| Hello. Today we look at how fear rather than interest rates is driving global currency markets, the improving bargaining power of American workers and the reforms needed to cut China's reliance on fossil fuels. "Brutal." That's how Jean-Claude Trichet used to describe unwelcome gains in the euro when he ran the European Central Bank in the early 2000s. The problem for policy makers was that a rising currency can curb economic growth by hurting competitiveness. It's often been a reason to be careful in raising interest rates — to avoid driving up the exchange rate. As countries around the world look at tightening monetary policy, however, something's changed: currencies aren't really reacting to expectations for interest rates in the way they used to. Take the most recent U.S. retail sales report, released Aug. 17. It was weaker than almost all the forecasts. Logic suggests that makes for a less-aggressive Federal Reserve, and in turn a weaker dollar. In fact, however, the dollar rose that day. Adam Cole, who's been monitoring economies and currencies for three decades, uncovers what's going on: since the pandemic struck, currencies are basically moving based on the magnitude of fear in markets on any given day. When things look dark — cue the weak retail sales report — currencies associated with safety gain (dollar, yen, Swiss franc.) The opposite happens when risk appears to recede. Cole, head of currency strategy at RBC Capital Markets, calls this the "world of one trade." Looking at 45 exchange rates between the main 11 developed-world currencies, some 35 pairs had a significant correlation with appetites for risk, Cole found in a note released last week. That pattern could remain in place for years, he says. After the global financial crisis when there was a similar correlation between risk attitudes and exchange rates, "it took about five years before we really got back to an environment where monetary policy was the main driver," Cole says. For policy makers, it means a freer hand to set central bank policies without worrying about the currency implications. With the ECB set to start debating as soon as next week how it will phase out its pandemic-era stimulus, it makes the consequences a whole lot less "brutal." —Chris Anstey At the start of the pandemic, American workers were thrown out of jobs in their millions. By the time it ends, they could be in their strongest position in decades. Jobs lost to Covid are coming back — often with better salaries than before. The August employment report, due out on Friday, is forecast to show more than 700,000 people added to payrolls, and corporate giants from Amazon to McDonalds have been raising pay. In the rush to reopen, bosses have needed to hire like never before, and that's given workers some bargaining power, Katia Dmitrieva reports. Union leaders and labor economists caution that the big battles have yet to be won, but they can see conditions in place for workers to claw back some of the ground lost during the U.S. economy's long slide into inequality. - Left behind | The pandemic trend of white-collar employees working remotely or fleeing for the suburbs has disproportionately hurt low-skilled workers who stayed behind in deserted U.S. neighborhoods.

- ECB divide | The euro-area economy's rebound and a dramatic inflation surge has reignited the sparring among policy makers about when to shift the institution away from crisis mode.

