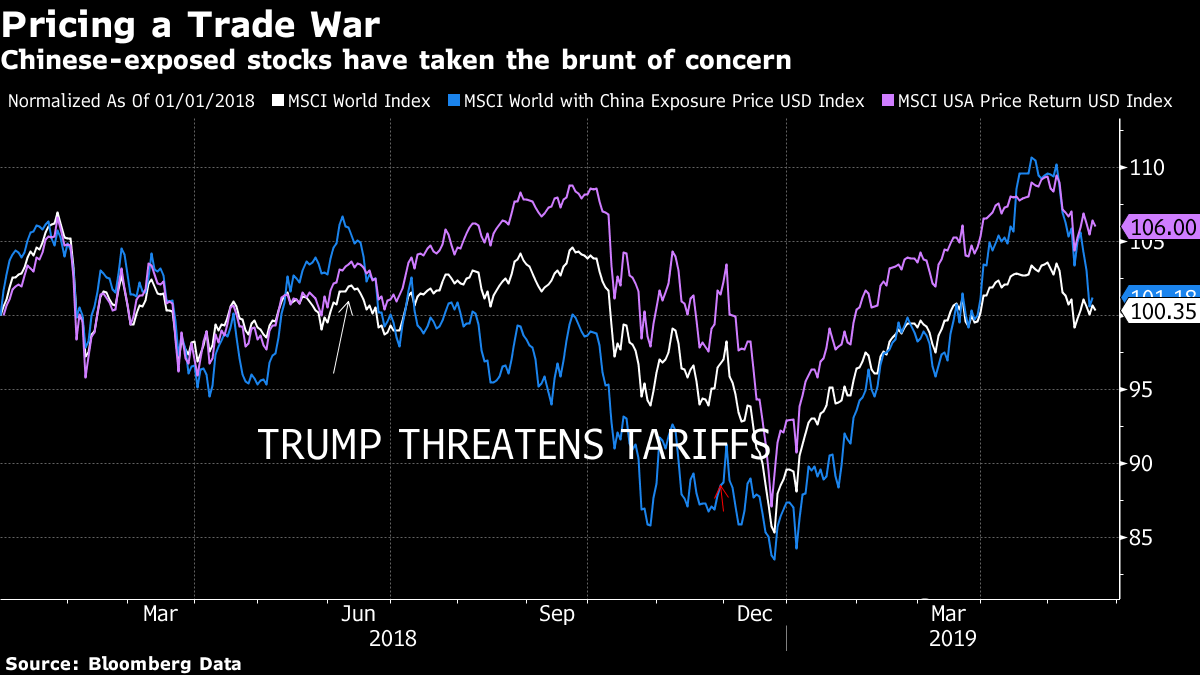

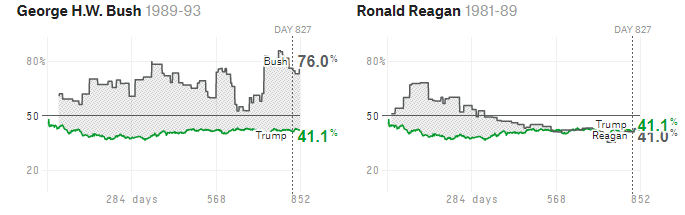

| With the conflict between the world's two biggest economies over trade and intellectual property intensifying, the markets still seem oddly insouciant. This is how global stocks and volatility have behaved over the last decade — and the market does not appear to be treating this as a major historical event:  If this conflagration implies a new type of cold war, a return to mercantilism or any of the other alarming scenarios that are making the rounds, the market is not yet attempting to handicap them. However, my Bloomberg News colleague Cameron Crise did demonstrate that on a bottom-up basis, the U.S. stock market is beginning to penalize companies with big sales in China:  For those who want chapter and verse on how he did this using the EQS function on the Bloomberg terminal, read on: I created a screen for U.S. firms with a market cap of at least $5 billion that derive at least 15% of their revenues from mainland China. The basket currently has 25 names in it, comprised largely of chip-makers and other go-go tech names. Naturally, these types of stocks tend to be pretty volatile at the best of times; however, even if we beta-weight the basket to match the volatility of the S&P 500, we find that there has been sharp underperformance of the benchmark in the second half of last year and again in recent weeks. It's true that our basket of exporters to China started under-performing before Donald Trump sent his fateful tweets earlier this month. But that performance lag coincides more or less exactly with the decline in Chinese equities in the second half of April. That sure looks like stocks are sensitive to China risks. I think he is right. Markets are not yet sensitive to the deepest risks of the moment, but they have been to any news emanating from China for a while. This includes both concerns over the Chinese economy and concerns over the effect that the tariffs could have on that economy. To look at it more crudely, an MSCI index of the 100 developed-world companies with the greatest exposure to China took a dive when Trump first threatened tariffs, surged ahead of both world and U.S. stocks after the November "truce" in Buenos Aires, and tanked again in the last month:  So take great care when buying anything linked to China. There may be a buying opportunity when and if a resolution is reached, but probably not before. And if you think some of the more bearish scenarios could come true, you have plenty of time to place the appropriate bets, as the market has barely started to price in such possibilities. Political uncertainty. There is plenty of it about, and not just in Europe. Next year's U.S. presidential election is wide open, and the president's level of popularity remains a political phenomenon like no other. By some measures, Trump's approval rating has barely deviated throughout his term in office. A majority of Americans have never approved of him, but the number who do approve has barely ever dipped below 40%. Thus, while he entered as the most unpopular new president on record, he has maintained support through thick and thin in a way none of his predecessors could manage. If you want to map this on to the likely outcome in next year's presidential election, good luck. FiveThirtyEight's fascinating historical coverage shows that at this stage in his presidency, Ronald Reagan was if anything less popular than Trump is now. He was re-elected in a landslide. Meanwhile, by far the most heavily approved post-war president at this stage in his first term was George H.W. Bush. He had just emerged victorious from the Gulf War. The following year, the voters denied him a second term.  