| Hello. Today we look at what a $15 hourly minimum wage means in the U.S., the rise of stagflation chatter and the companies of the future. President Joe Biden's effort to more than double the national minimum wage to $15 an hour was stymied in the U.S. Congress earlier this year, with prospects looking dim unless key moderate Democrats have a change of mind. Turns out that may not matter so much. The massive shortfall of workers — the number of job vacancies in July exceeded new hires by 4.3 million, the most in data going back to 2000 — is helping to deliver notable wage gains for the lowest-tier earners, Mike Sasso reports. Read the full story here. "People are looking at $15 as the new normal, kind of the new standard," says Aaron Lee, the California-based co-founder of a business that handles customer support for companies. "As we bump up to $15, we see a lot more applicants."

An analysis of jobs posted from spring 2019 to spring 2021

from a sampling of cities shows many service-sector industries

crossed above a $15 starting wage during the period — often

by significant margins — according to Emsi Burning Glass, an

analytics firm that tracks job postings. Several large employers, including Walmart, Target, Best Buy, and Chipotle Mexican Grill, are bumping up starting or average hourly pay to $15 or more. Amazon.com Inc. recently announced it was boosting average starting wages for open logistics jobs to $18 an hour. Now, less than 20% of U.S. workers make below $15 an hour. And while a new nationwide minimum isn't on the cards for now, about 40% of the U.S. workforce lives in states where the level is mandated to rise to $15 an hour, according to estimates by the Economic Policy Institute. Opponents say the wage competition is proving too much for some employers, contributing to production problems as they struggle to find enough workers. Progressives by contrast are still pushing for a nationwide $15, saying millions of workers have yet to benefit. "The fight for $15 is the floor. It's not the ceiling," says Chris

Figueredo, who oversees the Ballot Initiative Strategy Center,

a nonprofit that pushes for progressive state ballot measures.

—Chris Anstey Stagflation concerns are picking up, according to Bloomberg's News Trend function. It shows uses of the word shot up this month to the highest since at least September 2011 amid worries growth is slowing and inflation is elevated. While growth still looks set to remain decent and a return to the 1970s is far off, Europe's energy crunch may keep the word in the minds of traders. A major fertilizer maker has already shut two U.K. plants as gas and power prices surge. Click on the blue links to read any of the stories in full: - "Get Me a Box" | The pandemic has thrown the vital but usually humdrum world of logistics into a tailspin, spurring shortages of everything from masks to semiconductors and bicycles.

- Biden Delays | President Joe Biden's economic agenda risks getting delayed in Congress with tax, health care and other issues still unresolved and continued squabbling between Democrats.

- Powell fans | Federal Reserve Chair Jerome Powell picked up a handful of fresh endorsements from U.S. senators this week for another term, but several key Democrats aren't yet sold.

- Chip meeting | The Biden administration plans to convene another meeting with companies in the semiconductor supply chain next week amid ongoing disruptions and production delays.

- Japan exports | Those supply chain snarls dented Japanese exports, which slowed more than expected in August. The government cut its assessment of the economy for the first time in four months.

- Emerging rates | Egypt looks set to retain the world's highest inflation-adjusted interest rate on Thursday. Meantime, a deputy governor of Czech Republic's central bank told Bloomberg it may accelerate rate increases too.

- United Nations outlook | The global economy is expected to undergo its fastest recovery in almost five decades this year, but deepening inequities threaten to undermine this, the UN warned.

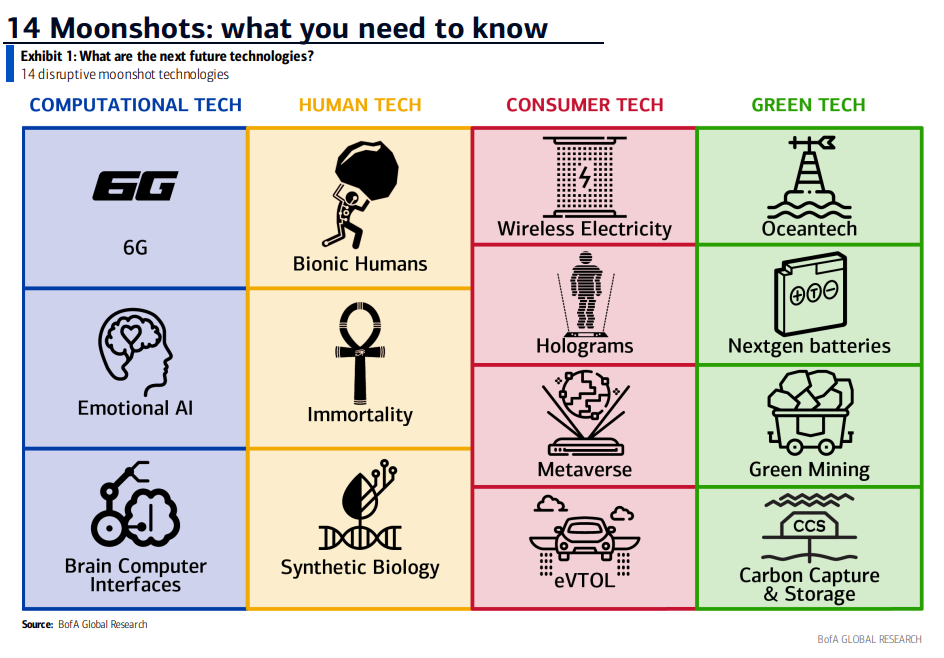

Imagine flying cars, emotionally intelligent computers, wireless electricity and instead of meeting colleagues and friends over Zoom, you see them in 3D holograms. These are a few of the technologies that could change our lives and accelerate the impact of global megatrends, according to new research from Bank of America. And they're not as distant as you might think, strategists including Haim Israel say. "The pace of transformation in many fields is the fastest in human history," according to the 152-page report. "And the impact of this change is more tangible than ever before, whether via climate change, demographics, or technological innovation." Read more reactions on Twitter - Click here for more economic stories

- Tune into the Stephanomics podcast

- Subscribe here for our daily Supply Lines newsletter, here for our weekly Beyond Brexit newsletter

- Follow us @economics

The fourth annual Bloomberg New Economy Forum will convene the world's most influential leaders in Singapore on Nov. 16-19 to mobilize behind the effort to build a sustainable and inclusive global economy. Learn more here. |

Post a Comment