| This is Bloomberg Opinion Today, a SpongeBob episode of Bloomberg Opinion's opinions. Sign up here. This newsletter has a long, proud record of being a Covid patience scold, going all the way back to March 20, 2020, when we warned readers to brace for "several more weeks" of pandemic restrictions. Ha ha, good times. Soon after, we compared the world to kids in a car begging for the ride to end and said it would be measured in months, not SpongeBob episodes. So it is with trepidation that we suggest today we might — might — be close to SpongeBob timescales now. The pandemic is far from over, particularly in parts of the world vaccines still haven't reached. Even in the U.S., though the delta-variant wave seems to have peaked, cases are still high. Horrible new variants could still evolve. The odds are strong we'll be preaching pandemic patience again on March 20, 2022. But here's the thing: Vaccine mandates, which we have said all along would work, are working. Despite a bunch of protests that they would rather be unemployed than inoculated, the vast majority of people subject to mandates are quietly getting shots instead of quitting, writes Bloomberg's editorial board. If success breeds more success, this success should breed more mandates that will lift America's relatively pitiful vaccination rates. Since the pandemic began, Americans have sought quick fixes, from fish-tank cleaner to horse dewormer. And though no fix is as quick and effective as a vaccine, a new antiviral drug from Merck and Ridgeback might at least start to fit the bill. Max Nisen suggests it could be more effective than Tamiflu at keeping patients out of the hospital or morgue, only for Covid instead of the flu. It's still not nearly as effective as vaccination, and overuse could lead to drug resistance. Still, this and other antiviral drugs in the pharma pipeline could make the rest of the Covid ride a lot less miserable. Let's say you run a $100 million New Jersey deli and you hear your sandwiches are making people sick. Do you: - Shut everything down until you make sure people are, in fact, getting sick from your sandwiches, at which point you conduct a thorough review of your deli operations until you find the source of the illness.

- Stick your head in the kitchen and ask your employee, let's call him Phil, if everything's OK with the slicers and whatnot.