For the markets, two layers of uncertainty lie ahead. The identity of the Democratic candidate is crucial. Some appear terrifying and others appear more palatable than Trump. And then the election itself is going to ratchet up the uncertainty further. Retailpocalypse, Part II. The retailpocalypse is back. Ahead of Black Friday in 2017, department store shares suffered a huge sell-off, and then staged a recovery. As this chart shows, the S&P 500 department-store sector is now back close to its low from Thanksgiving 2017. The sector's collapse compared to the S&P 500 as a whole has been staggering.  Looking at valuations, we see that this is more about sentiment, or about projections for the future, than about any news on revenue or earnings. This is how the price-to-sales ratio of the department-store sector has moved over time. Its recovery was driven almost exclusively by multiple expansion, and the same is true of its most recent sharp descent:  Naturally, Amazon.com has much to do with this. It is steadily putting brick-and-mortar retailers out of business. But it is not harming the total market value of other retailers as much as many think. I built the following chart using the AGG function on the Bloomberg terminal. The white line shows the market cap of the S&P 500 retailing sector over time excluding Amazon.com. The blue line shows Amazon.com's market cap.  It is not that great a surprise that the market now thinks Amazon.com is more valuable than all the other large-cap retailers in the U.S. combined. But it is not all at the expense of other retailers. Their market cap has risen at an acceptable 6.3% per year over the last five years, while Amazon.com's has grown at roughly 45%. Even after Amazon has gobbled its share, there has been some value left for other retailers. But it seems the market once again doubts whether there is any more value in department stores. The Ides of May. This is the month of May in more ways than one. It is hard to see how U.K. Prime Minister Theresa May can last out the month without offering her resignation. There is no chance that her latest attempt at a Brexit compromise will become law. With the resignation of Andrea Leadsom, her final opponent in the leadership contest that followed the referendum three years ago, May appears doomed. The latest ructions were enough to give sterling its 13th successive losing day, which is a record. The next big question concerns May's replacement. That decision should help determine the strategy that the U.K. will deploy. May's resignation and departure from office are unlikely to have much of an impact, at this point. Which is a shame. The last time the Conservative party in Britain decided to oust a ruling female prime minister, it seemed epic. And the resignation speech that sealed her fate, amazingly in retrospect, by her former foreign secretary and chancellor Sir Geoffrey How, came from a minister angry at the way Britain risked being isolated from the rest of Europe. He implored the country "not to retreat into a ghetto of sentimentality about our past." How times change.

Like Bloomberg's Points of Return? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment