| Hello. Today we look at the risk of a U.S. recession, what's coming up in the world economy this week and the rise of the super rich. Given America's pandemic recession is only judged to have ended in April 2020, discussion of a double dip so soon seems premature. Yet, David Blanchflower of Dartmouth College and Alex Bryson of University College London have kicked off such a debate. In a new research paper released last week, they used history to wonder if a recent decline in consumer expectations suggests the world's biggest economy is already in recession again. Every slump since the 1980s has been foreshadowed 18 months ahead of time by drops of at least 10 points in gauges of consumer expectations from the Conference Board and University of Michigan, according to the authors. The Conference Board's index dropped in September to the lowest since November last year, although the University of Michigan's gained.

"Downward movements in consumer expectations in the last six months suggest the economy in the United States is entering recession now," wrote Blanchflower and Bryson. The good news is that other indicators are more upbeat. Even in Friday's disappointing jobs report, the unemployment rate dropped top 4.8%. A single monthly rise of at least 0.3 percentage points in that measure is also a handy projector of recessions, the economists found. And even while Wall Street banks are cutting their forecasts for economic growth they still see robust expansion. Goldman Sachs, for example, told clients on Sunday that they now project the U.S. economy growing 5.6% this year and 4% next, even though both rates are slower than previously anticipated. But there's no denying risks are mounting. The delta variant has shown the pandemic will be here for a while, supply chains are squeezed and ports congested, food and fuel prices are surging, the labor market still has problems and fiscal and monetary policy makers may be pulling back stimulus soon. The debt limit fight has only been delayed. For those quick to scoff at the risk of a slump, let's also remember economists are pretty terrible at forecasting such turns. A 2018 study discovered that of 153 recessions in 63 countries from 1992 to 2014, only five were predicted by a consensus of private-sector economists in April of the preceding year. Time to cross fingers and hope history doesn't repeat. —Simon Kennedy U.S. consumer inflation and prices paid to producers probably advanced at healthy paces in September, suggesting cost pressures continue to percolate. The widely followed consumer price index is projected to match August's 0.3% monthly increase and the 5.3% year-over-year gain, according to the median of economists surveyed by Bloomberg. The government's gauge of producer prices is seen accelerating to 8.7% on an annual basis. Also this week, the International Monetary Fund meetings begin, the Federal Reserve releases minutes of its last meeting and Chile's central bank may raise interest rates. The inflation theme is certainly occupying the minds of investors. Read our quarterly guide to central banks here and our deep dive into whether inflation is transitory or not here.

For a full rundown of the week ahead, click here.  | - Just in | The Nobel prize for economics was awarded to David Card, Joshua D. Angrist and Guido W. Imbens for their work using natural experiments.

- IMF chief | The fund's executive board plans to deliberate further Monday over the fate of the lender's chief, Kristalina Georgieva, after discussions Sunday with her and the law firm that alleged improper actions in her previous job at the World Bank.

- BOE signals | Two Bank of England officials reinforced signals of an imminent rise in U.K. interest rates to curb inflation, with one telling households to brace for a "significantly earlier" increase than thought.

- Supply snarls | Factory workers are leaving Vietnam's industrial heartland to avoid virus lockdowns, threatening the supply of clothes and shoes shipped to the American market.

- India trade | India is racing to wrap up a clutch of quick-fire bilateral trade pacts by the end of March, officials said, as economic necessity spurs a shift from New Delhi's usual go-slow approach on such deals.

- Tax deal | Attention now turns to the upcoming Group of 20 summit and domestic legislatures, especially the U.S. Congress, after 136 nations backed a vast overhaul of corporate taxation. Treasury Secretary Janet Yellen said she's confident U.S. lawmakers will sign up.

