| This is Bloomberg Opinion Today, an idiot plot of Bloomberg Opinion's opinions. Sign up here. A common trope in bad entertainment is the Idiot Plot, which Roger Ebert once described as "any plot that would be resolved in five minutes if everyone in the story were not an idiot." The tedious drama around the debt ceiling is an example. It's a story cycle as old as time: Congress in its infinite wisdom sets a borrowing limit for the country. Congress borrows enough to make that limit a joke. Congress refuses to lift the limit and pay its debts until it has put us all through weeks of agony and Joe Manchin interviews, dancing on the edge of default and financial catastrophe. All along, there's a simple solution that would subvert the whole drama, like if the Empire had simply blown up the escape pod with R2-D2 and C-3PO at the start of the first "Star Wars" just to be on the safe side. That solution is just: Don't have a debt ceiling! There's no point to it. Other countries don't do it. It's an invitation for this country to bash itself in the face with a shovel every few years for no reason. Democrats will likely raise the debt ceiling yet again by slogging through the process known as "reconciliation," which is designed to get around another pointless, self-destructive tradition, the Senate filibuster. Dems want to avoid this because: - it's hard, you guys, and

- apparently they think voters know what the debt ceiling is and will care if they raise it, though there is no proof of this.

Whatever the cost, though, Dems should swallow their medicine for the good of the country, and while they're at it kill the debt ceiling once and for all, Bloomberg's editorial board writes. Mitch McConnell will reportedly give the Dems another couple of months to wallow in misery, setting up many fun Thanksgiving dinner conversations. The Dems could spare us all by nuking the filibuster, at least for the limited purpose of raising the debt ceiling, notes Jonathan Bernstein. It's possible McConnell actually wants this, maybe because it would give him a nice smoking crater to step through when the GOP regains control of the Senate. He's not an idiot. McConnell's kind offer to hold the football for Dems at least calmed stocks for the day. Earlier they had been in a tizzy because everybody is afraid it's the 1970s again, a nightmare era when all the hair, pants and interest rates were frighteningly large. It's probably not the 1970s again, but shortages in everything have conspired to make inflation much less transitory than we might have hoped, as John Authers writes. This is especially true in Renaissance-era Britain, whose post-Brexit business plan of - Phase 1: Close off the European labor pool

- Phase 2: ???

