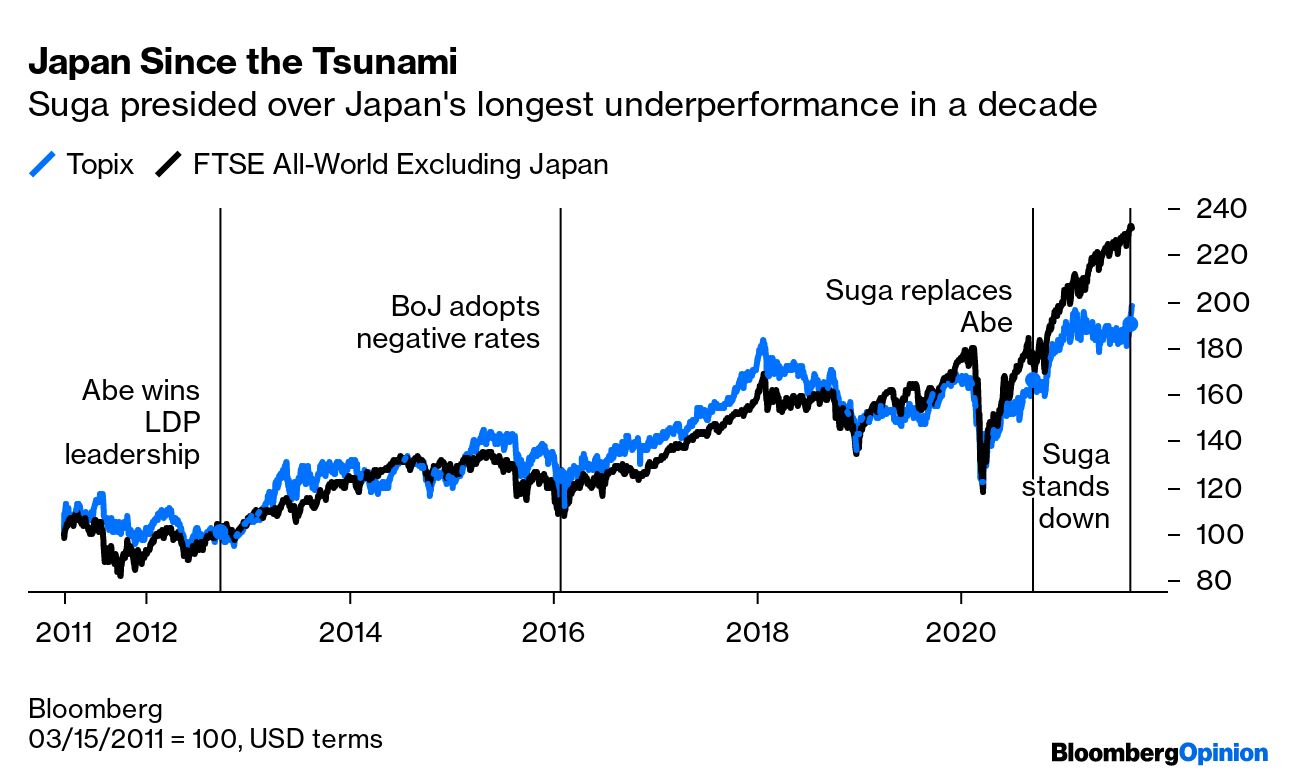

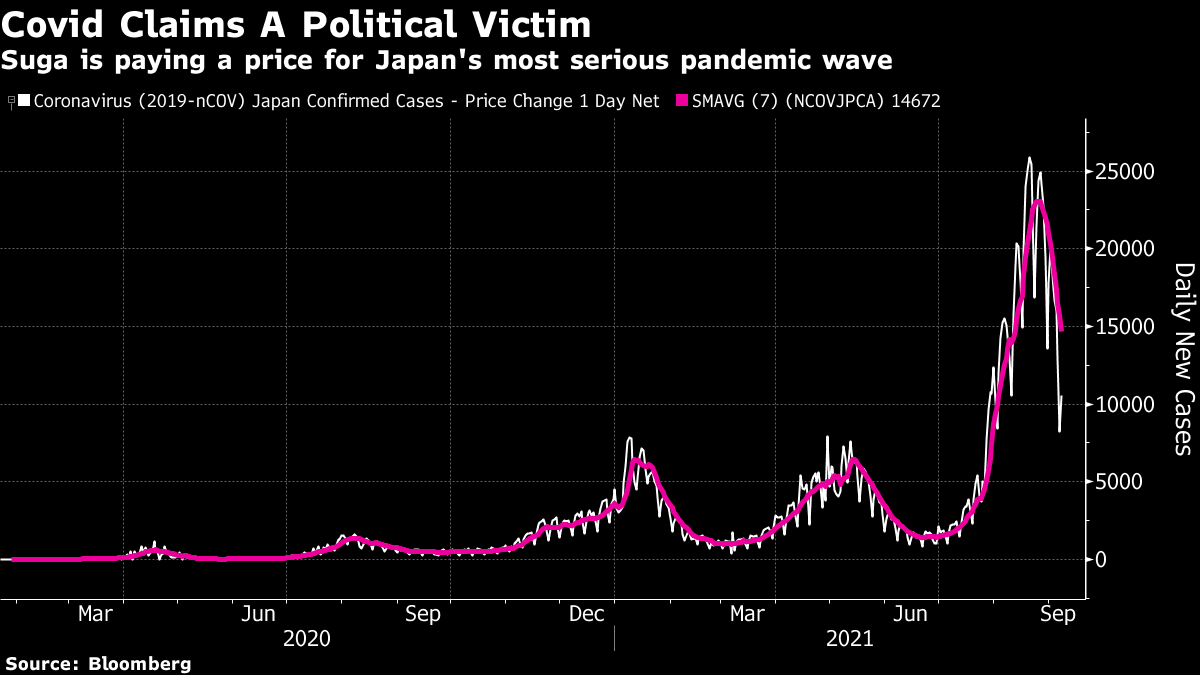

| It must be hard to be Yoshihide Suga at the moment. The man who took over as Japan's premier a year ago when the long-serving Shinzo Abe resigned due to bad health, announced last week that he wasn't running for re-election. That means he will no longer be prime minister at the end of this month. And the market is overjoyed to see the back of him. The immediate response to the news has seen the Topix index, covering the broad Tokyo Stock Exchange, surge above the 2,000 level to set a new 30-year high. The rally has been sharp and impressive:  But this is the Japanese stock market we're talking about. Since New Year's Eve 1989, when Tokyo peaked at a point when the total market cap of corporate Japan comfortably exceeded that of corporate America, the economy has been in a disinflationary slump and its stock market has massively underperformed the U.S. If we take the Topix's performance relative to the S&P 500, in common currency terms, and start on the last day of 1989, this is the picture of persistently painful performance that emerges:  As can be seen, there have been numerous flirtations over these decades of futility when it appeared that the bottom was in, and that Japan had turned the corner. Just as with the ever-downward trend in Treasury yields, the other great reliable financial trend of these three decades, it seems obvious and logical that this decline cannot continue forever, and at some point it will be time to buy Japanese stocks. But every apparent low — relative to the rest of the world — is after a while followed by an even lower low. That pattern has been particularly pronounced in the last 10 years. Earlier this year, Japan marked the 10th anniversary of the March 2011 tsunami. Those tragic events soon created a buying opportunity, and Japan has kept up with the rest of the world, if not with the U.S., for most of the time since then. During this period, Japan's politics have grown ever more important. The following chart compares the Topix to the FTSE index for the rest of the world, both in dollar terms, starting at the post-tsunami low in March 2011. Since then, the election of Abe in 2012, on his promise of an aggressive "Abenomics" policy to revive the economy, sparked one brief period of outperformance. Once that ran out of steam and turned into a new bear market in the wake of the 2015 Chinese devaluation, stocks were spurred to another period of outperformance by a startlingly aggressive new policy by the Bank of Japan, closely allied with Abe, to take bond yields negative. By the time Abe stood down, his program had fallen far short of hopes, but long-suffering investors in Japanese assets hadn't fared too badly. As Suga took over, Japanese stocks had matched the rest of the world for a decade. Since then, as the graph shows, he has presided over the most pronounced period of underperformance since the tsunami:  The surge since Suga's announcement makes plain that investors blame him in large part for Japan's drab performance. Even though he was seen as a continuity candidate for the charismatic and assertive Abe, he hasn't delivered in the way they had hoped. And now there seems to be hope that whoever replaces him will solve the problem. What exactly has Suga done wrong? And is last week's short-term buying opportunity already over? His greatest sin, viewed from afar, has been to preside over a deteriorating battle against Covid-19. In 2020, Japan was one of many Asian nations to enjoy success in limiting the pandemic. This year, it has had far greater difficulty dealing with the delta variant, and unfortunately this was broadcast to the rest of the world during the Olympics. The latest wave appears to have subsided since the games, but the political damage to the credibility of Suga, his party and and his administration, had been done:  For investors, however, the problem appears to be that he failed to splash around enough money, and lost a series of bureaucratic battles with the powerful finance ministry. Abe oversaw startlingly aggressive monetary policy, but didn't have the same effect on fiscal policy where two separate hikes in consumption taxes helped blot out incipient rallies. Abe won re-election in 2017 on a promise of eschewing future consumption tax increases, but failed to push through expansive spending. Suga appears to have fared even worse at the hands of the finance ministry. Jesper Koll, the long-term Japan-watcher who currently serves as an expert director for Monex Group Inc., points out that Suga even managed to win agreement on a 80 trillion yen ($725 billion) stimulus package to cushion the impact of the pandemic, but only managed to spend 50 trillion yen of it. He said: Basically, it very much looks like PM Suga lost every battle he tried to fight against the elite bureaucracy. Whether the next leader can re-assert political leadership over the technocrats is, in my view, key to predicting Japan`s future fortunes.

