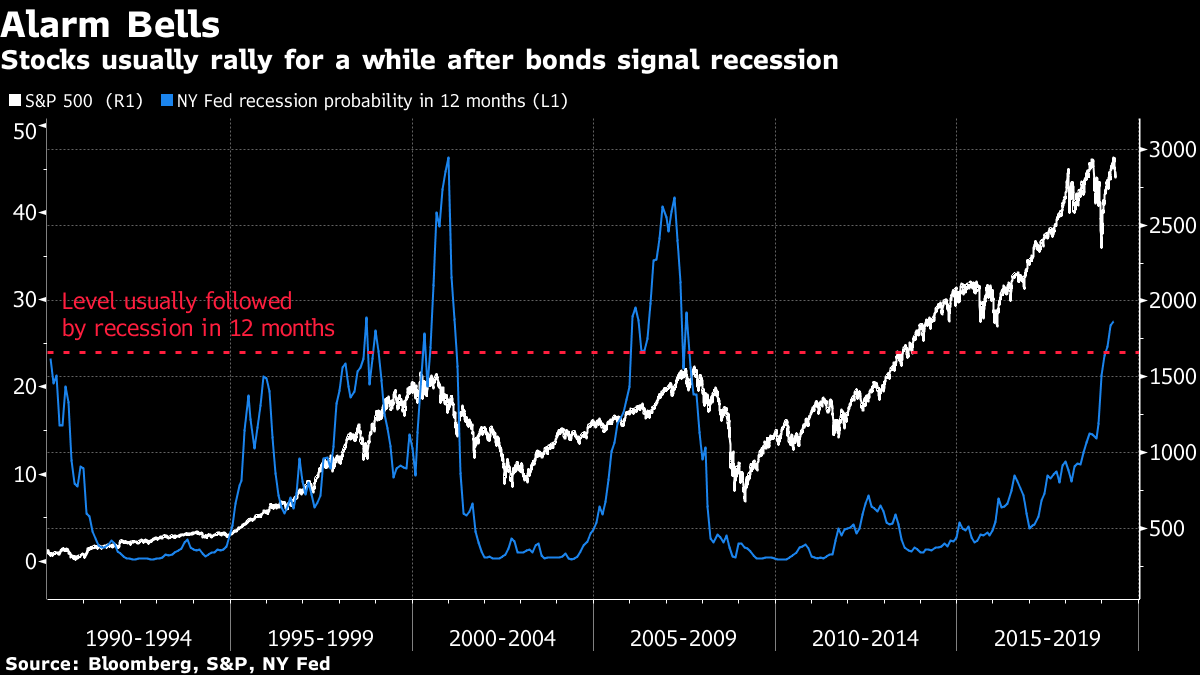

| Welcome to your morning markets update, delivered every weekday before the European open. Good morning. A Chinese telecom-equipment giant is the new focus of the U.S.-China trade war, Theresa May is still battling to stay in Downing Street, Italy risks riling the European Union over its fiscal policies again and everyone's favorite maker of luxury trenchcoats reports earnings. Here's what's moving markets. Huawei Targeted With U.S.-China trade tensions near a peak, President Donald Trump risked aggravating Beijing further by signing an order that's expected to restrict Huawei and fellow Chinese phone-gear company ZTE Corp. from selling equipment in America. The news was followed by the U.S. putting Huawei on a blacklist that could forbid it from doing business with U.S. companies. Here's a recap of how one of China's most global companies ended up in the cross-hairs of the U.S. and its allies. It seems like a long time ago now, but stock markets shot higher late in the European day yesterday on signs the Trump administration was working toward easing tensions with trade partners – specifically, a Bloomberg News report that Trump would postpone by up to six months a decision on car tariffs that was due by Saturday. Expect more abrupt swings like that, in both directions. Mixed Feelings Stocks fell in Tokyo and Seoul along with U.S. futures following the action against Huawei, although indexes in Hong Kong and China were modestly higher. Nasdaq futures took some support from earnings from one of its biggest constituents, Cisco Systems Inc., as the company's profit forecast signaled that corporations continue to spend on their computer networks despite ongoing trade worries. However, the most excitement in markets overnight came from Down Under as the Australian dollar dropped in reaction to an unexpected rise in unemployment. Could Labour Abstain? Theresa May flies back to London this morning from Paris to once again face colleagues seeking to oust her. She's promised to bring her Brexit deal back to Parliament at the start of June, and while the Labour party said Wednesday that it wouldn't be able to support the bill in its current form, it refused to say whether it would abstain from voting. That might leave May hopeful that that the opposition party will let it go through. With all of this generating as much uncertainty as ever, the pound is falling out of favor with money managers. Spend Everything Italy is up to its old tricks again: Milan's main stock market index slipped Wednesday after Deputy Premier Matteo Salvini said the country will "spend everything that we have to spend" in order to slash unemployment, spurring fresh concerns that it could break EU rules on deficits and government debt. With Italy's fractious coalition squabbling more than ever, President Sergio Mattarella is increasingly worried about how Italy will produce a budget for next year, a senior state official said. Coming up... A reasonably busy day of earnings awaits with luxury goods maker Burberry Group Plc and newly-listed eye-care firm Alcon Inc. among those providing updates in Europe. In the U.S., numbers from the world's largest retailer, Walmart Inc., are due later and we'll also get an update from New York-listed Manchester United Plc, whose team's recent on-field woes meant it missed out on a lucrative Champions League spot for next season. What We've Been Reading This is what's caught our eye over the past 24 hours. And finally, here's what Garfield Reynolds is interested in this morning Equity investors may be asking themselves again whether the global bull market is on its last legs. U.S. bonds are again flashing recession-warning signals as Wednesday's data releases unveiled in technicolor awfulness the harm done to the world's two biggest economies by their year-long trade spat. Industrial output and retail sales tanked in the U.S. and China, and the surprise indexes for both are negative. That punctures the narrative that was so prevalent amid the first quarter of 2019's stocks melt up that the global growth slowdown had stabilized and that the green shoots of recovery would be nurtured by China stimulus and a newly-patient Fed eschewing rate hikes. The inverted curve is signaling doubts that policy makers have the tools they need to revive growth, but that's not a message equities are taking to heart. That means there's an excellent chance the same playbook from many a previous recession will play out. Stocks will keep rallying for a while longer before crashing as the economic slump becomes imminent. Last time round equities only peaked after the recession indicator dropped back down.  Garfield Reynolds is the Asia Team Leader for Bloomberg's

Markets Live blog. Bloomberg Terminal users can follow him

there at MLIV <GO> Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. Before it's here, it's on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can't find anywhere else. Learn more. |

Post a Comment