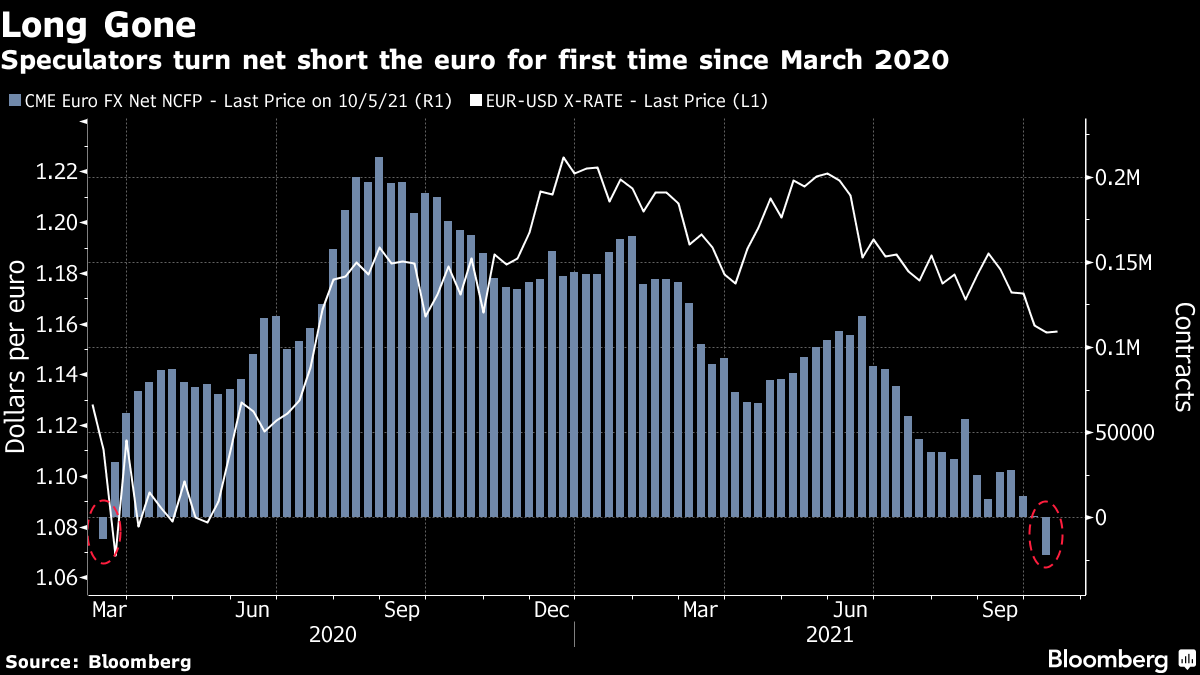

| Good morning. Officials hint at a U.K. rate hike, a clash over Northern Ireland is imminent, a French supermarket M&A deal has stalled and oil hits a psychological price threshold. Here's what's moving markets. Bank of England officials gave further hints that an increase in interest rates may be coming to tackle inflation. Michael Saunders suggested that traders were right to bring forward bets on hikes, while Governor Andrew Bailey warned of a "very damaging" period of inflation unless policy makers take action. Markets are almost-fully pricing in the first move by the end of this year — the next monetary policy announcement is due November 4. Britain and the EU are set for a potential clash on Northern Ireland this week as the U.K.'s Brexit minister will seek changes to the protocol that governs trade flows with Ireland. It comes as the government is facing other headaches, including rising energy prices and a dispute with France over fishing rights. Last week, the U.K. hit back at France over a threat to Britain's electricity supplies amid the fishing spat. Talks to combine Auchan and Carrefour — which would create a market leader among French grocers — have stalled on valuations and the structure of a deal. It's unclear whether discussions — which occurred amid a flurry of deal-making activity in the European supermarket sector — will be revived. A deal would have valued Carrefour at 16.6 billion euros ($19.2 billion), a level its management and shareholders see as too low. West Texas Intermediate crude oil futures have topped the psychological price threshold of $80 for the first time since 2014. Oil has benefitted from soaring prices of natural gas amid decreasing stockpiles ahead of winder in the northern hemisphere. Pricier crude adds to the global power crunch, which is prompting major energy trading firms to cut down on positions and increase borrowing. European stocks look set for a flat open despite a jump in Asia, where Japan climbed as the yen fell and the prime minister said he isn't considering changes to the country's capital-gains tax at present. There's no cash Treasuries trading because of the Columbus Day holiday, but the stock market will remain open. It's a quiet day for earnings worldwide with Sweden's Industrivarden among the few reports. CEOs of Santander, JPMorgan, BlackRock and Bank of America are among the speakers scheduled to appear at the annual meeting of the Institute of International Finance. Chicago Fed President Charles Evans will speak at an awards ceremony. And it's a big day in the "dismal science" as the winner of the Nobel Prize in Economics is announced. This is what's caught our eye over the past 24 hours. Speculative traders look to have given up on the euro. Net non-commercial positions in the common currency flipped to short for the first time since March 2020, according to the latest Commodity Futures Trading Commission data. The move is part of a broader push for dollar exposure — the same data showed net long non-commercial positions in futures linked to the ICE U.S. Dollar Index surged to the highest in two years. The euro has fallen 2% against the greenback over the last month, thanks in part to the contrast between the Federal Reserve's hawkish shift on rates and a still-dovish European Central Bank. The potential for soaring energy prices to undermine Europe's economy has also played a role. If benchmark Treasury yields can hold above 1.6% -- and continue to push higher -- expect those speculative short euro positions to grow.  Cormac Mullen is a cross-asset reporter and editor for Bloomberg News in Tokyo. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment