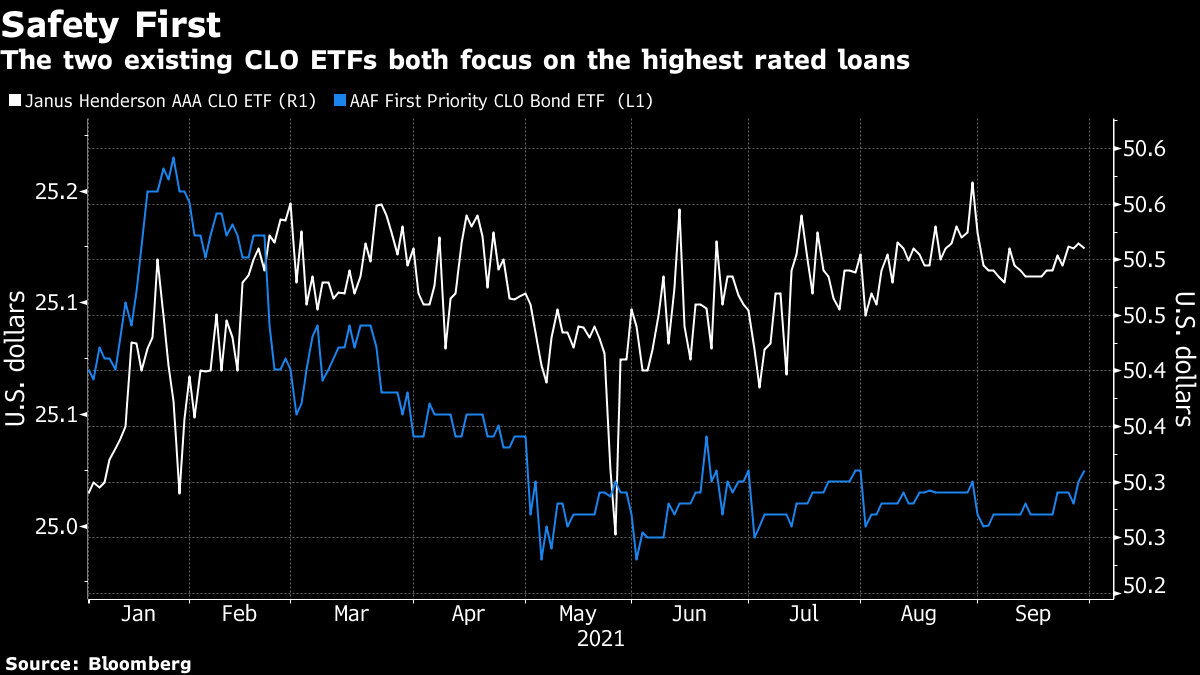

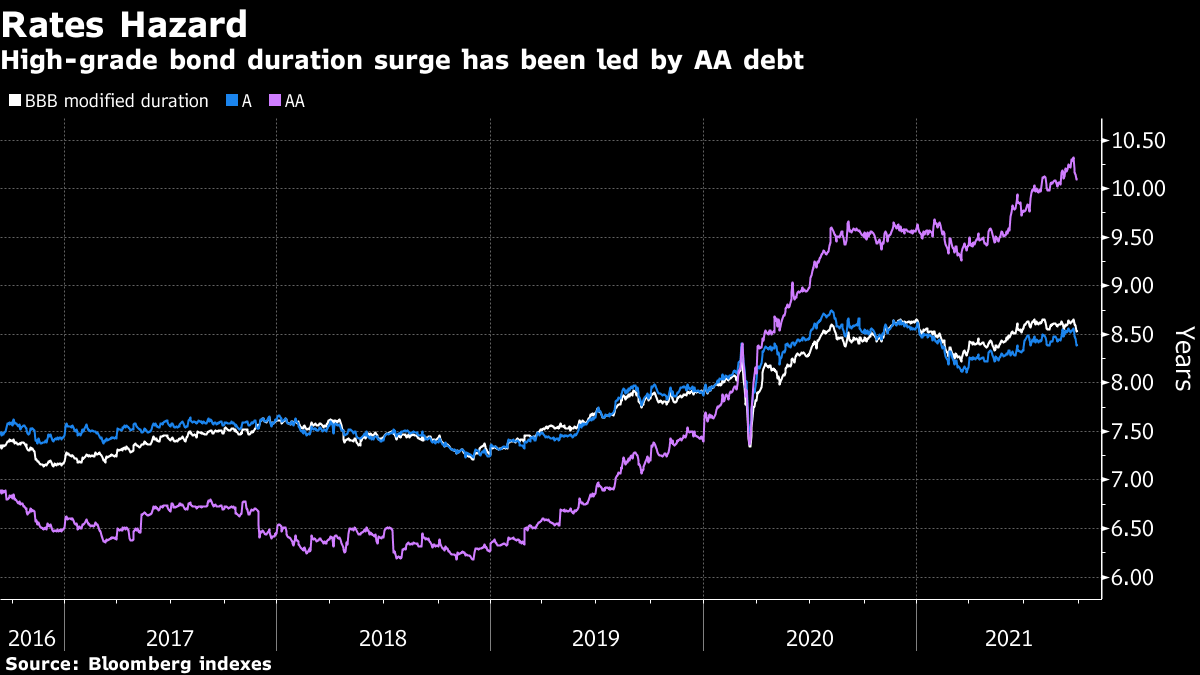

| Welcome to the Weekly Fix, the newsletter that refuses to discuss the U.S. debt ceiling. I'm cross-asset reporter Katie Greifeld Watching nominal Treasury yields has been entertaining enough, but as it often is, the real action is under the hood. So-called real rates -- the yield on Treasury Inflation-Protected Securities, which strip out the effects of price pressures -- have been making a run for it. While still deeply negative, 10-year real rates careened roughly 14 basis points higher in September, building on August's nearly 15 basis point jump. There are a few potential reasons why. Real yields are often viewed as a proxy for growth expectations, but that's probably not the proper takeaway given that the TIPS market is in such a "weird spot" at the moment after eighteen months of the Federal Reserve's bond-buying, according to Jefferies economist Thomas Simons.  "Post-September FOMC, there's been a big shift in inflation expectations. It was viewed as pretty hawkish, which has reduced the demand for inflation protection," Simons said. And then there's the whole turbocharged taper to worry about. "TIPS liquidity is so spotty, the market has the potential to take a hit in the tapering process without Fed support too." Even still, there's probably some economic signal to glean from the rise in real yields as the "back to office" narrative begins to pick up steam again, according to Ben Jeffery at BMO. The jump is "a function of renewed growth optimism as the delta wave abates," he said. That's the case in the U.S., where new cases slowed by a third in September, from a seven-day average of more than 161,000 on Sept. 1 to about 107,000 on Tuesday, according to the Centers for Disease Control and Prevention. And Citigroup Inc.'s economic surprise gauge -- which measures the magnitude to which reports either beat or miss forecasts -- has started to rebound.  While the thinly traded TIPS market has likely been distorted by the Fed's monster bond purchases, a brightening growth outlook is still visible, Jeffery said. "Just given the nature of the TIPS market, both in terms of size and liquidity, the argument could be made than lesser Fed buying starting by year end could be translating to higher real yields, combined with the growth story," Jeffery said. In a week rife with fun exchange-traded fund applications, one stood out: the Janus Henderson B-BBB CLO fund (ticker JBBB). If approved, it'll invest at least 80% of assets in securities rated from BBB+ to B-, according to the filing. Any out-of-the-box filing tends to attract scrutiny, since it's often easier to get your hands on an ETF than it is to buy the complex derivatives or hard-to-access assets it can track. That was certainly the case with the first few U.S. CLO fund launches last year, but those worries were quickly waved away by the fact that the ETF targeted only the highest-rated debt. Obviously, JBBB is a big shift down the credit-quality scale. And theoretically, anyone -- from an institutional trader looking for a liquidity sleeve to the Reddit crowd -- can access it. That has some money managers concerned that mom and pop could end up buying something they don't fully understand. "I don't think retail really needs to be getting into CLO BBBs, and I don't love packaging less liquid instruments into liquid wrappers," said John McClain, a high-yield bond portfolio manager at Brandywine Global Investment Management. "Dipping down in the stack you are picking up pennies in front of a liquidity steamroller if the market shuts down."  The filing lands smack in the middle of a red-hot CLO market. U.S. sales are inching closer to a new annual record as the average credit ratings of loans in CLOs has been improving. Additionally, since CLOs buy leveraged loans -- which are all floating rate -- the securities theoretically benefit in an environment of rising yields. Where McClain is concerned, Bloomberg Intelligence's Eric Balchunas is unfussed. JBBB "will serve a very niche audience who would likely have bought this stuff anyway but likes the convenience of an ETF," he said. Investors still need to be cautious and do their homework, Balchunas said -- but that warning is wrapper-agnostic. "People need to be careful and do their due diligence," Balchunas said. "But I'd say that about these in separately-managed accounts or mutual funds, too." One nation's potentially destabilizing debt crisis is someone else's bond bargain -- specifically, Marathon Asset Management's. The distressed-debt specialist's co-founder and Chief Executive Officer Bruce Richards said on Bloomberg Television on Wednesday that the firm bought the debt of troubled developer Evergrande for the first time this week, and will continue to do so at current low prices. "Low prices" may be an understatement. Evergrande 10% bonds due in 2023 led declines in the U.S. high-yield market on Wednesday, dropping 2.375 cents to 23.875 cents on the dollar -- a record low. Given that Evergrande is Asia's biggest issuer of high-yield notes, the ripple effects have been vast -- the yield on an index of the region's junk bonds has soared past 14%, to the highest in nearly a decade. A maiden voyage into Evergrande debt as the company teeters on the brink of default isn't for the faint of heart, and Richards is aware of the risks. The heavily indebted real estate giant will eventually need to be restructured, Richards said, though the company could "kick the can" by making some debt payments in the short term. Additionally, he expects that offshore investors will be only be paid after homebuyers, suppliers and Chinese bondholders are made whole.  