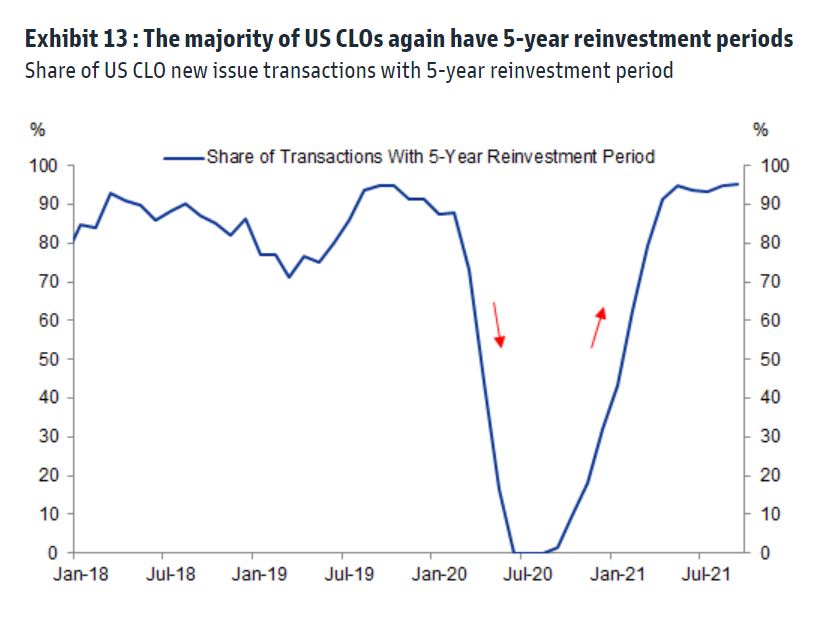

| Goldman slashes its U.S. growth forecast. Taiwan President Tsai Ing-wen sees unprecedented tests with China. Stocks look set for a mixed start. Here's what you need to know today. Goldman Sachs economists cut their forecasts for U.S. growth this year and next, blaming a delayed recovery in consumer spending. Goldman's team said they now expect growth of 5.6% on an annual basis in 2021, versus their previous estimate of 5.7%, and 4% next year, down from an earlier forecast of 4.4%. Meanwhile, sentiment could be more optimistic in Russia as surging energy prices stoke bullish bets on developing-nation exporters and as the nation emerges as traders' favorite investment destination. The ruble has gained more than any other emerging-market currency this month. Taiwan faces "unprecedented challenges" and will defend its sovereignty, President Tsai Ing-Wen said, pushing back after Chinese President Xi Jinping declared that unification with Taiwan "will and must be achieved." Taipei hopes to ease cross-Strait ties, but resolving differences requires dialogue on the basis of parity, Tsai said. She added the government would do its utmost to maintain the status quo and would not act rashly. Beijing said Taiwan's claim of maintaining the status quo was "an attempt to deceive the world." Meanwhile, in the U.S., a Navy Department employee and his wife were arrested on spying-related charges after they allegedly sold restricted data on nuclear-powered submarines to an FBI agent posing as a foreign official.  | Stocks looked set for a mixed start Monday as traders await the earnings season and weigh the risks to the pandemic recovery from inflation pressures and an energy crunch. The dollar was little changed. Equity futures slipped for Japan, were steady for Australia and earlier signaled gains in Hong Kong. The S&P 500 and Nasdaq 100 declined Friday after U.S. jobs data fell significantly short of expectations while also showing a jump in earnings. Four years after vying with Jack Ma for the title of Asia's richest man, Evergrande chairman Hui Ka Yan's fortune is plunging and his sprawling real estate empire is on the verge of collapse. It's a stunning reversal for a man who fought his way from poverty in rural China to build one of the world's largest property companies. In previous times of trouble, Hui had been able to rely on the help of his tycoon friends and local government support. This time, with $305 billion in liabilities and the company's asset prices plunging, Hui appears more alone than ever. India is racing to wrap up a clutch of quick-fire bilateral trade pacts by the end of March, as economic necessity spurs a shift from New Delhi's usual go-slow approach on trade deals. One potential investor who may face a roadblock is Elon Musk. India's road transport minister said he asked Tesla to avoid selling China-made cars in India ahead of the electric-vehicle maker's expected entry into the market. The minister said Tesla should "make cars in India, sell in India and export from India." What's caught our eye over the past 24 hours: If you're looking for signs that the credit market is well and truly over the trauma of 2020, then look no further than what's going on in collateralized loan obligations, the bundles of leveraged loans known as CLOs. During the worst of last year's market crash, sales of CLOs shriveled to practically nothing. As of this month, CLO sales have topped $130 billion, surpassing the highest annual amount on record. More tellingly, safety features that were embedded in CLOs by nervous investors or issuers after the Covid-19 shock are now being stripped away. No-call periods that had been reduced from a pre-Covid standard of two years to just one-year during the worst of the market stress are now being lengthened again. Meanwhile, reinvestment periods that had been cut from the traditional five years to just one or two years are also being stretched out again. Data from Goldman Sachs shows over 90% of recent U.S. CLOs once again feature five-year reinvestment periods — just like old (pre-Covid) times.  Source: Goldman Sachs Source: Goldman Sachs One of the strange things about the past year and a half is how we've managed to squeeze an entire credit cycle into such a short amount of time, moving from an all-out market crisis to possible overheating. Booming sales of CLOs with transaction terms that look just like they did before 2020 is a good example of this. You can follow Tracy Alloway on Twitter at @tracyalloway. |

Post a Comment