- Phase 3: Profit

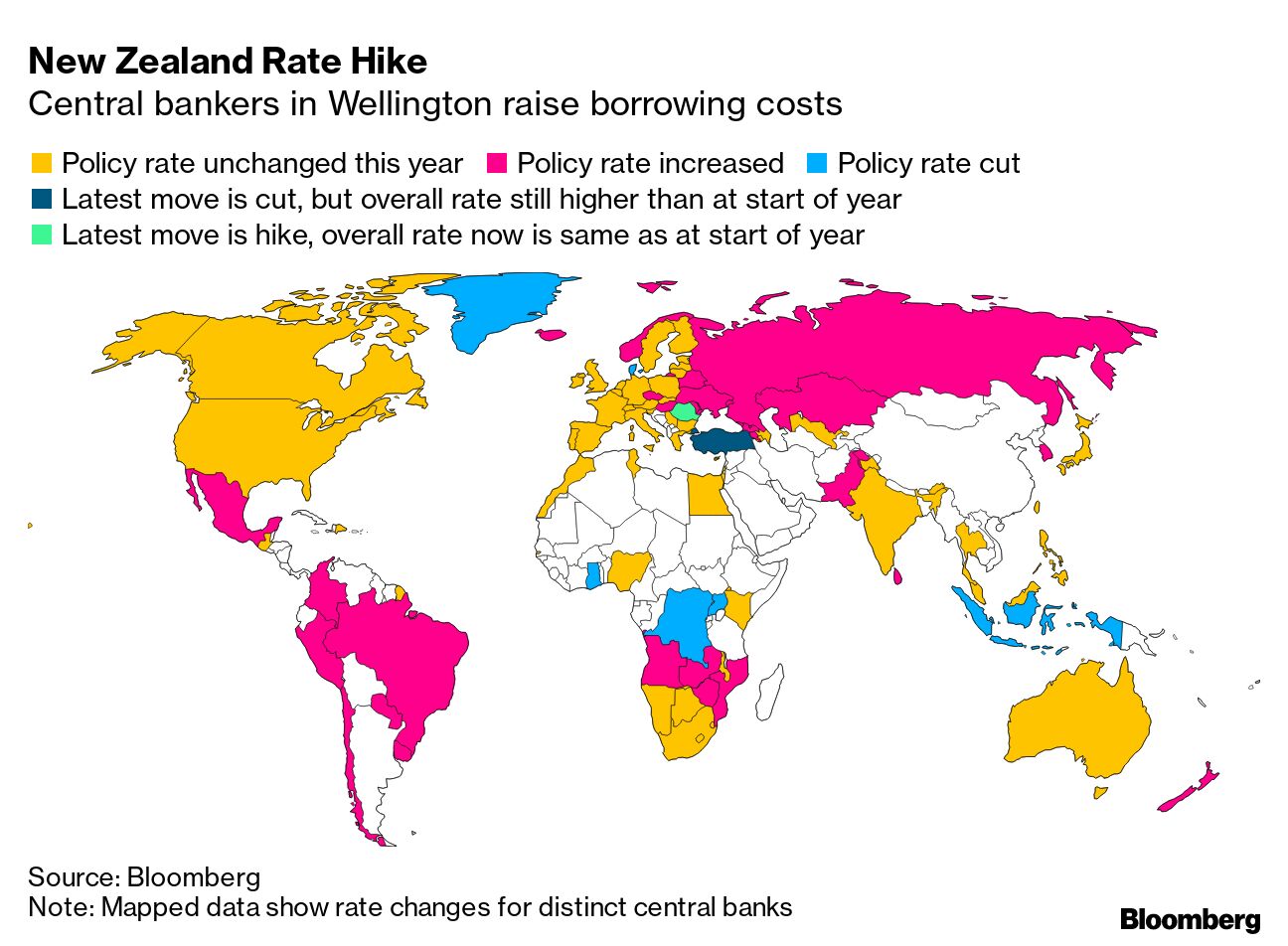

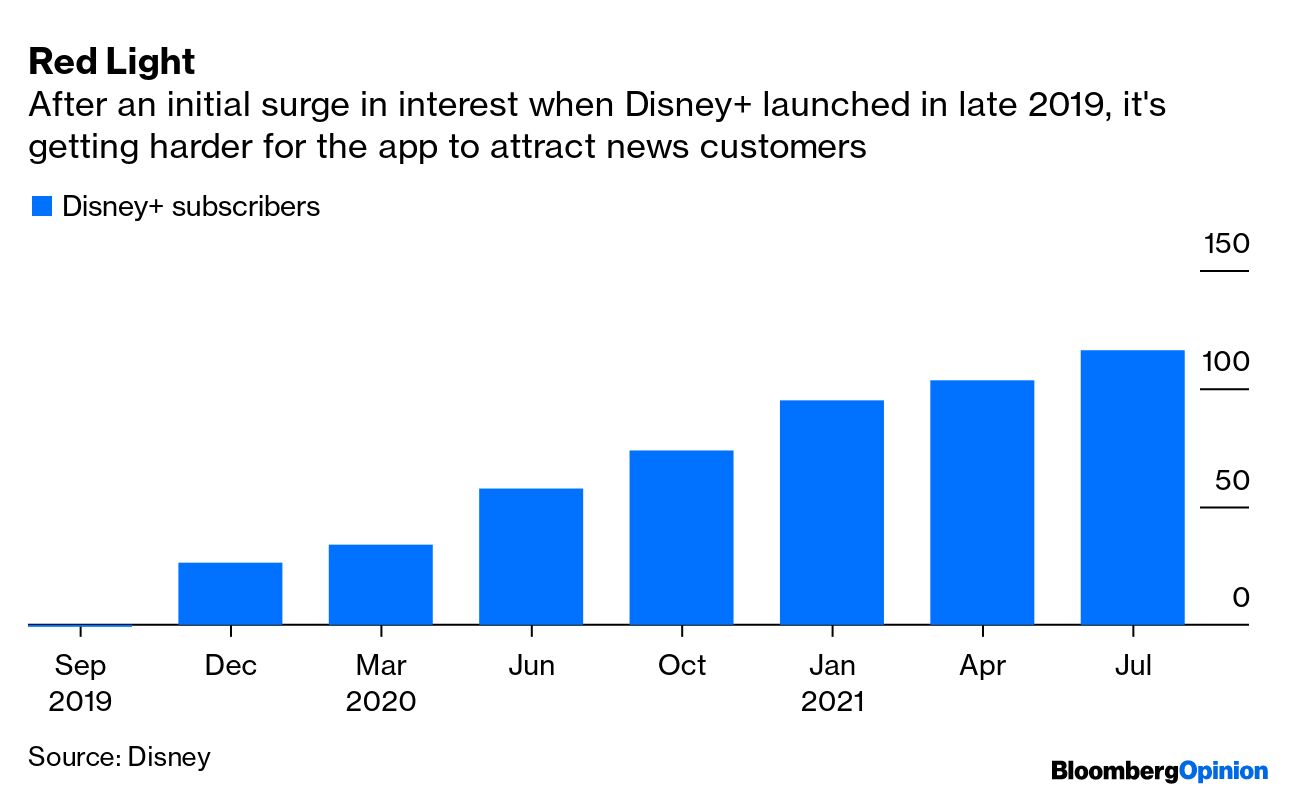

has raised prices on just about everything in the U.K., as Mark Gilbert notes. The Bank of England and its counterpart in the Colonies now must figure out how to curb inflation expectations without prematurely roasting the recovery. It's tricky, and Bill Dudley warns the Fed's long fight with deflation has left it ill-equipped. Other central bankers aren't waiting around. Dan Moss writes New Zealand, this newsletter's future headquarters, has joined a growing list of countries raising borrowing costs lately.  Bonus Whip-Inflation-Now Reading: Bitcoin miners aren't doing energy affordability any favors. — Lionel Laurent Just two weeks ago, everybody was worried about China Evergrande Group, the massive indebted developer with a Lehmany nose and an LTCM finish. When Evergrande did not immediately vaporize all the money, everybody moved on to worrying about debt ceilings and bell-bottoms. But Evergrande hasn't stopped melting down. Like "Squid Game" contestants, all of China's property developers are caught in a deadly game of "Red Light, Green Light," writes Shuli Ren. They must stop and start at Beijing's whim or die. This is warping their behavior in unexpected ways that could make the crisis worse. Fantasia Holdings is a tiny Chinese developer with a fun name that just decided to say "No, thanks" when asked to pay its bills, despite having the cash. And why not, Shuli Ren writes in a second column, when Beijing has made it impossible to make money. The risk is that others will follow Fantasia's example. You might have noticed this newsletter has mentioned "Squid Game" about 150 times in the past week. That's because we're all watching it like everybody else is, making it another huge hit for Netflix. With its exorbitant body count, this isn't the kind of hit Disney+ can ever have, writes Tara Lachapelle — unless, that is, it starts offering grown-up content, maybe by fully merging with Hulu. Without that, subscriber growth will keep slowing down.  China's belligerence has pushed Japan to reassert itself as a global power. — Hal Brands Why are regulators so reluctant to investigate fires in electric cars? — Anjani Trivedi Four steps for fixing Facebook, inspired by Frances Haugen. — Parmy Olson and Tae Kim Giving Iraqi citizens money could help fight corruption. — Ziad Daoud Somehow GlobalFoundries has found a way to lose money in a chip boom. — Tim Culpan China isn't giving up on the zero-Covid thing. ARK is leaving New York for Florida. Noma is still the world's best restaurant. Who is the bad art friend? Investigators say they've ID'd the Zodiac Killer. A new method for making molecules won a Nobel Prize. Sunlight affects whether languages have a word for "blue." They just don't make mobsters like they used to.  (h/t Scott Kominers) (h/t Scott Kominers) Notes: Please send Mr. Toad Sandwich Loaf and complaints to Mark Gongloff at mgongloff1@bloomberg.net. Sign up here and follow us on Twitter and Facebook. |

Post a Comment