Regardless, Marathon is still a buyer. Additionally, there are "absolutely opportunities" stemming from the Evergrande ordeal, Richards said: It is a problem for China, problem for its housing market. A problem for the whole segment that relies on this. There's a lot of jobs related to this and a lot of commerce related to this. Marathon isn't alone in vying for a piece of Evergrande's roughly $19 billion pile of obligations, given the relative shortage of attractive yields and distressed debt opportunities around the globe. Ashmore Group, BlackRock and UBS Group are the three largest holders of Evergrande debt among firms that have publicly disclosed positions. Meanwhile, Bloomberg News has reported that funds including Boaz Weinstein's Saba Capital Management and Ruben Kliksberg's Redwood Capital Management have also started to build positions in the company's bonds. As dramatic gyrations in rates often do, the past week's Treasury selloff temporarily upended corporate credit markets. Long-dated Treasuries yields shot higher to start the week in the kind of move makes high-grade credit investors "afraid of catching a falling knife," Bank of America Corp. strategists led by Hans Mikkelsen wrote in a note Tuesday. It also tends to push issuers -- fearing they'll miss the boat -- to sell more debt, they wrote. That's what they did, with companies more concerned that the window to borrow at still-low rates could be closing than the they were about selling bonds into a choppy market. More than $22 billion worth of high-grade debt was sold through Thursday, surpassing weekly estimates of $20 billion. Meanwhile, two more debut junk borrowers tapped the primary market on Thursday, bringing this year's count of inaugural borrowers to 79, according to data compiled by Bloomberg.  The reception was mixed. The rip higher in rates shredded returns for investment-grade investors, with blue chip posting a 0.9% loss in September -- the worst monthly return since March 2020, according to Bloomberg data. Junk bonds, with their relatively lower duration -- a measure of sensitivity of a bond's price to interest-rate changes -- fared better. High yield debt squeezed out a gain of just 0.04%, good enough for the 12th straight month of gains -- the longest streak in over a decade. Even with the wobble, investors such as BMO Global Asset Management's Scott Kimball expects demand to rebound in short order. Additionally, many buyers care more about absolute yield and may view higher rates as an opportunity to buy the dip, he added. "There's just a tremendous amount of cash on the sidelines," Kimball, co-head of U.S. fixed income at the firm, told Bloomberg's Caleb Mutua this week. "Whether rates are lower or rates are higher, there's a lot of money available." About 70% of Jobless Women Over 40 Are Long-Term Unemployed Jim Chanos Says NFT Market Is Rife With ' Nefarious Activity' Pro-Crypto Senator Warns Stablecoins Need to Be Backed by Cash |

Post a Comment