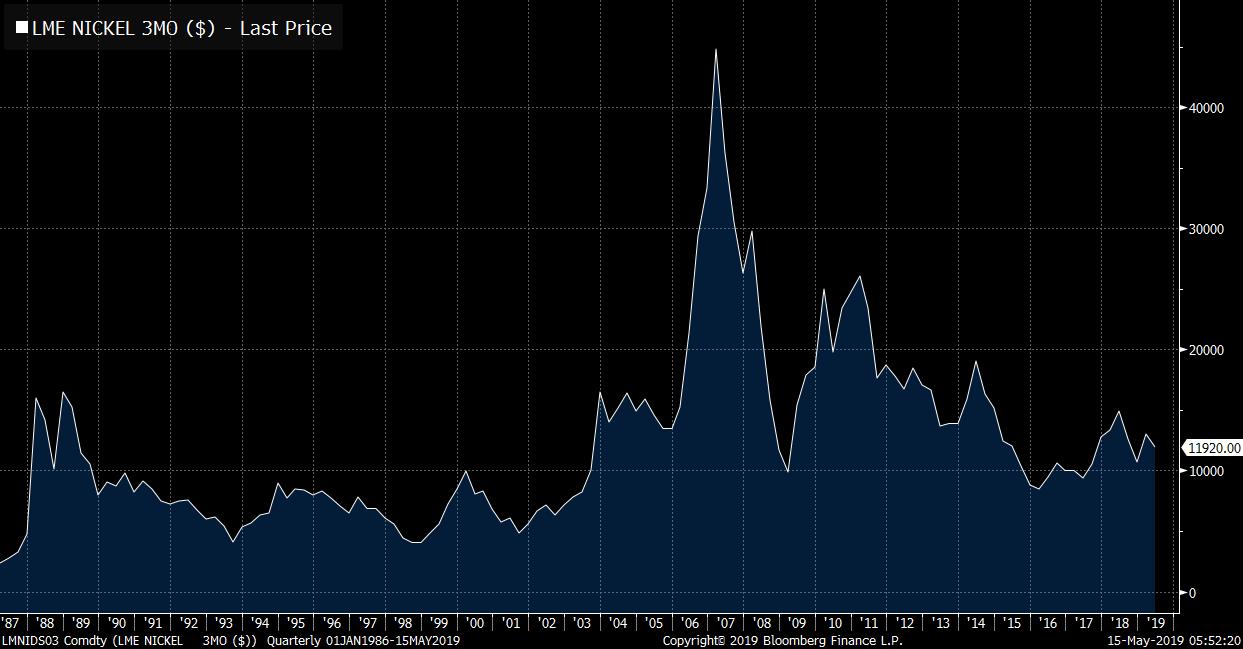

Bad news is good news for China stocks, IEA warns on oil demand, and Brexit is back. Losing steamData published overnight showed that China's growth eased in April, with industrial output, retail sales and investment all slowing more than economists had forecast. With the ruling Communist Party's promise to double the size of the nation's economy between 2010 and 2020 already under pressure from U.S. tariffs, investors see the latest data as more reason for policymakers to add stimulus. The Shanghai Composite Index ended the session 1.9% higher, while the CSI 300 jumped 2.3%. President Donald Trump seems to be hoping that the Federal Reserve will also get on the stimulus bandwagon, tweeting yesterday that it would be " game over" if the bank matched China moves. Crude outlookThe oil market, torn between tensions in the Middle East risking supply on the one hand and trade war hurting demand on the other, has been choppy this week. This morning's International Energy Agency report which cut its demand growth forecast has helped give some direction. That, coupled with an industry report that signaled a jump in U.S. inventories, means that a barrel of West Texas Crude for June delivery dropped as much as 1.2% in trading this morning. Brexit voteRemember all the excitement earlier this year as British Prime Minister Theresa May repeatedly put her Brexit deal to Parliament and repeatedly was defeated? Well, it seems she is going to have another go next month. The move comes after talks with the main opposition Labour Party have yielded nothing. Getting the vote through now assumes a change of heart from some members of Parliament who helped defeat it. The pound remained mostly unmoved by the development, trading just above $1.29 this morning. Markets mixedOvernight, the MSCI Asia Pacific Index climbed 0.4% while Japan's Topix index closed 0.6% higher as equities in the region were bolstered by bets on more Chinese stimulus. In Europe, the Stoxx 600 Index was 0.4% lower at 5:50 a.m. Eastern Time with carmakers among the biggest drags on the gauge. S&P 500 futures pointed to some red at the open, the 10-year Treasury yield was at 2.380% and gold gained. Retail salesEconomists are forecasting a considerable slowdown in U.S. retail sales in April, with predictions for 0.2% growth, well below March's 1.6%. The data is published at 8:30 a.m., with Empire Manufacturing at the same time. Industrial production numbers at 9:15 a.m. are also expected to be soft, with little change expected. Fed Vice Chair for Supervision Randal Quarles testifies before the Senate Banking Committee today and Richmond Fed President Thomas Barkin speaks later in New York. Hedge funds must make their first-quarter 13F filings showing their investments by the end of the day. What we've been readingThis is what's caught our eye over the last 24 hours. Want the lowdown on European markets? Get the European edition of Five Things in your inbox before the open, every day. And finally, here's what Joe's interested in this morningHedge funder Kyle Bass revealed yesterday on Bloomberg TV that he had exited his short bet on the Chinese yuan. Shuli Ren at Bloomberg Opinion has a great piece on why the move made logical sense, even if it seems like this is a moment of vulnerability for China. That said, what I'm more curious about is Bass' collection of nickels. It was reported years ago that he had amassed $1 million worth of nickels on the belief that the value of their metallic content might rise substantially above five cents. The details of the story aren't totally clear and it has legal complications, but it's fun to think about how this trade really works. Fortunately, the brilliant blogger JP Koning wrote a piece about this a few days ago. As he explains, there's a beautiful asymmetry to the trade. If commodity prices surge, you capture the upside. If commodity prices plunge, well then, a nickel will always be worth five cents, so your losses are capped. There's really just one problem besides the legality: you have to store and insure the nickels. Koning runs through the math, and ultimately concludes that in eight years, thanks to the various costs of nickel storage plus the loss of interest income (which he could have earned by holding money in a bank), he would have effectively lost 7% of his money keeping it all in nickels. The whole post is a really fun exercise, and a good reminder that while people love to bash the idea of central banks cutting rates into negative territory, physical commodities (including gold) have an implicit negative interest rate (the storage costs). If you want to save money and port it into the future, there's no easy way to do it; you have to pay up.  Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. Before it's here, it's on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can't find anywhere else. Learn more. |

Post a Comment