Koll's argument, echoed by a number of other optimistic Japan-watchers, is that a premier with a new mandate from the currently hobbled Liberal Democratic Party and then from the electorate has a good chance of pushing through a more aggressive agenda, much as Abe did earlier in his term. In particular, the hope is that Japan will now resort to helicopter money, or modern monetary theory, conceivably including paying checks directly to families. There is ample reason to disagree with such a policy, but for the time being it seems to be what international investors want. To quote Koll again: All the LDP leader candidates are poised to promise a big extra budget. The greater the LDP fears of losing the majority, the louder the calls for "bigger is better" will get. I expect big, i.e. around 8-10% of GDP; but more important than size is content: given the delta-variant induced cyclical downturn, it is increasingly likely that some of the candidates will advocate a new round of direct cash payments to households.

The technocrats are unlikely to fight much against a big headline number (headline extra budget numbers are easily dialed-down… ); but direct payments to the people are poised to be fought hard by the bureaucrats (people do actually notice when promised checks don't arrive, so you cannot hide inaction from even the dumbest politician).

Any new leader prepared to pick this fight deserves extra attention. In practical terms, he/she would almost certainly get the now dominant "modern monetary theory" global investor crowd to turn bullish Japan.

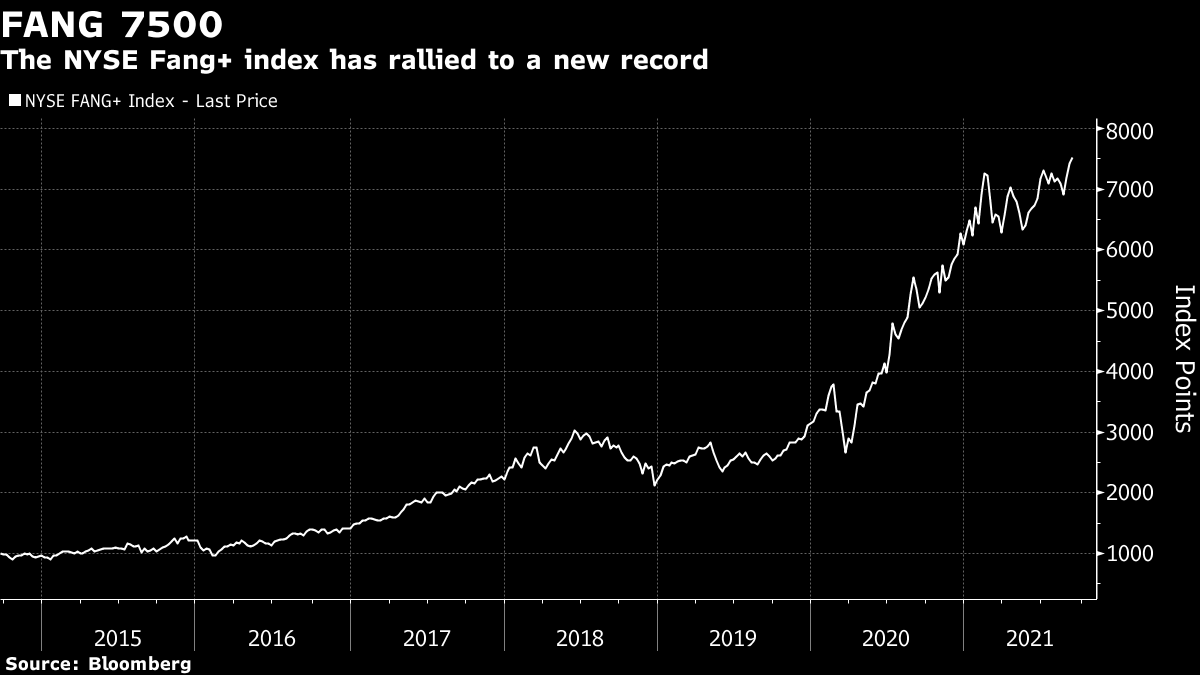

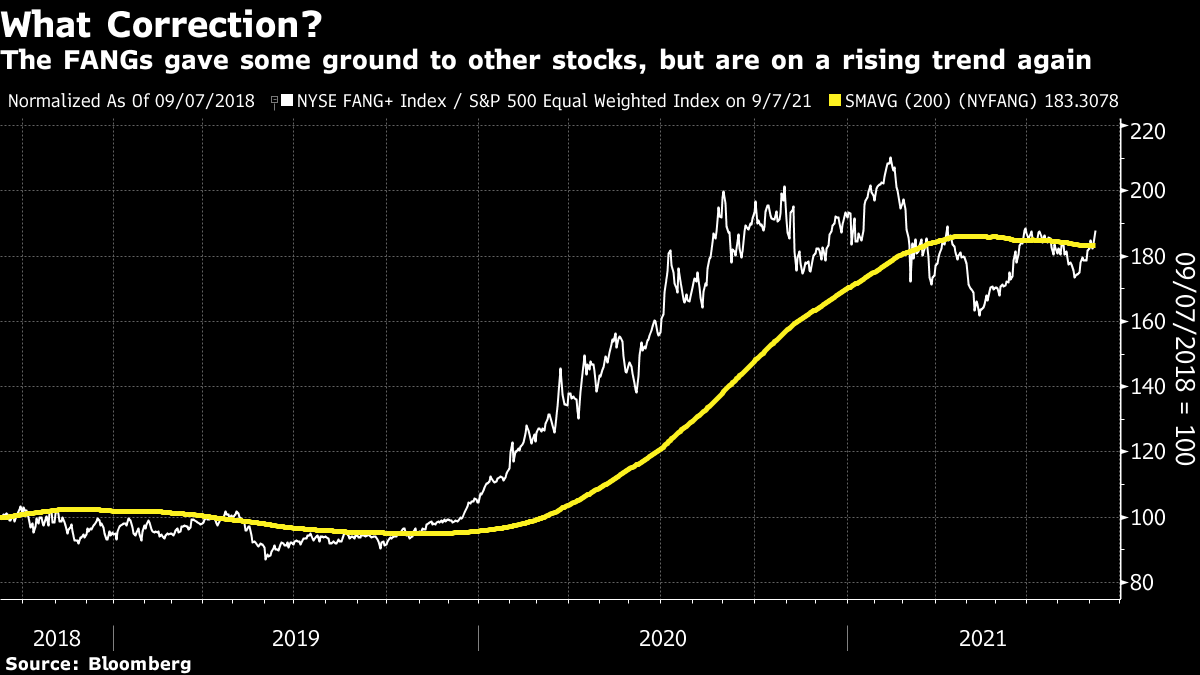

If the LDP can choose someone with a decent chance to last as long as Abe did, and restore some political stability, all the better. It is hard to discern any real chance for Japan to reverse its decades-long decline arising from all of this. But Japan's recent underperformance has been particularly brutal, and it has a recent history of staging catch-up rallies that last for a while. The longer term is as imponderable as ever; in the shorter term, it is a decent bet that Japan's politics have created another periodic buying opportunity. The FANGs — the acronym for the internet platform groups that originally stood for Facebook Inc., Amazon Inc., Netflix Inc. and Alphabet Inc.'s Google — are back. That's good if you hold stock in them, but beyond that it's rather depressing.

