| Hello. Today we look at how the coronavirus continues to hamper the world economy, the tax debate in the U.S. and how women may increasingly power the Chinese economy. The coronavirus continues to inflict pain on the world economy. That's the upshot of the latest Nowcasts from Bloomberg Economics which show that from the U.S. to China and on to Germany, the very latest economic data are flagging a mixture of slowing growth and persistent inflation as the delta variant hits. The U.S. economy is on pace for a 5.8% annualized quarter-on-quarter expansion in the current quarter according to the research, down from a 6.6% print in the second quarter. In China, the gauge is tracking a 6.1% year-on-year expansion in the same period, down from 7.9% in the second. The decelerations are faster than what economists previously expected as evidenced by the fact that Citigroup's surprise index shows the world economy is currently undershooting expectations by the most since the middle of last year. "We are not at panic stations — the data is pointing to a softer recovery, not a reversal," said Bloomberg Economists Bjorn van Roye and Tom Orlik. "Still, the latest Nowcast readings are a reminder that the virus remains a significant, negative, and hard-to-predict variable impacting the outlook."

From U.S. retail sales to China factory output, the Nowcasts unite hundreds of data points to provide a high-frequency read on the pace of growth and consumer prices ahead of the official reports. Most major economies are poised to end the year still some distance short of the pre-Covid trend, while inflation in many countries is above the target of central banks. The good news is that the Nowcasts point to a peak and the beginnings of a decline for the U.S. consumer price index, but they suggest such pressures will continue to mount in the euro area and U.K. —Simon Kennedy The Biden administration's push to enact the first major set of tax increases in a generation took a step forward Monday with the release of a key House panel's proposals. Democrats on the House Ways and Means Committee, which will hold votes on the measures Tuesday and Wednesday, floated higher tax rates for top individual earners and companies, along with a boost to the highest levy on capital gains. The 25% capital gains tax — up from 20% — would help address a widening wealth gap that has only increased during the pandemic. While the panel's package fell short of the White House's plan in some areas and may undermine Biden's bid to curb widening inequality, it may still be too much for some moderate lawmakers' liking. Click on the links to read any of the stories in full: - Coming up | The big debate over whether U.S. inflation pressures will soon pass heats up again on Tuesday with the consumer price index for August. It's tipped to show inflation still topping 5% on an annual basis.

- China slowdown | The world's No. 2 economy likely slowed further in August. Just how much will become clearer on Wednesday when data on consumption, industrial output and investment is released. Meantime, Goldman Sachs said the recent regulatory tightening will only cause limited damage to long-term economic growth.

- Veteran returns | Sri Lanka is turning to former central banker Ajith Nivard Cabraal as it seeks to bolster depleted currency reserves and service debt without an international bailout.

- Debt threat | Latin America's heavily-indebted corporations are likely to delay rehiring workers during the recovery from last year's slump, according to the World Bank. Separately, the Argentine government's election loss on Sunday weakens Economy Minister Martin Guzman's negotiating power with the International Monetary Fund.

- Worker shortage | A Manpower survey of nearly 45,000 employers across 43 countries showed 69% of employers reported difficulty filling roles, a 15-year high.

- Swedish climate | In climate activist Greta Thunberg's home country, a key government minister is calling for economic policy to be overhauled to acknowledge the dangerous pace at which the planet is overheating.

- Taliban conundrum | World leaders are calling for international cooperation on dealing with Afghanistan's economy even as they jockey to gain influence in the power vacuum the U.S. departure has left behind.

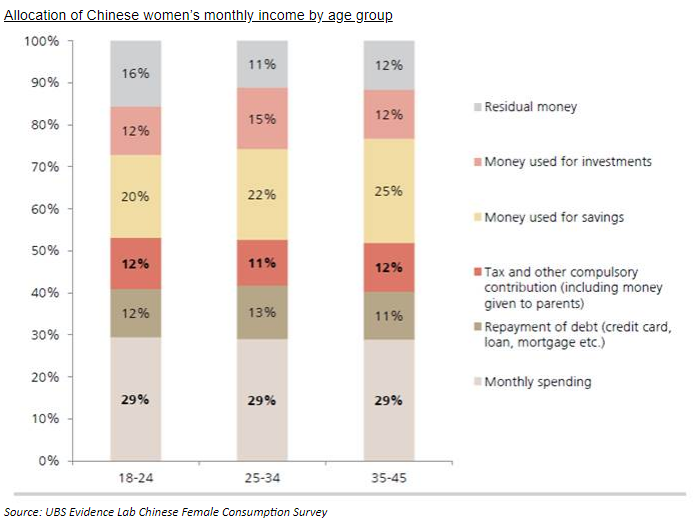

Chinese women will be the main drivers of an expected $5.3 trillion boom in consumer spending over the next decade as their incomes rise, UBS said. Consumption growth through 2030 will be 80% driven by expansion in women's income, Christine Peng, head of Greater China consumer sector at UBS Global Research, wrote in a recent report. "We forecast Chinese women to have the most impact on China's consumption growth," Peng said. "We expect the effects of the significant progress in Chinese women's education in the past 20 years to materialize, improving their social standing, particularly their status in the workplace." The estimated jump in household consumption in the next decade means China will contribute about 27% of global consumption growth by 2030, UBS forecast. That compares with a projected 19% for the U.S. Read the story by clicking here. The Biden administration hires the chief economist of Indeed... Read more reactions on Twitter - Click here for more economic stories

- Tune into the Stephanomics podcast

- Subscribe here for our daily Supply Lines newsletter, here for our weekly Beyond Brexit newsletter

- Follow us @economics

The fourth annual Bloomberg New Economy Forum will convene the world's most influential leaders in Singapore on Nov. 16-19 to mobilize behind the effort to build a sustainable and inclusive global economy. Learn more here. |

Post a Comment