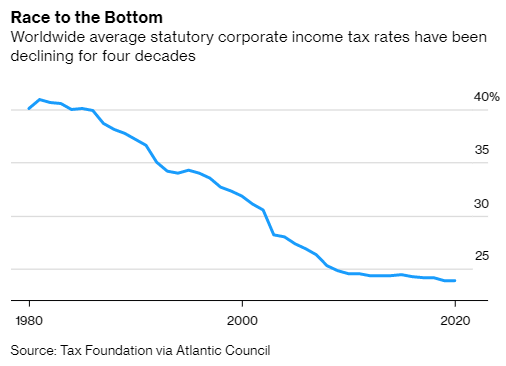

| Hello. Today we look at the struggle for a new global corporate tax agreement, the costly gender gap holding back Australia's economy and whether Treasuries are losing their haven status. How do you get a deal on corporate taxes between 140 countries? Not easily. There's one week to go before a meeting that's aimed at finding agreement on a global minimum rate and a formula for sharing the revenues from tech giants like Facebook and Google. Harmonizing tax policies is possibly even more difficult than working out international trade accords — and Thursday's news that World Trade Organization Director-General Ngozi Okonjo-Iweala has privately floated resigning out of frustration showcases how meaningful that comparison is. The Inclusive Framework — the 140 countries involved in the tax talks – reached a preliminary agreement back in July among almost all its members. But it left a few key details to be decided, before the Group of 20 major developed and emerging nations signs off at a leaders' summit in Rome at the end of October. Among the niggles to be worked out, William Horobin and Isabel Gottlieb report here: - Agreeing on a formula to reallocate some tax revenue from where multinationals book profits to where they have sales.

- Countries must also still determine where the reallocated profits will come from. The rules could draw relatively more revenue from countries like the U.S., or from countries like Ireland and Singapore, which serve as headquarters for many multinationals' activities outside the U.S.

- Final agreement on the precise minimum corporate tax rate. The July accord called for "at least 15%."

- Carve-outs that will be shielded from the minimum tax rate.

- Coordinating to halt new, unilateral digital taxes and unwinding existing ones.

Looming over the talks is the question of whether the U.S. will be able to implement any deal. The formula for reallocating tax revenue — the so-called Pillar One of the talks — will require treaty ratification, which needs a two-thirds vote in the U.S. Senate, according to the top Republican on the Senate Banking Committee. While the Biden administration disputes that position, it hardly instills confidence in other countries. The stakes are high. The Organization for Economic Cooperation and Development, which is attempting to broker a deal, has warned failure would lead to a cocktail of unilateral digital levies and trade and tax disputes that could strip more than 1% off global economic output annually. —Chris Anstey It's the Australian Paradox. In terms of women's educational attainment, no country does better, according to the World Economic Forum. But when it comes to women's participation in the economy, this nation of 26 million ranks 70th on the WEF's list — behind Kazakhstan, Serbia and Zimbabwe. As recently as 2006 it sat at no. 12. The price of inaction — nationally, as well as for individuals — is significant: Sexual harassment is costing the economy an estimated $2.75 billion a year. The numbers from corporate Australia over the past year are equally sobering. Only one of the 23 new chief executive officers appointed to a major company was a woman. Among the top 200 businesses, the number of woman CEOs has fallen to 10, down from 14 in 2018. Bridging the difference between male and female employment rates alone could provide an 8% boost — $114 billion a year — to the Australian economy, according to 2019 estimates from Goldman Sachs.  | - Energy scramble | China's central government officials ordered the country's top state-owned energy companies — from coal to electricity and oil — to secure supplies for this winter at all costs.

- Factory rebound | Asia's manufacturing activity rebounded in September after Covid-19's grip on several countries loosened. But European manufacturers reported increasing strains from supply-chain squeezes — a contributing factor, along with surging energy prices, in pushing inflation there to a 13-year high.

- Infrastructure vote | U.S. House Speaker Nancy Pelosi plans to try again Friday for a vote on bipartisan infrastructure legislation that's been held up by a battle between moderate and progressive Democrats over President Joe Biden's economic agenda.

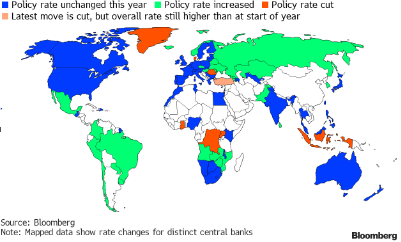

- Raising rates | Mexico and Colombia boosted interest rates Thursday, with further increases likely this year as all the major economies in Latin America struggle to contain surging prices.

- Egypt's dilemma | The country's reliance on foreign inflows has placed it among the emerging markets vulnerable to an investor exodus — but it's better equipped than many to weather any volatility.

- In the family | Former Olympics minister Shunichi Suzuki is likely to be named Japan's next finance minister, according to local media reports, replacing Taro Aso, who has held the post longer than anyone else in the country's modern era. Suzuki is Aso's brother-in-law through his sister.

- Digital doubts | Digital currencies backed by central banks might become a preferred safe haven during a future financial crisis, potentially aggravating runs at commercial lenders, according to a report.

U.S. Treasuries, traditionally a safe haven in rocky times for the global economy, appear to be losing favor while Germany and Japan are still hot picks, according to an analysis by the Institute of International Finance. The Washington-based IIF said in a report Thursday that the U.S. was one of few countries to see an outflow of foreign investment in government bonds in 2020, alongside Italy and Greece. "Our data are far from definitive," the IIF analysts, led by Managing Director Robin Brooks, said in the report. "But because a change in how markets see Treasuries would have far-reaching consequences, the U.S. macro picture deserves far greater consideration in the debate around what happened to U.S. Treasuries in 2020." Read more reactions on Twitter - Click here for more economic stories

- Tune into the Stephanomics podcast

- Subscribe here for our daily Supply Lines newsletter, here for our weekly Beyond Brexit newsletter

- Follow us @economics

The fourth annual Bloomberg New Economy Forum will convene the world's most influential leaders in Singapore on Nov. 16-19 to mobilize behind the effort to build a sustainable and inclusive global economy. Learn more here. |

Post a Comment