The NYSE Fang+ index started life at 1,000 back in 2014. Now it has topped 7,500 for the first time:

Earlier this year, there appeared to be the start of a correction following the FANGs' remarkably strong performance during the worst of the pandemic. That is now over. If we compare the FANG index to the equal-weighted version of the S&P 500 (representing the average stock), it's clear that the FANGs are outperforming once more, despite that correction:  As we all know, the FANG index includes some very successful companies with business models that currently appear impregnable. But it is still disturbing to see them recover to this extent. Their rally last year was built on the (correct) notion that they were defensive; whatever happens, the likes of Microsoft Corp. or Amazon are going to make money. That investors are already returning to the fortified ramparts of the FANGs, rather than looking around for bargains elsewhere, is another sign that hopes for a true reflationary economic boom are dwindling. While I was away in England, Charlie Watts died. The eternally calm and classy drummer of the Rolling Stones played a full part in the band's remarkable career, without ever catching the eye like the far more charismatic Mick Jagger and Keith Richards. And the outpouring following his death shows that he is recognized by those who understand the dynamics of a rock band as a contributor just as important as the Glimmer Twins. His drumming wasn't flashy, but the English media were full last week of tributes by great rock musicians to a great drummer. That at least provided a great excuse to listen to some of the Stones' classics again, and to hear him with new ears. Listen out for the way Watts' beat shaped classics from the catalogue such as Paint It Black, Sympathy for the Devil, and Honky Tonk Women. Led Zeppelin decided not to continue without John Bonham, in a decision that confounded many. They didn't think they would sound like Led Zep anymore with another drummer, and they were probably right. Similarly, the surviving Stones might be well advised to pay one big tribute to their departed drummer and then call it quits. And rest in peace, Charlie Watts. Like Bloomberg's Points of Return? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment