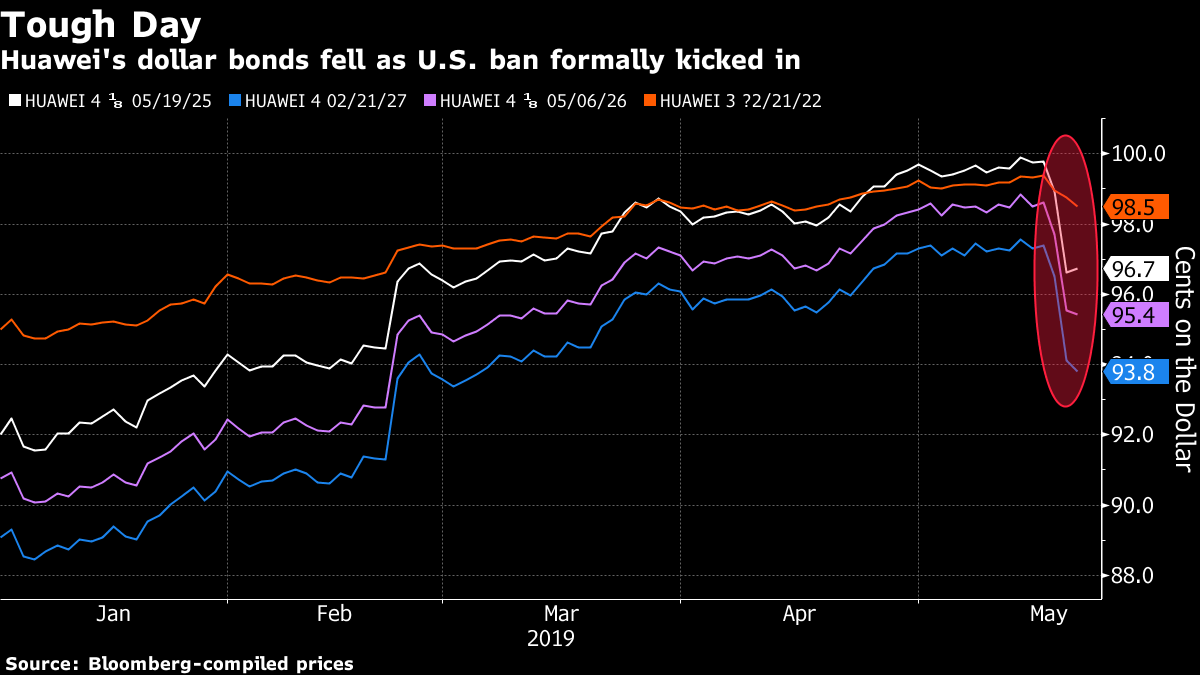

The isolation of Huawei begins, oil jumps on continued OPEC cuts, and incumbents win in India and Australia. Tech stocks fallPresident Donald Trump's moves against Huawei Technologies Co. are being felt in the tech sector this morning after chipmakers including Intel Corp. and Qualcomm Inc. are said to have told employees they will not supply the Chinese company until further notice. Reuters reported that Alphabet Inc.'s Google will no longer transfer hardware and software products to the phonemaker. Tech hardware companies in Asia and Europe fell. The longer-term fallout could mean that China develops an independent infrastructure, kicking off a tech cold war. Oil bounceThere were signs of dissent over the weekend among OPEC and its allies with respect to production strategy. While Saudi Arabia and other key producers signaled their intention to keep output curbs in place until the end of the year, Russian Energy Minister Alexander Novak talked about wanting to wait and see before making a final decision next month. A barrel of West Texas Crude for June delivery was trading at $63.08 by 5:40 a.m. and the outlook for extended cuts and continued Trump pressure on Iran lifted the market. ElectionsIndian stocks rallied the most in three years while the rupee and sovereign bonds climbed after exit polls in the world's biggest election signaled that Prime Minister Narendra Modi's ruling coalition is poised to retain power. Vote counting begins on Thursday, with an official result expected on the same day. Also in the region, Australia's center-right government surprised analysts by securing enough seats to maintain a majority in parliament at the weekend's election. Markets slipOvernight, the MSCI Asia Pacific Index climbed 0.4% while Japan's Topix index closed less than 0.1% higher as positive GDP data helped shield the gauge from the worst of the Huawei fallout. In Europe, the Stoxx 600 Index was 0.5% lower by 5:50 a.m. with tech and chemical shares leading the decline. S&P 500 futures pointed to a loss at the open, the 10-year Treasury yield was at 2.403% and gold was lower. Fed speakersFederal Reserve Chair Jerome Powell will speak at 7:00 p.m. this evening on risks to the financial system. Fed Vice Chair Richard Clarida and New York Fed President John Williams take part in a "Fed listens" event in New York earlier in the day. Over the weekend, Federal Reserve Bank of Dallas President Robert Kaplan said that trade tensions might have a chilling effect on the U.S. and global economy. The minutes from the most recent FOMC meeting are published on Wednesday. What we've been readingThis is what's caught our eye over the weekend. Want the lowdown on European markets? Get the European edition of Five Things in your inbox before the open, every day. And finally, here's what Joe's interested in this morningDespite the market's recent volatility, U.S. equities remain very close to all-time highs. As of right now, S&P futures are just 3.5% below their record. Meanwhile, observers of the U.S.-China relationship have become extremely dire in their rhetoric. President Trump's move against Huawei is already suffocating the company, and analysts see major spillover effects from it, on both geopolitical and economic realms. "The macro and micro implications are immense," said Jefferies strategist Sean Darby. It seems like there are basically three main possibilities here. One is that the markets are wrongly ignoring how serious the situation has gotten. Another is that analysts are over-estimating the severity of the situation. And then finally there's the scenario that both the strategists and the market are right: In other words that the China situation is bad, but that it's not really that bad for the markets, even under the extreme scenario. There may be some validity to that last point. Arguably trade isn't that crucial to the U.S. economy (and therefore corporate profits). However if the trade war creates an air of uncertainty, and puts a chill on investment and spending, a relatively minor dollar amount could become amplified as corporate and investor angst cascades through the stock market to the real economy. On that note, it should be an interesting week ahead.  Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. Before it's here, it's on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can't find anywhere else. Learn more. |

Post a Comment