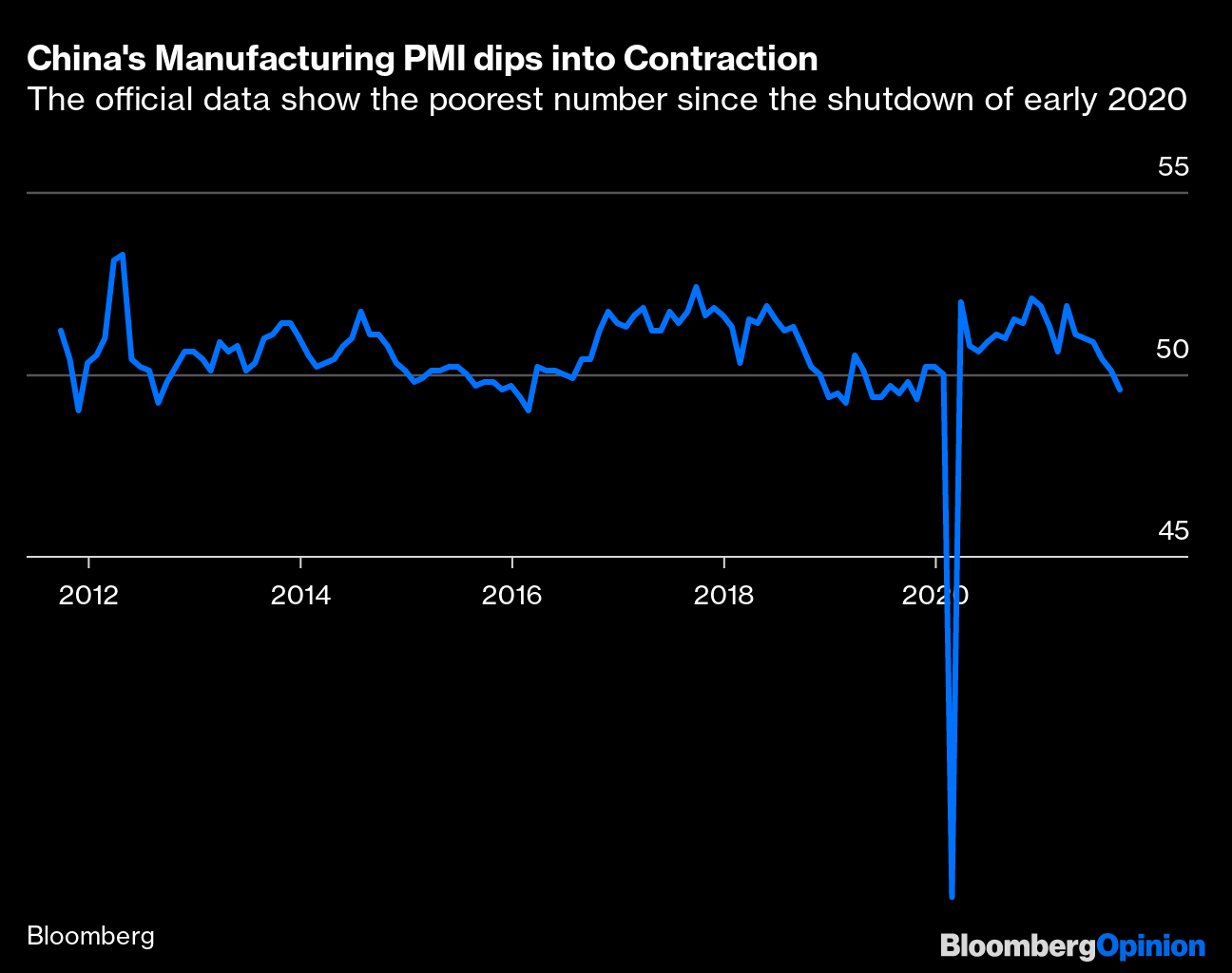

If you picked the first option, then congratulations, you deserve to be the CEO of a $100 million New Jersey deli. But you know what's cooler than $100 million? $970 billion, which is the market value of Facebook, a company that apparently prefers the "check with Phil" approach to seeing if its products make people ill. Facebook is in trouble again, as usual, this time because reporters got ahold of internal studies of whether Instagram is ruining children's brains. One of the company's defenses is hey, don't worry, these aren't real studies, with science and rigor and all that junk. To which Cathy O'Neil responds: Why not? "If it's possible that your product is leading young women to kill themselves," she writes, "wouldn't you want to explore further, at least to clear your name?" Maybe Facebook doesn't want to know the answer. But the rest of us should. Read the whole thing. There's still only black smoke pouring from the Capitol Hill chimney today, meaning Democrats haven't yet struck a deal on their infrastructure and spending plans. Sometimes the news is encouraging, sometimes it's Kyrsten Sinema rushing home for a checkup/fundraiser. It's all ignorable, if you prize your sanity. What we shouldn't do is take this messy process to mean there's something unusually disarrayed about it, writes Jonathan Bernstein. Democrats have a rare moment of unified government, and only just barely. So they're trying to do something big while they have the chance. Given the wafer-thin margins and competing interests, this will naturally be like getting pandas to mate. If it all falls apart, Dems can console themselves by remembering their $1.9 trillion relief package will be pumping money into the economy for months to come, writes Conor Sen. It's a far cry from the last recession, when a meager stimulus package was overwhelmed by years of austerity and deleveraging that neutered the recovery. It might even help Dems stretch that unified government out for another two years. Bonus Econ Reading: Central bankers are focused on demand when the economy's real problem is supply. — Mohamed El-Erian Bond markets aren't registering much panic about a U.S. default yet, writes Brian Chappatta, who points out what charts to watch as the deadline approaches.  Traders have moved on from Evergrande far too quickly, warns John Authers. It may not be the next Lehman, but it will still do real damage to China's economy.  Trading scandals show the investing game really is rigged against the little guy. — Mark Gilbert European security faces four crises at once. — James Stavridis The world must stay focused on human-rights abuses in Afghanistan. — Ruth Pollard Germany's future, and maybe the planet's, depends on an alliance of hippies and yuppies. — Andreas Kluth Foxconn's rescue of Lordstown is also a rescue of its own EV ambitions. — Tim Culpan A new middle class of airline seats is flourishing as business class dies. DeFi platform Compound accidentally gave away $90 million and wants it back. RNA donuts could be used to treat cancer. Now we know what a solid made of electrons looks like. Eritrean man dies at 127 years young. Thirty mustards, ranked, sort of. Every "Sopranos" episode, ranked.  Notes: Please send ziti and complaints to Mark Gongloff at mgongloff1@bloomberg.net. Sign up here and follow us on Twitter and Facebook. |

Post a Comment