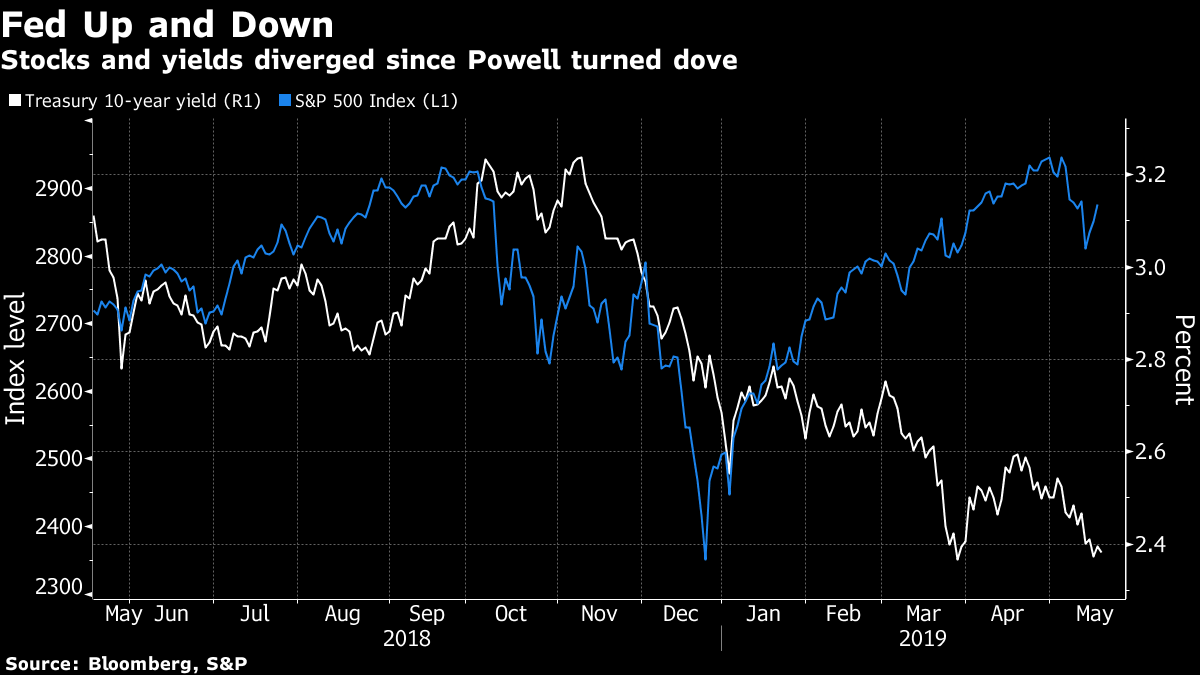

| Welcome to your morning markets update, delivered every weekday before the European open. Good morning. A familiar face is the front-runner to replace the U.K. leader, China may be losing interest in trade talks, the food-delivery business is getting shaken up, and a luxury watch maker and budget airline are reporting earnings today. Here's what's moving markets. BoJo Backed? A trimmed-down Boris Johnson, the Brexit-backing former U.K. foreign secretary and mayor of London, is favorite to replace Theresa May as prime minister, according to bookies. May is set to finally give in to calls to announce a time-frame for her departure, while trying one last time to get her divorce deal voted through the House of Commons next month. Oh, and if you hadn't noticed, Nigel Farage is attempting a comeback, and no one knows what to do do about it. The pound is on course for its worst week since October. No Interest Futures on the U.S. S&P 500 Index hit were at a session low as European traders headed to their desks this morning, following China's state media reporting that the government may have no interest in continuing trade talks with the U.S. for now. Technology shares were weak in Asia as suppliers Huawei Technologies Co., Ltd. continued to tumble. Earnings reports from U.S. chipmakers Applied Materials Inc. and NVIDIA Corp. provided a positive note for the global sector, with both large-cap names trading higher in the post-market. Amazon Delivers The cutthroat food-delivery business is getting shaken up today with news that Amazon.com Inc. is leading a $575 million investment in Deliveroo, handing the startup the capital it needs to expand across new markets. Keep an eye on shares of Just Eat and Domino's Pizza in the U.K., as well as European peers Delivery Hero and Takeway.com. Amazon has been linked with a bid for Deliveroo in the past, as has car-sharing group Uber, which runs the Uber Eats service. A report of Uber's interest in September sent shares in Just Eat and Delivery Hero lower. Richemont, EasyJet Eyed Company earnings are lighter today, although posh watch-maker Richemont is out with profit that's a bit below expectations. Luxury goods is among the sectors most susceptible to trade war developments. EasyJet plc is also due to update, with shares of the budget airline at a two-year low despite the summer Brexit reprieve amid concern over rising oil prices and overcapacity in Europe. Coming up... A final reading of euro-zone inflation is expected to confirm an acceleration in April, while the currency bloc's finance ministers are meeting in Brussels today to discuss a budget plan as Italy attempts to ease concerns over its fiscal strategy. What We've Been Reading This is what's caught our eye over the past 24 hours. And finally, here's what Garfield Reynolds is interested in this morning The trade war's impact on U.S. assets has heightened the puzzling divergence between shares and yields. While equities have swooned, they haven't dropped too far. Meanwhile Treasury yields keep grinding down and are paying little heed to those times when stocks rebound on earnings or positive trade noises from the White House. What looks like the key reason for this divergence is the Federal Reserve's dovish shift back in January. Last year when equities and yields tumbled on global growth concerns the Fed was sticking with plans to hike rates and trim its balance sheet. That exacerbated the potential severity of any slowdown by signaling a lack of policy support. Now, trade war angst adds to the case for the Fed to stay on hold, or even cut. That matches well with a slow descent for yields and buoyancy for stocks. A trade war resolution could well see equities surge even as yields stay lower for longer on the economic damage already done. The question is whether a full-blown trade conflict would send both sliding again as they did at the end of 2018.  Garfield Reynolds is the Asia Team Leader for Bloomberg's Markets Live blog. Bloomberg Terminal users can follow him there at MLIV <GO> Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. Before it's here, it's on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can't find anywhere else. Learn more. |

Post a Comment