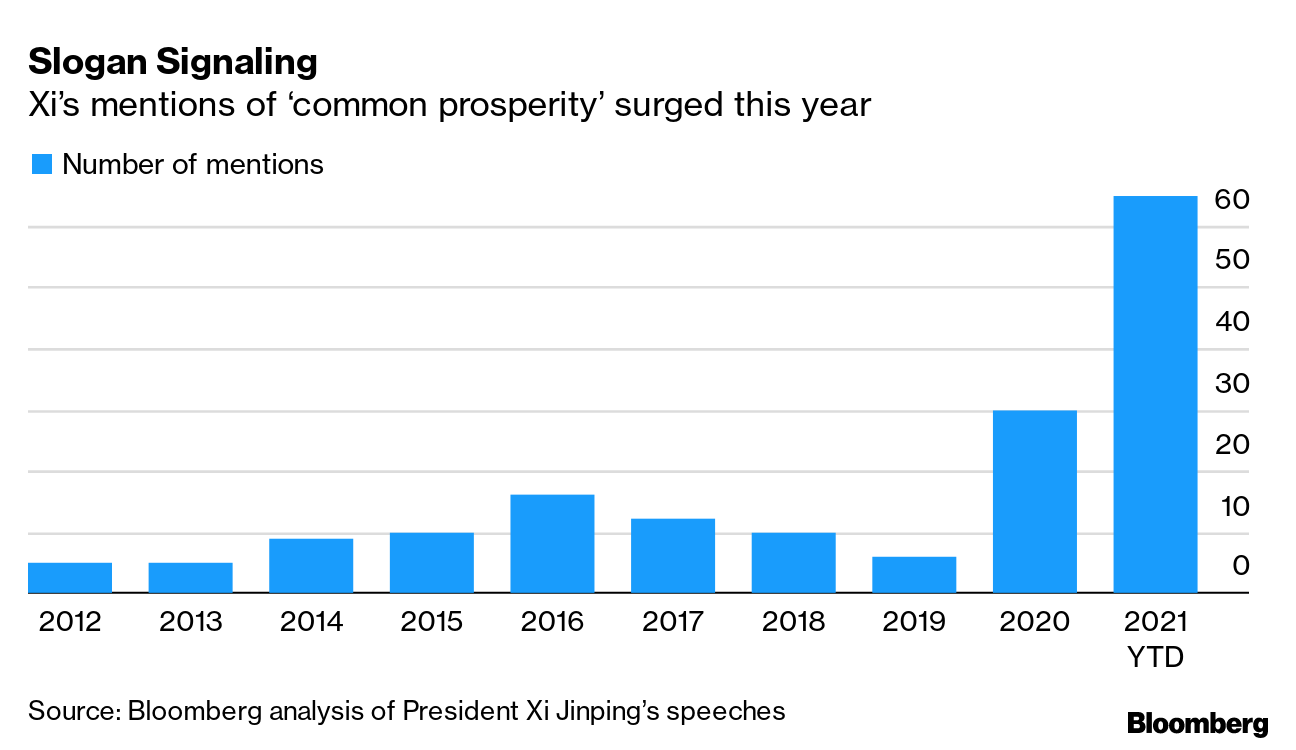

- Party line | Scores of listed Chinese companies have name-checked President Xi Jinping's "common prosperity" drive in earnings reports, as they seek to align with the campaign to reduce wealth inequality. Elsewhere, China's infamous ghost cities are filling up.

- Even longer recession | The devastating earthquake that hit Haiti last month will make one of the world's longest recessions much deeper, central bank chief Jean Baden Dubois said.

- Food worry | Whether it's fruit pickers, slaughterhouse workers, truckers or waiters, the world's food ecosystem is buckling due to a shortage of staff.

- Canadian election | Prime Minister Justin Trudeau, facing an unexpectedly tight race for re-election, promised tens of billions of dollars in spending on new initiatives that he says would be financed by a tax-revenue windfall from an expanding Canadian economy.

In China, three "essential" reforms will be needed over the next year to 36 months to accelerate the transition away from fossil fuels outlined by President Xi Jinping last year, according to Eleanor Olcott and Grace Fan, researchers at TS Lombard wrote in a note this week. - Improve grid connectivity. That includes expanding ultra-high voltage lines carrying renewable energy from remote regions of the world's third-largest nation. One, originating in Tibet-neighbor Qinghai, runs almost 1,600 kilometers (1,000 miles).

- Reform the power market to make it more centralized. "There is strong local resistance," Olcott and Fan said. Sounds just the kind of job for Xi.

- Strengthen the recently launched emissions trading system, which caps carbon intensity — not absolute emissions.

The Bank of England named Huw Pill, a Goldman Sachs and ECB alumnus who now works at Harvard Business School, as its next chief economist. His former employer is impressed... Read more reactions on Twitter - Click here for more economic stories

- Tune into the Stephanomics podcast

- Subscribe here for our daily Supply Lines newsletter, here for our weekly Beyond Brexit newsletter

- Follow us @economics

Bloomberg New Economy Conversations — China's Tech Crackdown: Join New Economy Forum Editorial Director Andrew Browne on Sept. 8 at 10 a.m. as he analyzes the sweeping regulatory crackdown underway in China. The private sector helped power China's economic rise, but President Xi Jinping seems determined to rein in what he sees as its excesses. Is this transitory or a game-changing shift? Joining Andy are Keyu Jin, Associate Professor of Economics at the London School of Economics & Political Science, and Kevin Rudd, President and Chief Executive Officer of the Asia Society. Register here. |

Post a Comment