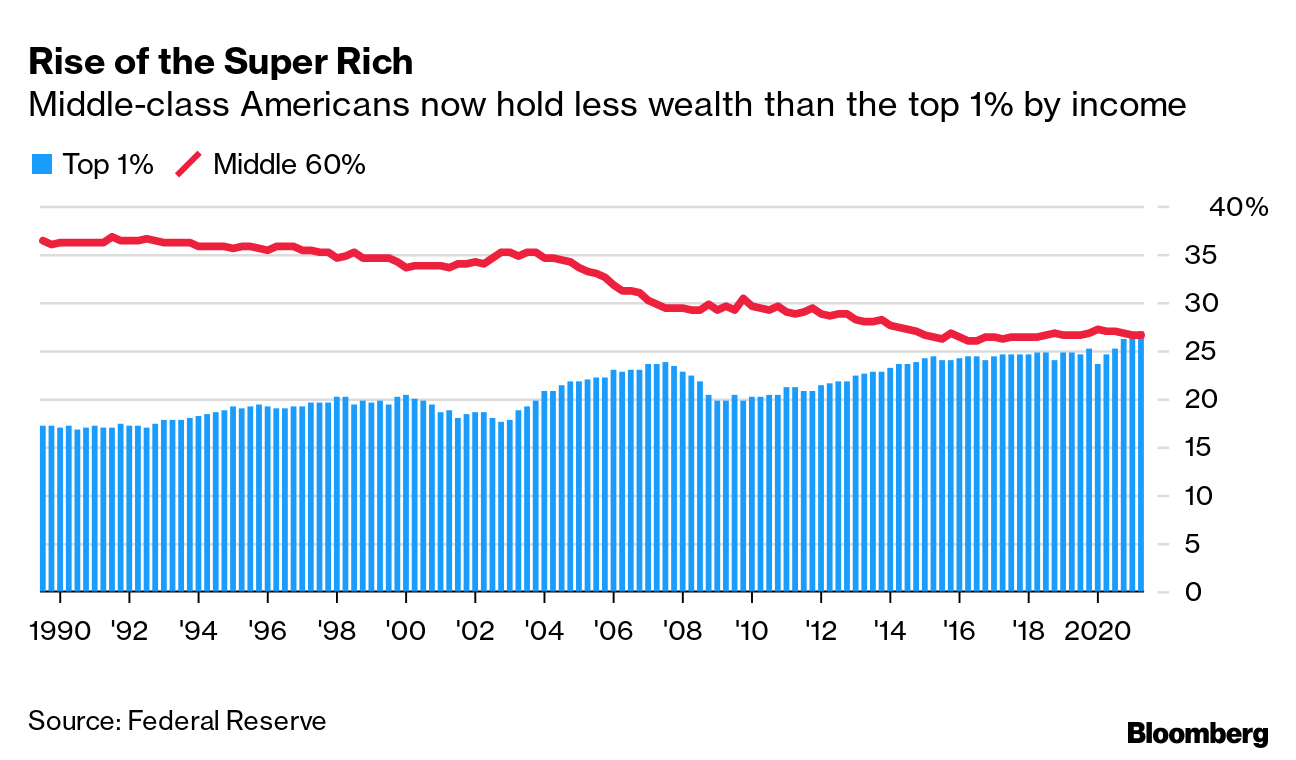

After years of declines, America's middle class now holds a smaller share of U.S. wealth than the top 1%. The middle 60% of U.S. households by income -- a measure economists often use as a definition of the middle class -- saw their combined assets drop to 26.6% of national wealth as of June, the lowest in Federal Reserve data going back three decades. For the first time, the super rich had a bigger share, at 27%. The data offer a window into the slow-motion erosion in the financial security of mid-tier earners that has fueled voters' discontent in recent years. That continued through the Covid-19 pandemic, despite trillions of dollars in government relief. History fans... Read more reactions on Twitter Join the Bloomberg Women's Community on World Menopause Day on Oct. 18, as we host a virtual panel discussion on perimenopause and menopause in the workplace. The event aims to raise awareness of these life stages, including what to look out for, and the support available at work and elsewhere. Register here. - Click here for more economic stories

- Tune into the Stephanomics podcast

- Subscribe here for our daily Supply Lines newsletter, here for our weekly Beyond Brexit newsletter

- Follow us @economics

The fourth annual Bloomberg New Economy Forum will convene the world's most influential leaders in Singapore on Nov. 16-19 to mobilize behind the effort to build a sustainable and inclusive global economy. Learn more here. |

Post a Comment